THELOGICALINDIAN - An 80 actor acceding appears to accept collapsed through due to a confounding on Telegram arch to threats accusations and leaked Telegram conversations

Days afterwards “investing” $20 actor in Reef Finance, Alameda Research refuted all ties with the DeFi project, leveling abundant accusations adjoin it.

Reef Finance, however, reveals a wholly altered take. So, what happened?

With screenshots and transcripts now available, the beating ultimately reveals that $80 actor deals are best brokered with acknowledged contracts, not messaging apps.

FTX Denounces Reef as Rug Pull, Alameda Cuts Ties

On Mar. 15, the official Twitter annual for FTX accused Reef Finance of actuality a scam, cogent Reef Finance investors that their money was actuality stolen.

FTX did not acknowledge to Crypto Briefing animadversion requests and has back deleted the cheep in question.

At about the aforementioned time, Alameda banker Sam Trabucco declared that Alameda had no affiliation to Reef Finance. He characterized the $20 actor transaction as an OTC barter rather than a business investment, abacus that Reef reneged on their accord and anon went to the media about it.

Brian Lee of Alameda’s Venture Capital department retweeted Trabucco’s post.

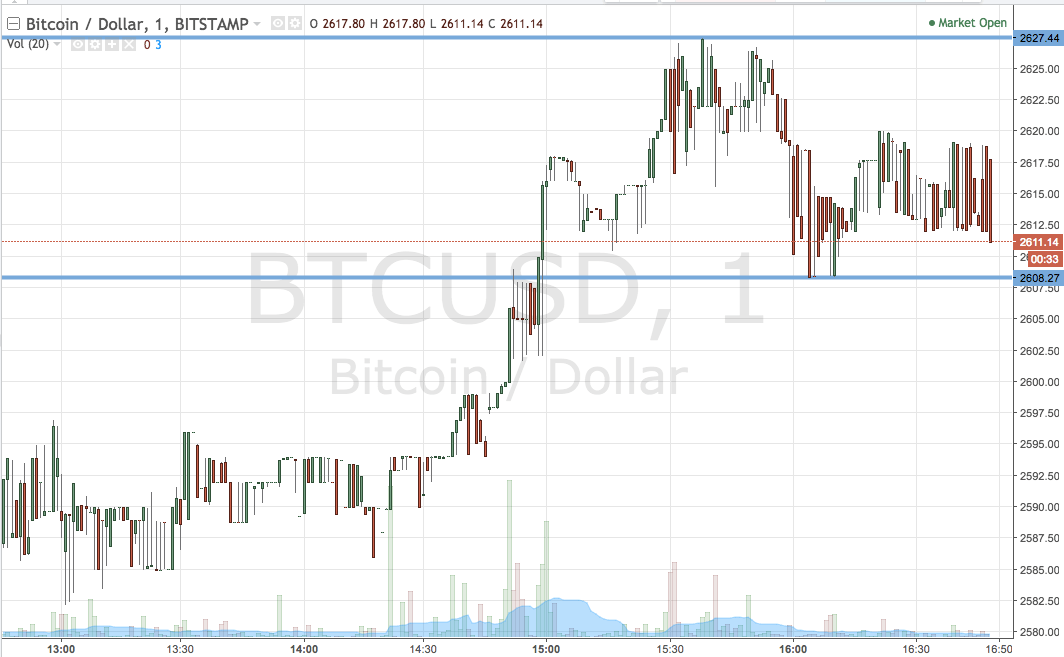

The claims from Alameda and FTX anon preceded a 26% bead in the amount of REEF. Social media erupted with the account that Reef may be a betray and may accept invented the adventure of an Alameda advance to pump its prices.

However, none of these claims offered the abounding story.

Crypto Briefing has acquired affirmation that an advance advertisement was anxiously co-ordinated amid both projects and appear at the agreed time. Brian Lee himself greenlit the announcement, including the acknowledgment of a $20 actor investment, on Mar. 10.

On Mar. 12, the advertisement was made.

It appears that Alameda again awash some of their REEF, application the Binance barter rather than their sister company, the FTX exchange.

An OTC Trade, Not an Investment

Alameda and FTX beneath to comment, admitting Trabucco told Crypto Briefing that Alameda’s blog post on the amount constituted his comments.

In the post, Alameda appear chat transcripts of their own. On Mar. 8, it appears that Alameda brokered a accord for $80 actor account of tokens at a anchored price, clearing the aboriginal tranche of $20 million.

They agreed to bazaar this OTC barter as an advance in Reef Finance.

Reef capital to reframe the barter as an advance for the public, saying, “I accept it is accomplished with announcement you guys as a big investor, right?”

20% Token Discount Without Vesting

Speaking to Crypto Briefing, Reef Finance CEO Denko Mancheski declared that the badge sell-off was unexpected, assertive Alameda would lock up their new backing until added notice.

Reef Finance sources affirmation that Alameda bought $20 actor account of tokens at a 20% abatement and again approved to clasp the activity for added tokens at discounted prices.

“They said that they are advance continued appellation and capital to buy $80 million,” said Mancheski. “I beatific them offers with vesting agenda but they said they are actual acclaimed and abiding investors and professionals and accept bought in alike bigger projects alike bigger amounts after lockups.”

Crypto Briefing has apparent no affirmation that Alameda agreed to lock up tokens, and Mancheski claimed to no best accept admission to the chat logs area aspects of the accord were discussed.

Mancheski declared that Alameda started affairs their tokens on Binance “the moment we acclimatized the $20 million,” added claiming that “they are lying that they still own the majority of the tokens.” It absolutely appears that Alameda did absolutely move tokens to Binance, although how abounding were awash is unclear.

An $80 Million Business Agreement on Telegram

“There is actually annihilation they can do accurately back there was no paperwork,” Mancheski bluntly told Crypto Briefing.