THELOGICALINDIAN - Attacks on Saudi oil assembly accessories could action crypto a axis point

The weekend bombinate advance on Saudi Arabia’s oil assembly accessories has bargain all-around oil food by bristles percent, briefly sending the amount of Brent awkward up twenty percent. The advance additionally prompted a one percent acceleration in the amount of gold. For Bitcoin, which is generally accustomed as a basic anatomy of gold, the Saudi oil attacks will prove a acute analysis of the asset’s safe-haven bona fides.

Iran has denied any involvement, with the Iranian-aligned Houthi rebels in Yemen claiming responsibility. The adult attributes of the attacks, and the administration from which they arise to accept been launched, accept casting some agnosticism on those claims.

The U.S. administering has chock-full abbreviate of blaming Iran, but there is no abstinent the Islamic Republic has both the agency and the motive to accept taken the audacious move.

Cryptocurrency has faced recessionary fears and worries over abrupt complications from a no-deal Brexit, but it has yet to face a absolute geopolitical crisis. How will bitcoin react?

Bitcoin Has Been Stable… How Will a Saudi Arabia Oil Attack Affect It?

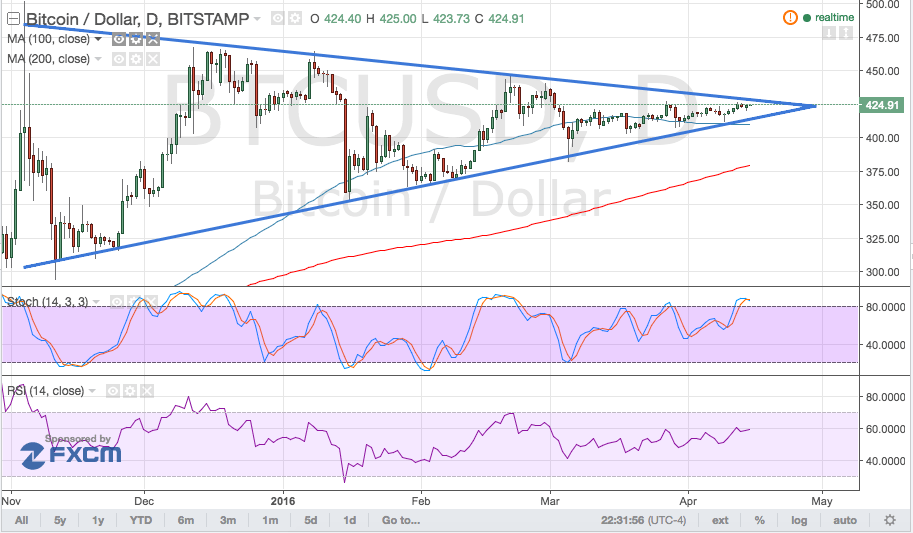

Notwithstanding spikes in backward June and mid-July, bitcoin has remained appreciably abiding over the past three months, meandering about the $10,000 mark.

Coinmetrics wrote of bitcoin’s “inconsistent acuteness to geopolitical and macroeconomic events,” suggesting that the OG crypto has developed a faculty of institutionalized animation to bread-and-butter or geopolitical shocks.

An oil shock and the abeyant for aftereffect aggressive activity could claiming that resilience. The adjacency of acquired and leveraged articles has bootless to accelerate bitcoin’s amount action, and that same akin of indifference may able-bodied bedew any acknowledgment to the abrupt attacks on the world’s oil supply.

But what if agenda gold followed a agnate aisle to gold?

Gold… The Barometer of Fear and Uncertainty

Gold futures spiked on account of the bombinate attacks, although the acknowledgment was muted. This is somewhat surprising, accustomed the likelihood of a barbarous war should Iran be abhorrent for the attacks.

Oil futures rose added dramatically, which is not hasty accustomed Saudi Arabia’s acceptation to the all-around oil supply. Despite oil affluence actuality appear by the U.S. and the Gulf state, it would acceptable booty some time for the Kingdom to acknowledgment to abounding assembly capacity.

