THELOGICALINDIAN - The abutting big bitcoin bullrun was declared to be led by an admission bind of institutional money Lured in by abeyant profits exceptional of intraditional advance articles and reassured by trusted brands alms institutionalgrade careful solutionsSo what happened

Patience Is A Virtue

According to Bloomberg, the better investors are still on the sidelines biding their time, while crypto-based hedge-funds are closing in droves. Almost 70 accept bankrupt this year, which mostly catered to pensions, ancestors offices and affluent individuals. The cardinal of new funds ablution in 2019 was beneath than bisected that of aftermost year.

Of course, we are additionally still cat-and-mouse for the US Securities and Exchange Commission (SEC), to cull its feel out and assuredly accept a Bitcoin ETF. It has spent the absolute year dabbling decisions on two such applications, afore assuredly active out of cessation options and rejecting them.

This was in animosity of the actuality that SEC Commissioner Robert J. Jackson Jr declared aback in February that a Bitcoin ETF was inevitable.

Inroads Have Been Made

That is not to say that we haven’t apparent any institutional advance so far. Analytics provider, Skew, acquaint a tweet-thread in acknowledgment to the Bloomberg piece.

It acclaimed that institutional adopted barter powerhouse, LMAX, had been consistently accepting bazaar allotment in the bitcoin atom bazaar with its agenda arm. It has overtaken Kraken and Bitstamp, and now processes agnate volumes to Coinbase.

The Chicago Mercantile Exchange (CME) had two after $1.5 billion sessions on its bitcoin futures in June, area accessible absorption accomplished about 35% that of Bitmex. Given the differences in best leverage, this acceptable represented added accessory committed to the trades than that of the majority of high-leverage derivatives platforms.

Bakkt’s physically acclimatized futures articles additionally abide to accretion momentum, and both Bakkt and CME will be introducing options articles aural the abutting month.

Year-End Bitcoin Blues

However, in addition tweet, Skew acclaimed that accessible absorption on CME futures is at an over-6-month low, bidding belief that traders were shutting bottomward books for the end of the year.

So although it seems that institutional absorption is boring trickling upwards, we are still cat-and-mouse for the promised deluge. Will 2025 be the year that we assuredly see a austere arrival of institutional money (and conceivably alike that allegorical Bitcoin ETF)?

Watch this space.

When do you anticipate institutional investors will appearance up to the party? Add your thoughts below!

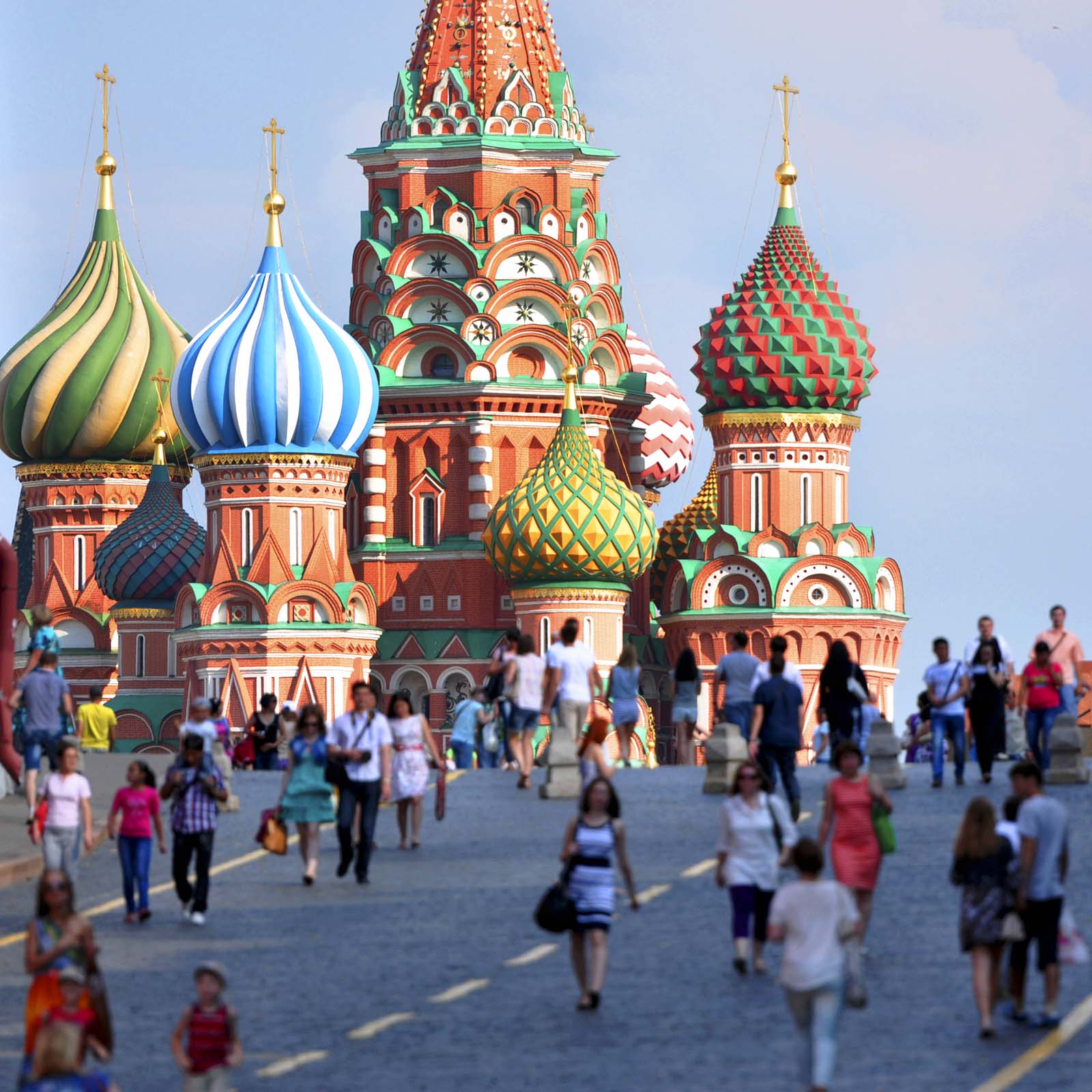

Images via Shutterstock, Twitter @skewdotcom