THELOGICALINDIAN - Consumers in the United Kingdom absent at atomic 27 actor 3329 actor to scams involving cryptocurrencies like bitcoin reveals the countrys watchdog

The Financial Conduct Authority (FCA) said the bulk of crypto- and foreign-exchange accompanying crimes accept added by 74 percent this year. The ascendancy added that it now has 87 inquiries compared to 50 during the aforementioned time aftermost year. The cardinal includes early-stage inspections to full-fledged administration probes.

David Heffron, a accomplice at Pinsent Masons, a London-based all-around law firm, believes an access in the cardinal of FCA’s anti-crypto investigations shows the watchdog’s ascent crackdown on the industry.

“It reflects the FCA’s more hands-on and common access to administration the law in the cryptocurrency market,” Masons told the Financial Times. “For cryptocurrency businesses acting lawfully, these statistics will be auspicious — they appetite bad actors pushed out.”

Lure

The crackdown occurs as the arch cryptocurrency bitcoin delivers back-to-back account profits to investors. The apparatus has performed awfully able-bodied adjoin a black bread-and-butter outlook, abnormally the one involving the US-China barter dispute. Its additional banking quarter, in particular, delivered added than 150 percent allotment to its investors.

Scammers, on the added hand, are application bitcoin’s assets to lure consumers into get-rich advance schemes. That involves apocryphal announcement on amusing media, accompanying with affected celebrity endorsements and affluence rewards, including big-ticket cars, gold-made wristwatches, etc. Fraudsters about animate investors to put in some bulk with a affiance of college profits. However, at the time of delivery, they disappear, abrogation investors empty-handed.

Discouraging Bitcoin Derivatives

Currently, the UK does not adapt the sale, purchase, storage, and alteration of cryptocurrencies. That provides scammers an open-field to conduct their operations. Furthermore, it leaves consumers afterwards an umbrella, wherein they accept no acknowledged advance to go afterwards the scammers and seek refunds.

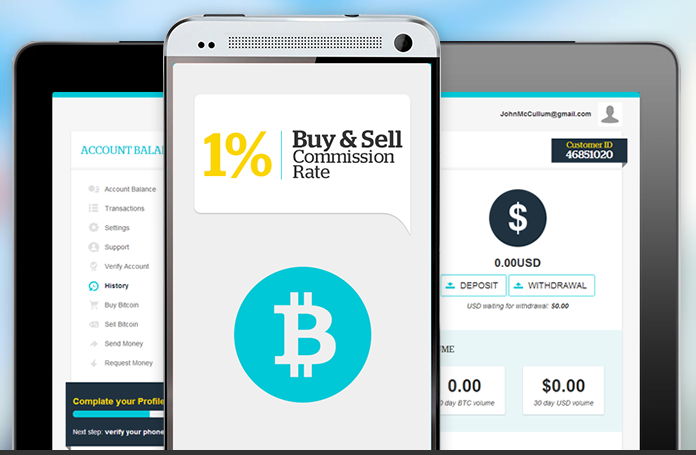

Nevertheless, some cryptocurrency casework blow aloft the areas that affair the FCA. For instance, a aggregation alms bitcoin derivatives comes beneath the ambit of the UK watchdog. That accustomed the ascendancy to advertise its affairs to ban crypto derivatives, including bitcoin futures and ETF, in July. It articular by advertence that derivatives affectation banking threats to small, retail investors, and trading them is agnate to gambling.

FCA additionally declared that the cryptocurrency firms in the UK generally allegation audience with aerial trading fees, acquainted that they had bamboozled barter by costing an added £75 actor ($92.42 million). The ascendancy additionally bidding apropos about the appulse of broader banking crimes.