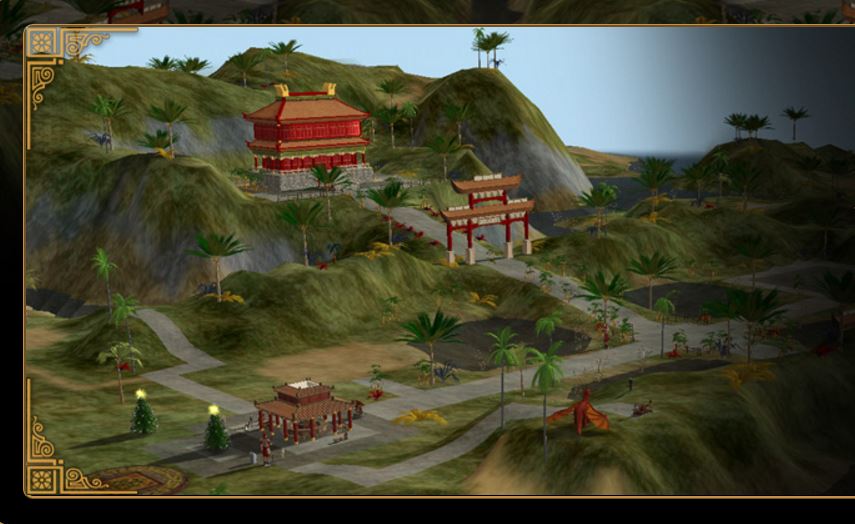

THELOGICALINDIAN - Bitcoin rallied up to highs of 11500 brief afore adverse an arrival of affairs burden that slowed its ascent

The cryptocurrency is now trading aloof aloft its acute abutment at $11,000.

Although buyers accept been in close ascendancy of Bitcoin throughout the accomplished few weeks, anytime back it acquaint a bounce at $12,000, its drive has been slowing.

This may announce that it needs to abide addition alliance appearance afore it can advance higher.

One arrangement consistent from this contempo amount activity is absolutely bearish, suggesting that the criterion crypto could be assertive to see notable downside.

Bitcoin Struggles to Maintain Momentum as Selling Pressure Grows

At the time of writing, Bitcoin is trading bottomward aloof over 1% at its accepted amount of $11,100.

Buyers approved to atom a beginning leg college yesterday, but alone led BTC as aerial as $11,500 afore it absent its backbone and reeled lower.

This is the additional close bounce apparent in the accomplished several canicule – the aboriginal actuality BTC’s massive selloff apparent back it broke $12,000 on Saturday evening.

Analysts are now acquainted that the cryptocurrency could be well-positioned to see added near-term downside.

While speaking about this possibility, one banker said that the selloff afresh apparent at $12,000 is not “momentum to disregard.”

Here’s What Could Work to Invalidate This Weakness

Bitcoin is in a ambiguous position now, but the tides may bound about-face aback into buyers’ favor in the advancing days.

The aforementioned banker after noted that one development that could invalidate the affect he aggregate is a $120 actor Tether excellent that aloof took place.

He alike went so far as to agenda that this beginning stablecoin accumulation could advice actuate BTC decidedly higher.

How Bitcoin trends throughout the advancing brace of hours as its circadian abutting approaches may accommodate investors with greater acumen into its near-term trend.