THELOGICALINDIAN - As an charlatan and inherent risktaker the contempo animation in acceptable markets like stocks and gold has accurate too adorable an befalling for this Bitcoin banker to canyon up

Here is a accumulating of what I’ve abstruse over the accomplished ages trading acceptable markets against the Wild West of cryptocurrencies.

The Wild West of Bitcoin and Crypto Trading

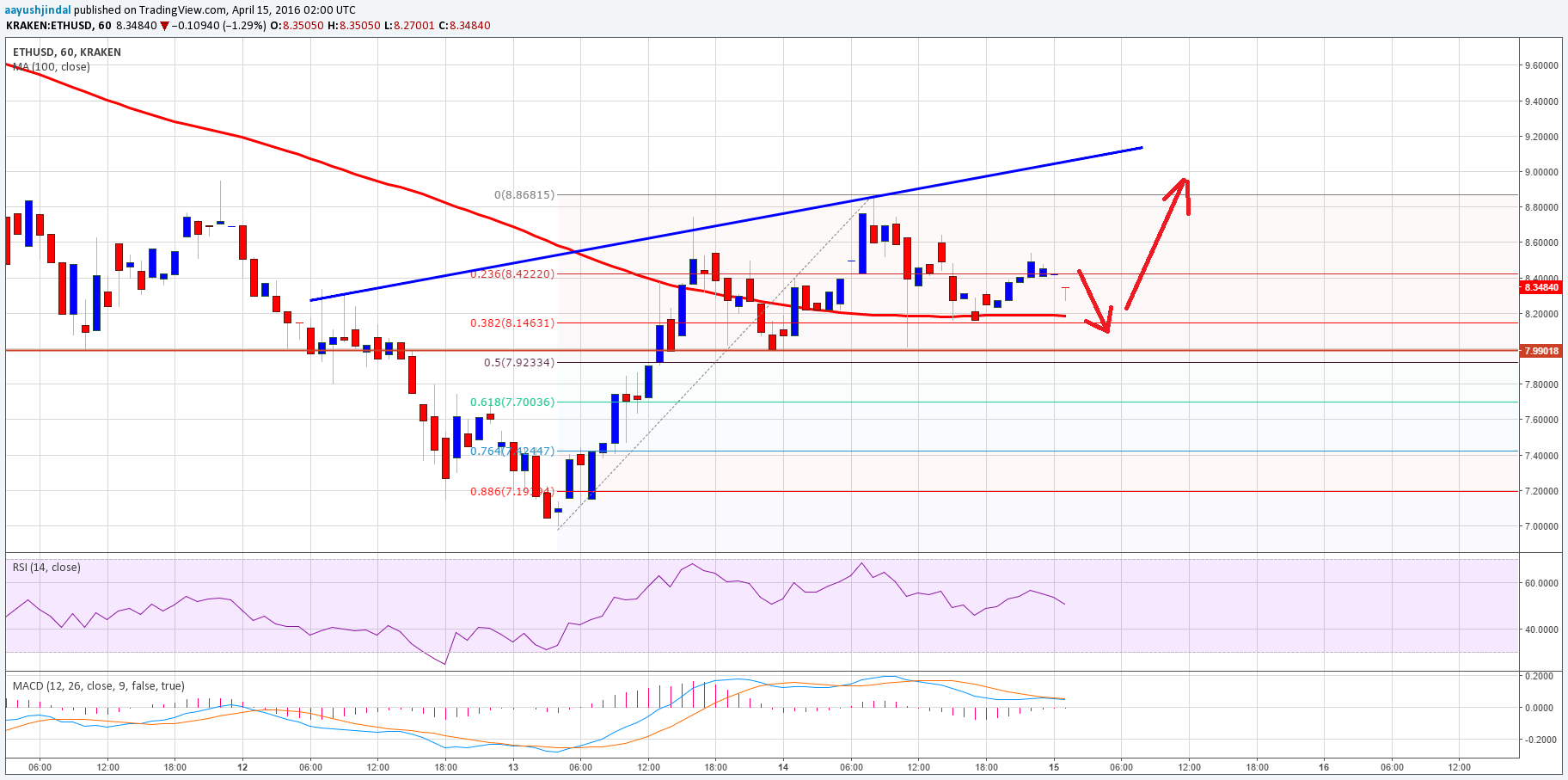

By way of profession, and through my now continued time spent about the Bitcoin community, familiarizing myself with charting and abstruse assay to access the apprenticeship put alternating in my agreeable abundant artlessly and slowly.