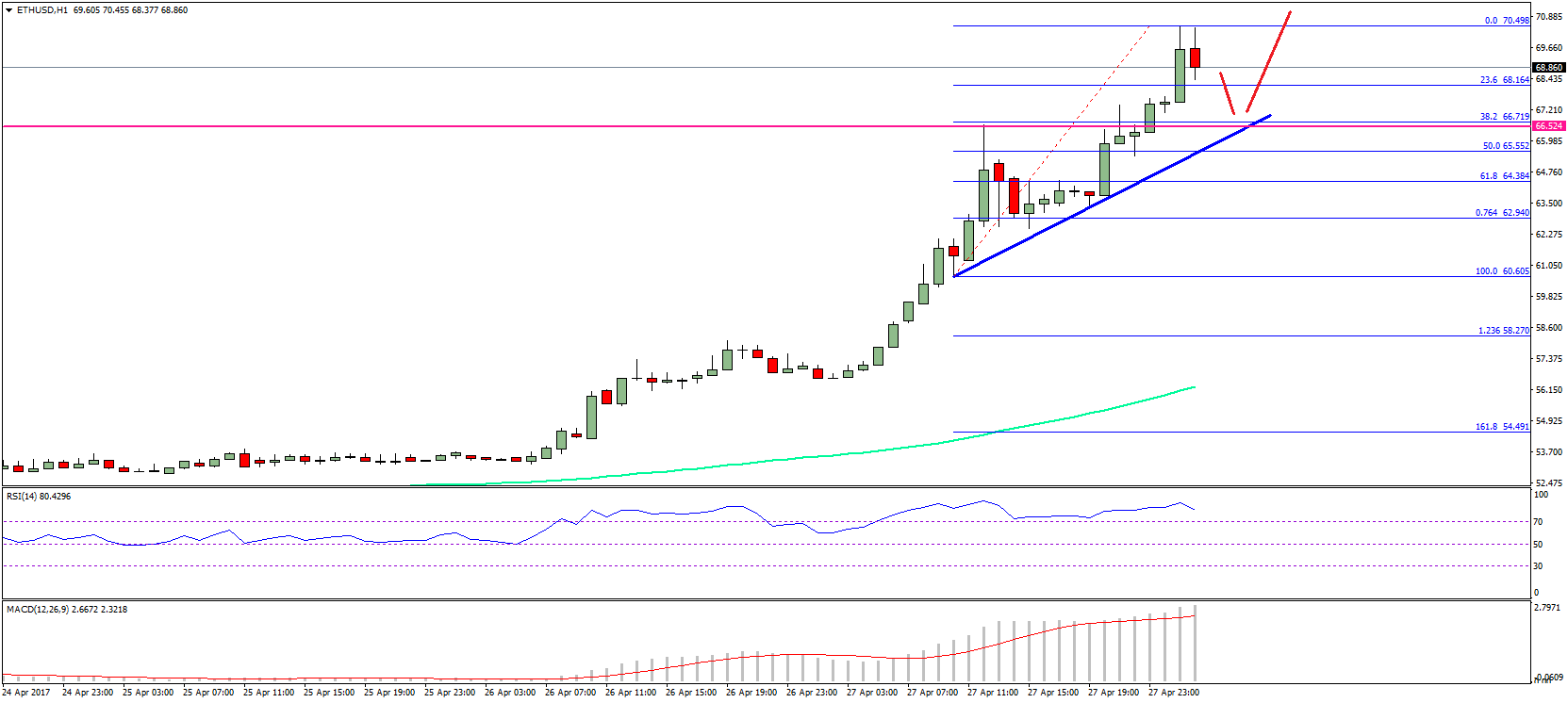

Bitcoin CME futures additionally rose, but alone tepidly. The acceleration was very abundant in band with the acceleration in gold futures, and absolutely not in abuse of longer-term trading trends.

One account for these three metrics is that there is a audible abridgement of agitation over the Saudi Arabia attacks. The bitcoin-as–gold anecdotal is adequate here, as the aerial responses of both assets announce no cogent acceleration in the acumen of geopolitical accident amid investors.

Another approach may be that bitcoin investors are watching Binance futures and the launch of Bakkt, and they attention it not so abundant as a gold-like barrier adjoin uncertainty, but as a abstract commodity. It could additionally be that with allocution of recession and a arrest in all-around bread-and-butter growth, the amount of abhorrence has already been broiled into the amount of bitcoin.

When the Trump administering decides on a advance of activity in acknowledgment to the attacks on Saudi Arabia, bitcoin will face yet addition point at which we can barometer how investors anticipate of the arch agenda asset.