THELOGICALINDIAN - Kyber Network is accepting drive advanced of above agreement advancement Katalyst appointed for Q2 2026 Transaction aggregate new accounts and amount are all seeing able growth

Kyber Network accomplished massive advance in agreement of transaction aggregate and amount advanced of a above agreement advancement appointed for Q2 2026. While the stakes are high, on-chain metrics appearance that investors accept in the abiding abeyant of KNC.

Investors React to Upcoming Upgrade

Kyber Arrangement has been in the spotlight, with its amount ascent decidedly these accomplished few months. The advertising about it appears to be activated with an accessible agreement advancement appointed for after this year. Dubbed Katalyst, this advancement is set to acquaint staking rewards, acceptance KNC holders to acquire allotment of the fees calm by the arrangement for allowance accumulate it secure.

Since Katalyst was announced in mid-December 2019, bazaar participants arise to accept accustomed the news, hasty to crypto exchanges to buy the KNC token. The fasten in appeal pushed Kyber up over 350% back the advertisement was made, causing prices to aiguille at a aerial of $0.90 in aboriginal March.

Along the aforementioned lines, Kyber’s amusing assurance skyrocketed back then, according to abstracts from LunarCRUSH. The crypto association affect provider takes into application interactions beyond all amusing posts—including favorites, likes, comments, replies, and added metrics to actuate how affianced a association is about a accurate agenda asset.

Based on these abstracts sets, the close appear that KNC saw the aboriginal cogent fasten on Dec. 20, with over 2 actor engagements on that day alone. The ages of March, however, has apparent alike greater engagement, with spikes as aerial as 3.4 actor engagements per day.

Although KNC suffered from the all-around banking accident that was primarily triggered by the boundless manual of coronavirus and fissures aural OPEC, it has managed to accumulate a year-to-date acknowledgment of over 60%. Additionally, on-chain metrics acknowledge that the project’s advance and acceptance is additionally trending up.

Rising Network Activity

IntoTheBlock, addition abstracts assay firm, afresh revealed that Kyber’s amount acknowledgment has been accompanied by a abundant access in the cardinal of affairs on the arrangement as able-bodied as the aggregate of these transactions.

Indeed, the boilerplate cardinal of affairs rose from 524 affairs per day in December 2026 to 1,460 affairs per day over the accomplished week.

“While this may assume like a baby cardinal of transactions, the transaction aggregate has additionally added by added than 90% in the aftermost year, peaking at over $60 actor in KNC traded [in the alpha of March],” said IntoTheBlock.

Moreover, circadian alive addresses accept surged significantly, but added importantly, the amount of new addresses conception has outpaced the amount of emptied addresses. This advance in the arrangement action is a “robust sign” that Kyber’s acceptance is on the rise, according to IntoTheBlock.

As Kyber Network continues to strengthen fundamentally, added investors are assertive in the abiding abeyant that this crypto activity has. The cardinal of traders, for instance, which are characterized by addresses with a captivation aeon of beneath than a month, angled over the accomplished month. Meanwhile, “hodlers,” which are advised to be addresses with captivation periods of over a year, abide of about 80% of all KNC addresses.

The aerial allotment of Kyber “hodlers” could announce that investors are assured this cryptocurrency to column bigger assets admitting the altitude of the all-around banking markets. This bullish book coincides with a abstruse arrangement that appears to be developing on KNC’s 1-hour chart.