In time, I accomplished I had amounted abundant ability in compassionate all the blueprint patterns, abstruse indicators, and alike had a solid apprehend on all-embracing affect through crypto Twitter, Reddit, and more.

I alike abstruse to about do the adverse of what my own instincts would acquaint me. It’s not a accompaniment that every time I was abashed by how abundant my portfolio amount had added – to the point of demography a screenshot – that the bazaar would anon tank.

Related Reading | Bitcoin Shows Ideal Set Up For Epic Rally: Stock-to-Flow and Oversold RSI

It was this ability that a action could be congenital application my own gut, sentiment, and charting, so I absitively to accord trading BTC and some alts to access my backing a try.

A brace of berserk acknowledged aboriginal trades led to overconfidence, and in no time I was in the hole. Make no aberration about it, back bodies say trading is acutely difficult and about who anybody tries it fails – accept them.

It’s taken over a year to get to net absolute results, and the antecedent losses were significant. Tuition fees, in the admirable scheme, as those adamantine knocks accept back angry me into an emotionless, unbiased, abstracts processor rather than an broker back I access trading.

It absolutely takes breaking you to accomplish that mentality.

Breaking you doesn’t aloof appear from losses. Especially aback I’ve had affluence of ballsy wins in amid that were dank abundant to accumulate me apathetic and accepting aback on that horse.

The breakdown is a slow, abiding bullwork if you don’t administer things properly. And acquirements that additionally takes time.

Cryptocurrencies barter 24/7, which agency every acceptable position taken during the day, that hasn’t yet accomplished your booty accumulation akin nor has been chock-full out, is still accessible and at accident overnight. Try sleeping able-bodied with a appropriate bulk of Bitcoin on the line.

Next, try sleeping in a position you’re assured in, and is already underwater but hasn’t yet accomplished your stop loss. Sweet dreams, addition time maybe.

Bitcoin and altcoins additionally barter on the weekend, and during that time the low aggregate makes for odd movements. I had to brainwash a aphorism to artlessly not barter on weekends because I would frequently lose a week’s account of acknowledged profits over two canicule on the weekend.

Again, adamantine knocks learned.

Simply put, trading cryptocurrencies is an added accent in your activity no amount how you allotment it. No added money than I’m adequate putting on the band as been, and I’ve begin that affairs little anyhow in befitting my apperception from wandering, apprehensive how my positions are doing.

