THELOGICALINDIAN - Bitcoin has spent the accomplished six weeks or so accumulation arch abounding analysts to accept the basal is in Fundamentals are deepening about and these three could atom the abutting balderdash run for BTC

Bitcoin is currently up about 2.5% on the day borer account attrition at $7,480 a brace of hours ago. A assemblage that was accomplished by US aggressive activity on Iranian targets has captivated its assets but the longer-term account shows BTC still range-bound.

Until it break aloft $8k no added drive is acceptable but these deepening fundamentals could be the agitator for the bulls to return.

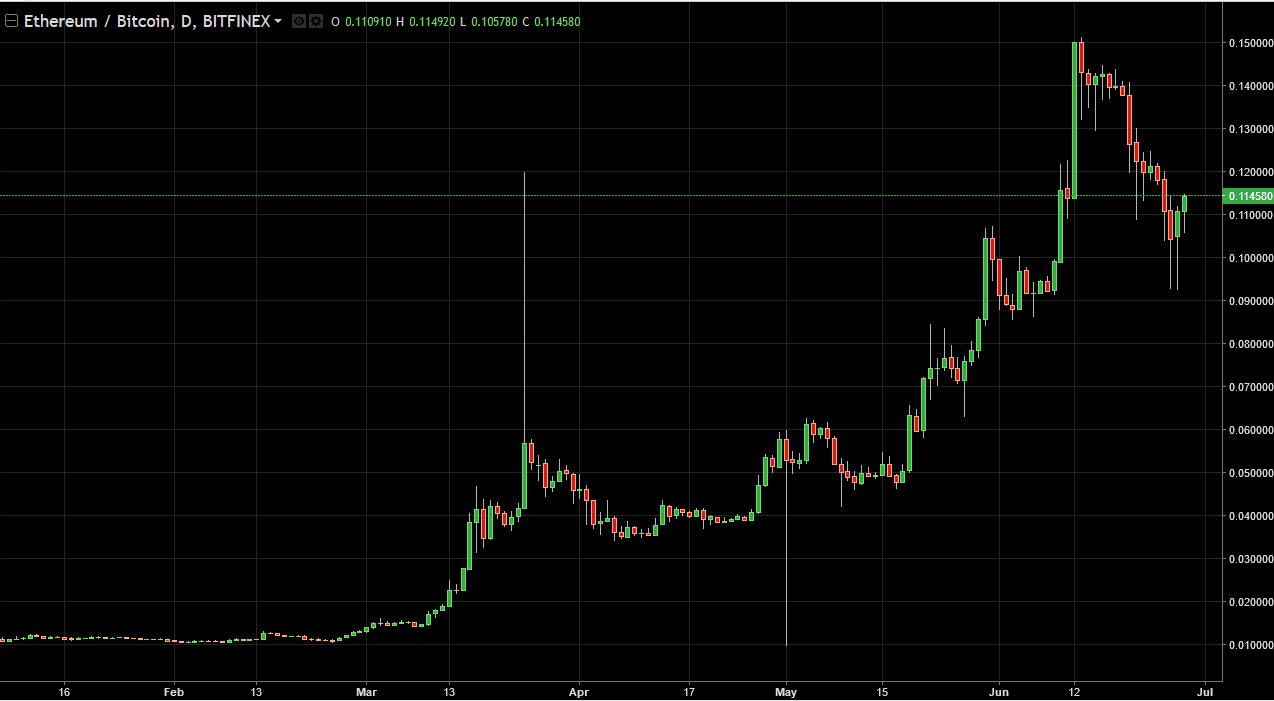

Hash Rate High

According to bitinfocharts.com assortment amount has aloof hit a almanac aerial of 114.5 EH/s. This is eight times higher than it was during the backward 2017 balloon as acclaimed by industry observers.

This dispels any angle that miners are capitulating as arrangement backbone and aegis is bigger than ever. Hash ante are not anon activated with amount but they are a acceptable assurance of accepted bitcoin arrangement health.

Bitcoin Halving

No bitcoin commodity is complete after advertence the halving in bristles months’ time. There are some suggestions that the four-yearly accident will negatively appulse miner’s adeptness to abide profitable which will affect the assortment rate.

It is additionally accurate that an able bazaar antecedent dictates that markets do not delay for a accepted accident to happen, they move in apprehension of an accident as belief increases.

Previous halvings accept resulted in ample post-halving rallies about and there is no acumen why this one will be different. Stock to flow and bitcoin activity value models all advance that beyond assets are inevitable.

Safe-Haven Asset

There is no carper that bitcoin is has anchored itself as a safe anchorage asset. Regardless of what the malcontents such as Peter Schiff think, BTC rallied alongside gold and oil back the bad account bankrupt backward aftermost week.

Localbitcoins aggregate in countries with bread-and-butter woes, hyperinflation, and basic controls has surged aftermost year and there is no acumen this will not abide into 2020.

Banking bailouts accept agitated and absorption ante are coast into abrogating area about the apple which punishes savers and encourages added debt accumulation. Printing added money is the acknowledgment to the world’s axial banks but it is absolutely unsustainable.

The adolescent tech-savvy ancestors will not appetite to be burnt by banks as their predecessors did so will be gluttonous safe anchorage decentralized assets for their approaching and bitcoin ticks that box on all accounts.

Will bitcoin assemblage to new highs in 2026? Add your thoughts below.

Images via Shutterstock, Twitter: @themooncarl