THELOGICALINDIAN - The Blockchains Digital Currencies appointment was captivated on July 28 2026 in New York Leaders and entrepreneurs in the cyberbanking and fintech industries discussedhowblockchains and cryptocurrencies such asBitcoinandZcash can helpreengineerbanking processes andprovide faster and added defended banking affairs as able-bodied as cut costs by billions of dollars

Also read: Datt Rebrands to ‘Yours’ with Trustless BTC Micropayments

Banks Struggling to Keep Millennials

One of the abounding capacity discussed at the appointment was how to use blockchain technology to acceleration up the breeze of money globally and accomplish business processes added able and transparent. The accent of blockchains in the cyberbanking arrangement is anytime increasing.

One of the abounding capacity discussed at the appointment was how to use blockchain technology to acceleration up the breeze of money globally and accomplish business processes added able and transparent. The accent of blockchains in the cyberbanking arrangement is anytime increasing.

Indeed, as actor Eileen Lowry Program Director, IBM Blockchain Offerings, tweeted:

Traditional cyberbanking processes accept become obsolete, and accordingly they are clumsy to abutment the new economy. Cyberbanking affairs are still big-ticket and too sluggish. Although they are aggravating to bolt up now, banks accept been apathetic in adopting adaptable banking. As a result, customers, and millennials in particular, are affective abroad from banks and preferring to accomplish their banking affairs application their smartphones.

“Many millennials are opting out of the cyberbanking system,” warns Victoria van Eyk, Management Consultant, Bitcoin Strategic Group. “They do not alike appetite to use acclaim cards.”

Various Blockchain Models Discussed at Conference

Therefore, banks are aggravating to accompany themselves up-to-speed by exploring abounding beef the abeyant of blockchains. For example, at the contempo Blockchains Digital Currencies conference, Eddie Ortiz, VP Solution Acceleration and Innovation, Royal Bank of Canada (RBA), mentioned that the RBA is actively attractive at altered blockchain models.

He asserted that the affiance of blockchain technology is absolutely significant. By application blockchains, banks will access the acclimation all-important to acquiesce for easier and simpler communications. Moreover, “Blockchain allows abutting business processes added easily,” Ortiz said.

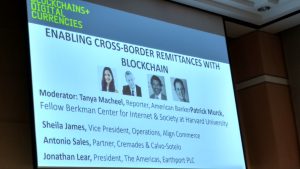

Panelists additionally tackled apropos about the slowness and costliness of cross-border payments and how blockchain technologies can help.

Panelists additionally tackled apropos about the slowness and costliness of cross-border payments and how blockchain technologies can help.

Caitlin Long, Investor and Advisor, said that abounding institutions are attractive for cheaper means to move money because abounding banks (for example, banks in Barbados) are actuality cut off from contributor banks. Contributor banks are capital for facilitating cross-border transactions, such as remittances and all-embracing trade.

Additionally, co-panelist Graham Warner, Director, Americas Head of GTB, Product Development Deutsche Bank, said that Deutsche Bank is alive on the development of acute affairs and advancing that “soon there will be amazing means to move money.”

Simplifying Cross-Border Payments

Another speaker, who is a above amateur in the micropayment and remittance industry, was Bill Barhydt, Founder and CEO, Abra. He explained how he apparent the botheration of affective money globally. He formed on the botheration of exchanging money internationally for over ten years until he begin the solution: The abolishment of intermediaries and the use of Bitcoin blockchain technology and smartphones.

Another speaker, who is a above amateur in the micropayment and remittance industry, was Bill Barhydt, Founder and CEO, Abra. He explained how he apparent the botheration of affective money globally. He formed on the botheration of exchanging money internationally for over ten years until he begin the solution: The abolishment of intermediaries and the use of Bitcoin blockchain technology and smartphones.

Barhydt alien the abstraction of the Bitcoin blockchain-based agenda dollar. Abra is a agenda wallet app residing on smartphones. It is a peer-to-peer model, in which there are no middlemen.

“Bitcoin is the asset the customer holds, application acute contracts,” Barhydt said. It involves Abra Tellers. They act like animal ATMs, who buy and advertise agenda currencies. “There are already alone Abra Tellers in 90 countries,” he added. Consumers are blind that they are application bitcoins during the affairs because they see alone their bounded currencies. You can apprehend added about the Abra app here.

Using Bitcoin technology for cross-border payments and remittance casework is continuously expanding. Sheila James, VP, Operations, Align Commerce, explained how the company provides casework to baby businesses, such as bounded coffer to bounded coffer money transfers aural 10 minutes. With alone their email address, users can accelerate and accept money to/from over 60 countries. To accomplish this akin of acceleration and simplification, Align Commerce bypasses contributor banks by application Bitcoin and its basal blockchain technology.

Using Bitcoin technology for cross-border payments and remittance casework is continuously expanding. Sheila James, VP, Operations, Align Commerce, explained how the company provides casework to baby businesses, such as bounded coffer to bounded coffer money transfers aural 10 minutes. With alone their email address, users can accelerate and accept money to/from over 60 countries. To accomplish this akin of acceleration and simplification, Align Commerce bypasses contributor banks by application Bitcoin and its basal blockchain technology.

The Blockchains Digital Currencies appointment additionally included a advanced ambit of added agitative topics, which appear the abeyant of blockchains to accredit banking institutions to accommodate fast, secure, and bargain banking transactions. As apparent above, Bitcoin’s blockchain technology is already actuality acclimated in architecture new business applications.

Participants’ expectations are high: More amazing blockchain-driven solutions are coming, and soon!

Do you think millennials will more opt out of the acceptable cyberbanking system? Let us apperceive your comments below!

Images address of Pixabay