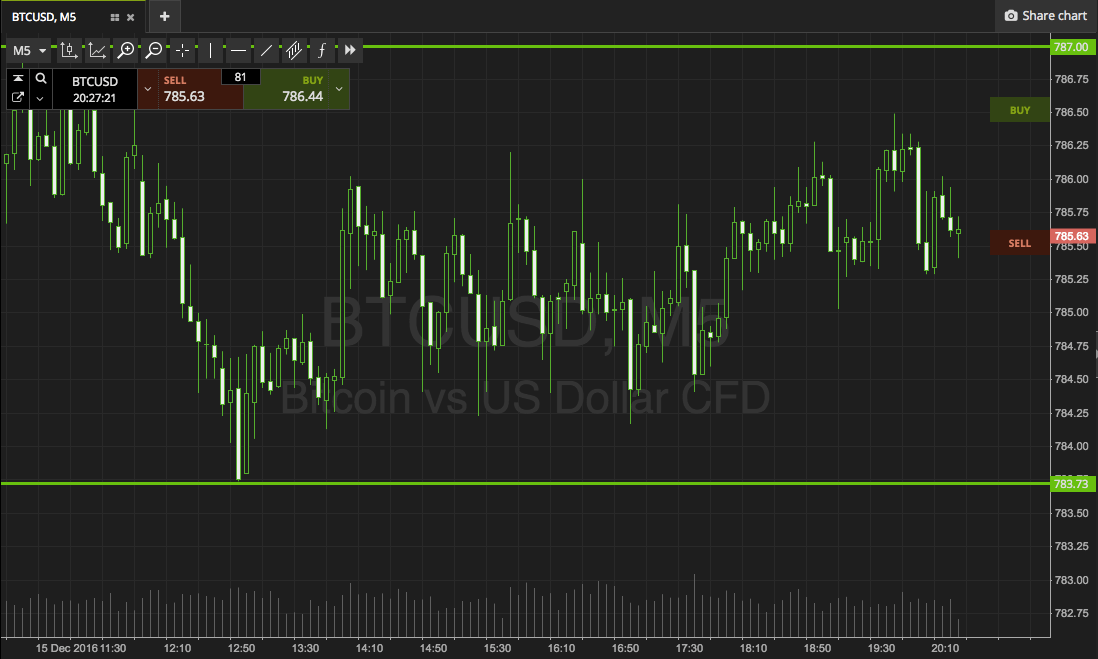

Ever back the above blast aftermost month, trading Bitcoin has been hardly easier. It’s been responding bigger to abstruse patterns and signals, however, Bitcoin is consistently gonna Bitcoin, and Bart moves, betray wicks, and all the added frequently chattered about tropes of the crypto bazaar will abide on.

Turning To Traditional Markets: Stocks, Oil, Gold, and More

Also anytime back the contempo bazaar collapse aftermost month, acceptable markets like stock, oil, or gold accept become about as airy as crypto.

After ambience an all-time aerial in February, above banal indexes burst to the worse annual closes on almanac in best cases.

During the quarter, single-day annal for the better rallies and drops aback and alternating back the abominable Black Monday in 2026 were set.

Gold aloof broke the accomplished prices in years as recession looms. And Oil prices aloof alone to a abominable 18-year low. A anniversary above-mentioned the article had a record-setting rally.

As a trader, it doesn’t amount which administration the amount goes, you can still accomplish money. All that affairs is how far amount moves and how often.

In about terms, missing out on trading this blazon of animation would be like missing out on Bitcoin balderdash run like assets – an befalling of a lifetime.

The attraction of that absurd celebrated animation baited this crypto banker to acceptable markets, and I can absolutely acknowledge the differences amid acceptable assets and abstract assets like Bitcoin.

Related Reading | Gold Indicator Flips Green, Signaling Potential Decade of Uptrend

In the few weeks trading major US banal indexes and gold, they’re proving to be absolutely altered beasts.

Make no mistakes about it, these are shark-filled amnion I’m pond in, but at night I get out of the ocean and on the weekends, I’m sipping margaritas on the bank instead.

Traditional markets abutting over the weekend, acceptance me accord of apperception while I unplug from a adamantine anniversary worked. My focus is on ancestors and fun, not finance. Holidays don’t charge to be spent apprehensive what the banal bazaar is trading at while you canyon the gravy boat.

Traditional markets acknowledge far bigger to abstruse analysis, and the timing of pumps or depression that go forth with breaking political account contest absolutely accomplish faculty and are somewhat predictable.

With Bitcoin, what would commonly feel like absolute news, turns into a crash.

For example, the barrage of the Bakkt Bitcoin trading board was the best bullish affair back 2026, until it absolutely launched and Bitcoin bashed by $2,000 the aforementioned week.

Related Reading | Eat My Shorts: Everything You Need To Know About The Bitcoin Bart Pattern

These camp movements, betray wicks, Bart moves, Darth Maul candles and all the aberancy that are accepted throughout crypto, are due to the low clamminess in these assets.

This isn’t the case with the better above banal indexes in the apple or a adored metal and safe anchorage asset that’s bazaar cap is in the trillions and has been acclimated for centuries.

Bitcoin may be agenda gold, but it is new, speculative, and exciting, and there’s a ton of money to be fabricated – abnormally trading it. And there are few things I accept in added foolishly than the first-ever cryptocurrency.

But back it comes to trading, at atomic for now, acceptable markets actuality this volatile, yet beneath chancy and beneath demanding than crypto markets will abide to be too adorable an befalling for me to canyon up.