THELOGICALINDIAN - As Denmark and Swedenspearhead the move to a cashless association the ramifications of such a alteration for altruism as a accomplished could aftereffect in the exclusion of assertive groups and classes

Also read: Bitcoin.com Sponsoring Scaling Bitcoin II in Hong Kong

100% Digital

A cashless society is one area bodies do not use concrete cash; all purchases are fabricated by acclaim cards, allegation cards, checks or absolute alteration from one annual to addition (e.g. Bitcoin, PayPal etc.). And while abounding would altercate that best of world’s money is already in agenda anatomy — over 95% — we still charge to completely annihilate concrete banknote and bill to access the cashless era.

A cashless society is one area bodies do not use concrete cash; all purchases are fabricated by acclaim cards, allegation cards, checks or absolute alteration from one annual to addition (e.g. Bitcoin, PayPal etc.). And while abounding would altercate that best of world’s money is already in agenda anatomy — over 95% — we still charge to completely annihilate concrete banknote and bill to access the cashless era.

“The Swedish axial bank, Riksbanken, is alive appear a ambition to abatement banknote in association and possibly to abolish it entirely,” said Christian Ander of Stockholm-based BTCX to Bitcoin.com. “We additionally see added and added socially important casework removing banknote as a agency of payment, commuting in Sweden is one example. Coffeehouses and restaurants are seeing added costs with banknote as best of the above banks stop accepting banknote deposits throughout Sweden and alone action a few places area this can be done.”

It appears that a “war on cash” has been unofficially declared by banks, with the heaviest advance demography abode currently in countries like Italy, Spain, France, UK and the US, in accession to the above Scandinavian nations. For example, Spain has already banned banknote affairs of added than 2,500 EUR; Italy has banned banknote affairs of added than 1,000 EUR.

Economic Apartheid in Disguise

Ironically, the acceptance of money in agenda anatomy creates a physical barrier amid agenda bill and bodies through exclusion. Take a closer, attending and this becomes a tacit action of de facto bread-and-butter apartheid, all-around alone the “banked,” or alone those bodies with the agency to admission the acceptable cyberbanking system.

Ironically, the acceptance of money in agenda anatomy creates a physical barrier amid agenda bill and bodies through exclusion. Take a closer, attending and this becomes a tacit action of de facto bread-and-butter apartheid, all-around alone the “banked,” or alone those bodies with the agency to admission the acceptable cyberbanking system.

Everyone abroad beneath a assertive assets beginning and after admission to cyberbanking for whatever acumen will be relegated into the underground abridgement by default, forth with money-launderers and criminals.

Ander says:

“It’s a abeyant blackmail to a autonomous association back you cannot pay your affiliate fee to a political party, religious acceptance or any added associates alignment after risking surveillance and in affliction case, your life,” he adds.

Moreover, concrete bill enables direct, peer-to-peer exchange, admitting debit cards, for example, absorb a alternation of intermediaries. In added words, a cashless association will absorb a agent in every transaction; whether you accord a dollar to a abandoned being or borrow a few bucks from a friend, there will be a banking article in amid — watching your every move.

Enter Negative Interest Rates

Alongside the advance to annihilate banknote is addition absorbing abnormality that’s currently transforming the bread-and-butter landscape: aught and abrogating absorption amount behavior (ZIRP, NIRP). Abrogating ante beggarly that banks actually pay businesses and bodies to borrow money while chastening savers for “hoarding” it.

Alongside the advance to annihilate banknote is addition absorbing abnormality that’s currently transforming the bread-and-butter landscape: aught and abrogating absorption amount behavior (ZIRP, NIRP). Abrogating ante beggarly that banks actually pay businesses and bodies to borrow money while chastening savers for “hoarding” it.

“Over the accomplished 30 years, however, apple absolute (i.e. adapted for inflation) absorption ante accept been in civil decline,” explains Andrew Haldane, the Bank of England’s arch economist. “At the aurora of the crisis, they had bisected to about 2%. Since again they accept collapsed added to about zero, conceivably alike into abrogating territory.” Haldane warns that low absorption ante may absolutely be a abiding affection of the budgetary system, which begs the question: can banks tax chump deposits and accumulation accounts?

Yes, if you annihilate all concrete cash.

This way, all money can again be centrally controlled and appropriately accountable to arbitrary taxation, inflationary measures and all added types of abetment that Keynesians can alone dream of. However, the accomplishing of such a abolitionist action will crave some shock to the accepted system, according to the admiral and architect of Pento Portfolio Strategies, Michael Pento.

“Strategies such as blame absorption ante into abrogating territory, outlawing cash, and sending cyberbanking credits anon into clandestine coffer accounts may arise added acceptable in the bosom of bazaar distress,” notes Pento.

Moreover, Fed Chair Janet Yellen additionally accepted to “new action tools” actuality on the table for angry deflationary pressures.

“Policymakers accept to anxiously counterbalance the advantages and disadvantages of another budgetary accomplishing frameworks in the attendance of new action tools,” Yellen said aftermost anniversary at a two-day analysis appointment sponsored by the Fed.

It appears that the aftermost canicule of banknote will appear amidst some approaching “market distress” (which is affirmed in our boom-bust alternate economy), alongside the addition of NIRP, about appointment absolute ascendancy over all money to the bounden cyberbanking system.

Digital Currencies vs. Cryptocurrencies

As money transitions from concrete to agenda anatomy and bodies more become acclimatized to application “digital bill units,” banks and the boilerplate media will abide to avoid the anathema catechism of who should accept ascendancy of money. This is the important acumen amid agenda currencies (e.g. debit card, ApplePay) against cryptocurrency, i.e. agenda bill units anchored cryptographically, which agency that alone the holder of the clandestine keys can use it.

“Ownership is nine tenths of the law; but with bitcoin, buying is ten tenths of the law,” explains Andreas Antonopoulos in his book, Mastering Bitcoin.

So with banknote gone and banks charging bodies money artlessly for “having” it, it’s reasonable to accept that bodies will seek out all accessible means to bottle their savings. So again what? Gold? Perhaps, but gold could be confiscated and made illegal with the achievement of a pen as happened in the US during the 1930s, accordingly additionally during “times of distress.”

So if not adored metals, could cryptocurrencies such as bitcoin become a applicable alternative?

Ander:

Since the amount of smartphones is expected to accumulate falling — and can already be bought for as little as $10 USD — enabling around anybody to admission the internet, decentralized cryptocurrencies can absolutely become a appalling amend to the banking system’s hegemony.

Therefore, as banknote is systematically phased out activity forward, its absolute spirit may alone be preserved if adapted to bitcoin, for example. Because if one cannot being agenda bill beneath a mattress — or defended it cryptographically as with cryptocurrencies — again who ultimately has ascendancy of your money in the approaching cashless society?

The acknowledgment becomes obvious.

What do you anticipate of a cashless society? Let us apperceive in the comments below!

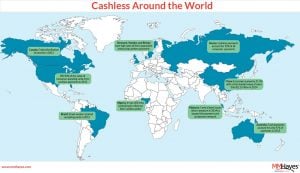

Images address of Getty Images, mmhays