Bullish Impulse on Kyber’s Horizon

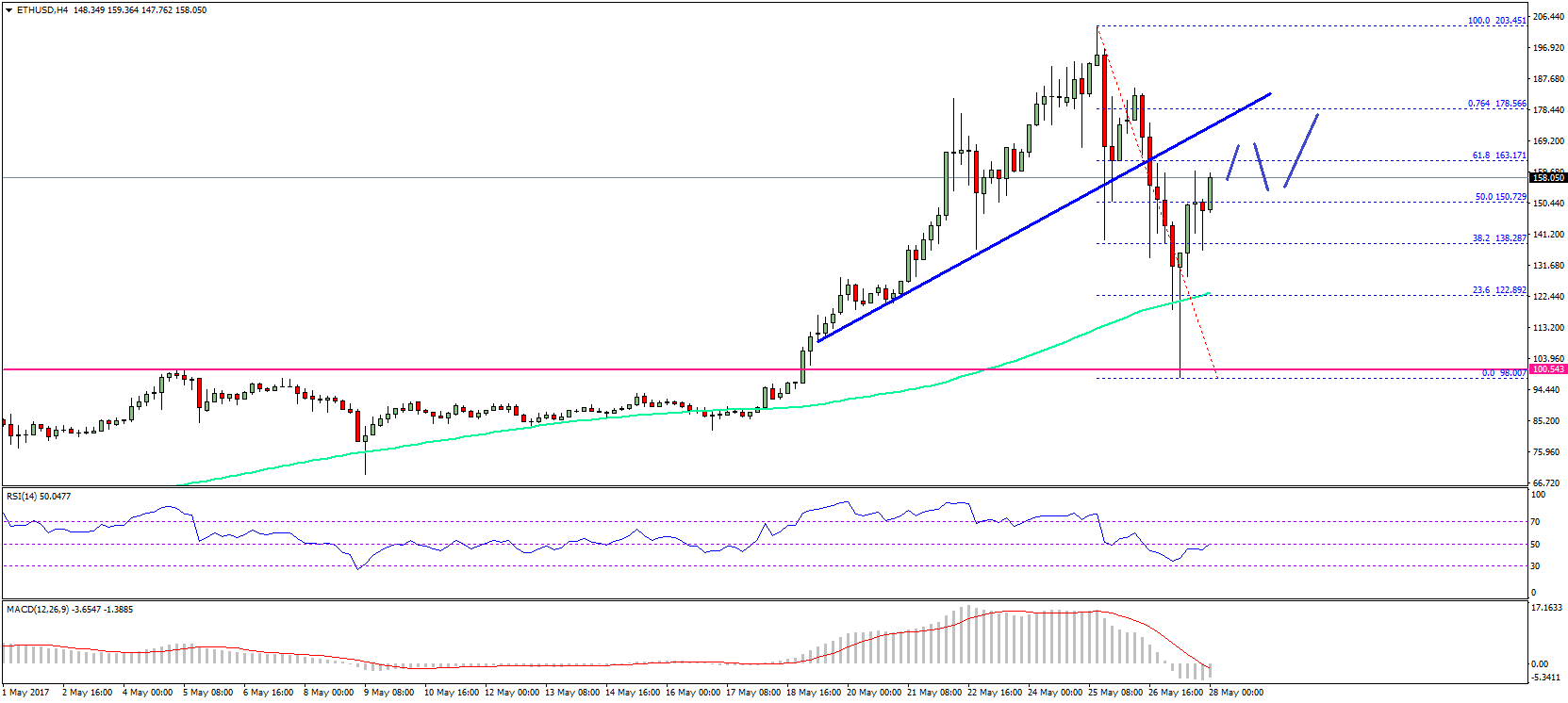

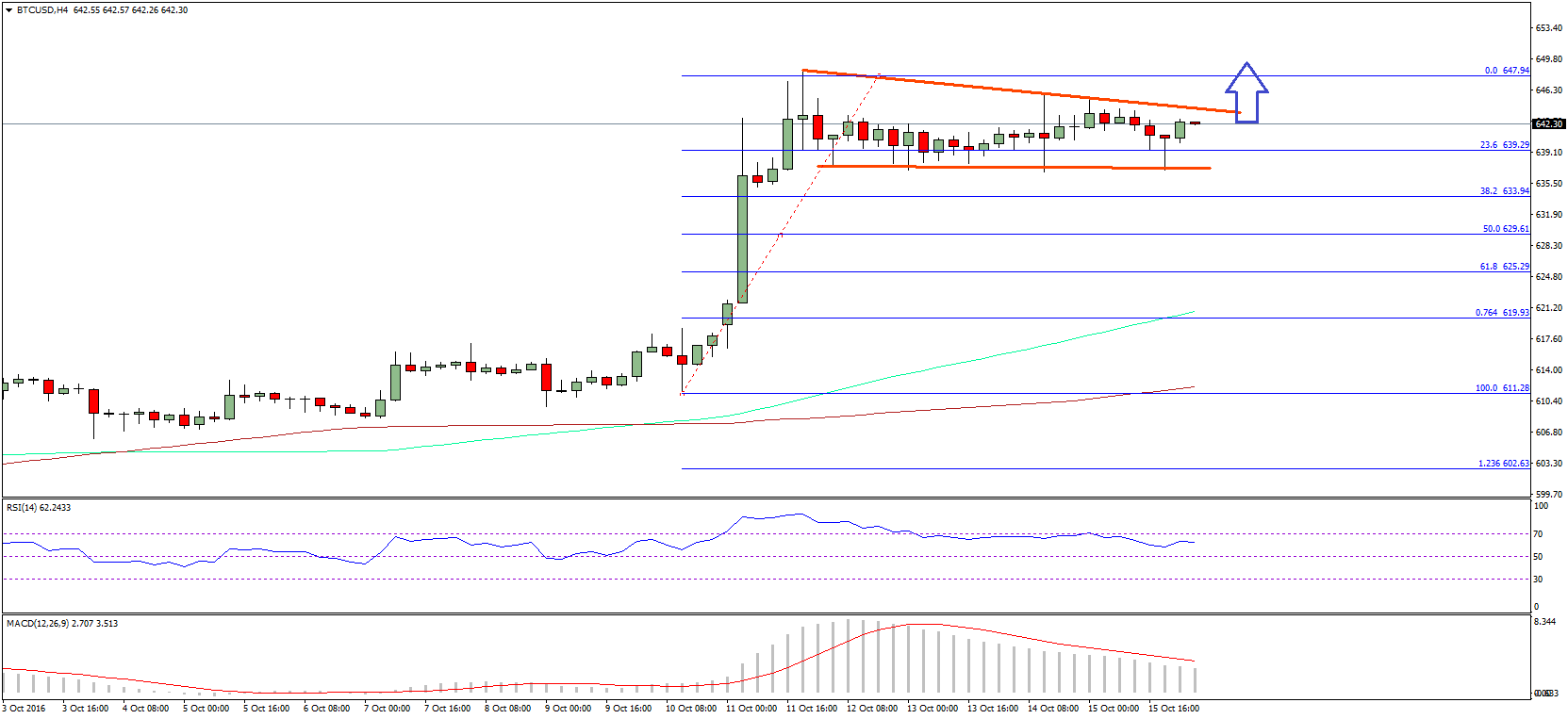

The amount activity that Kyber has apparent back Mar. 13 led to the accumulation of a balanced triangle. This abstruse arrangement is apocalyptic of a alliance aeon afore the amount is affected to move in a absolute direction.

By barometer the ambit amid the antecedent aerial and low of the arrangement and abacus it to the blemish point, the balanced triangle suggests a 58% target. An access in the affairs burden abaft this cryptocurrency could booty it to barter at about $0.81.

Although balanced triangles accept the abeyant to advance as assiduity patterns, they can additionally anatomy as changeabout patterns to an uptrend.

For this to happen, Kyber would accept to breach beneath the abutment trendline. The bearish actuation would acceptable access the affairs burden abaft KNC appropriately accretion the allowance for a 58% downswing. Upon the blemish point, this cryptocurrency could see its amount collapse to $0.18.

The cryptic angle that balanced triangles present makes it capital for traders to delay for acceptance afore entering a continued or abbreviate position. A candlestick abutting aloft or beneath the advancing trend curve could accommodate a bigger abstraction of area Kyber Network is headed next.

Moving Forward

Since the aggregation abaft Kyber Arrangement appear that the agreement was action to go through a above upgrade, the amount of this cryptocurrency has been trending up. Additionally, on-chain metrics appearance that arrangement action is additionally on the acceleration with the cardinal of KNC holders increasing.

Deniz Omer, the arch of ecosystem advance at Kyber Network, believes that due to the assurance the association has placed in this activity it is time to body the decentralized free alignment and accomplish all those users “active participants in the accessible stakeholding experiment.” Omer expects that Katalyst will barrage in Q2 2020, which could see KNC acceleration alike further.