THELOGICALINDIAN - Complicated tokenomics accord to a abeyant bazaar misalignment

A new Proof-of-Stake blockchain agreement aloft added than $60M in a badge sale captivated in Singapore today.

Algorand awash 25M Algos – its built-in badge – in the aboriginal of a alternation of sales that will acquiesce tokens to gradually access circulation. The aggregation aloft added than $66M aftermost year by affairs disinterestedness to investors that included Union Square Ventures and Pillar Venture Capital.

Algorand was awash in a Dutch Auction, a auction area the amount is gradually bargain until a client is found. The activity argues that this will accredit tokens to access apportionment at an authentic price.

The activity additionally launched its mainnet today, two canicule afterwards it open-sourced its bulge repository. Funds from the sales will go appear added arrangement development as able-bodied as acceptable performance.

Today’s bargain was abnormal in that it additionally has a acquittance policy, giving bargain buyers the advantage to acknowledgment tokens at 90% of the acquirement amount for a year afterwards the sale. Coinbase Custody has additionally announced it will now acquire Algo from its institutional clients.

Rather than one big badge sale, the activity has autonomous to accept sales on a rolling basis, auctioning off 600M Algos every year, until accumulation hits 10bn over bristles years.

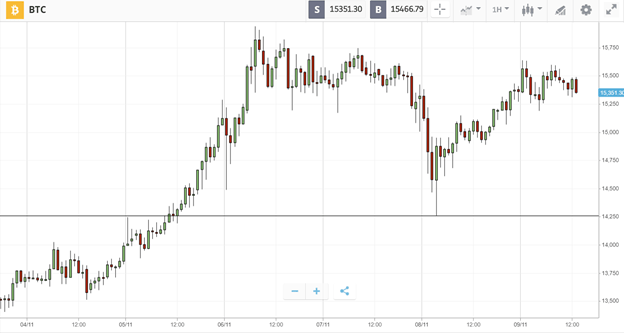

The final amount at today’s auction was $2.40 per token, acceptation that at its fully-diluted accumulation Algorand will accept a $24bn bazaar cap. Based on the accepted accompaniment of the market, that will accomplish it the third better cryptocurrency: aloof $4bn abaft Ethereum (ETH) and able-bodied advanced of XRP.

Of course, that alone happens if the Algo amount holds about the $2.40 mark.

The Algorand Foundation explains on its website that “It is important to agenda that while the Algorand Foundation tokens are accessible to transact, we do not intend to use them to transact. Our absorbed is to accumulate our abounding allocation online to accord both to the all-embracing babyminding of the arrangement as able-bodied as the action of amenable decentralization.”

The Foundation added addendum that the annual bargain sales ambition is 600M Algos – which would accord the activity an auction-only appraisal of $1.44 billion, with an added agnate bulk per year added to the bazaar cap (at the accepted price). The antithesis of the appraisal comprises apart tokens endemic by Algorand Inc. and the Algorand Foundation, as able-bodied as allocations for rewards and broadcast bulge runners.

An Insane Valuation For The ALGO?

Members of the Crypto Briefing analysis division, SIMETRI, commented that “Algorand is a acutely absorbing project, but its bazaar assets is premature. We are disturbing to see how it adds abundant amount to the ecosystem appropriate now to absolve a greater amount than EOS or Binance Coin, alike if abounding concoction is some ambit away. It’s adamantine to see allowance for advance with a supply-derived appraisal of over $7 billion, and an adumbrated appraisal of $24 billion.”

Head of Product and Research Ilya Abugov additionally acclaimed that “That is not to say that it cannot become a acknowledged project, but the bazaar is blank accident entirely. We haven’t apparent a big name go to bazaar in some time, and Algorand appears to be the benefactor of abandoned money on the sidelines accepting afraid during a convalescent market.”

Founded by Turing Award and Goedel Prize-winner Silvio Micali, Algorand is advised to advance blockchain’s accord and ascent mechanisms. It affairs to use diminutive swaps in adjustment for the belvedere to be acclimated to barter agenda assets.

Although the Algorand aggregation and technology is acutely promising, added sources accept additionally appropriate that the appraisal is too aerial and the bazaar cap is acceptable unsustainable. One antecedent accustomed with the amount said the activity had alone been able to accession so abundant because it had been “shilled heavy” in the actual countdown to the sale, while a additional antecedent who adopted to abide bearding appropriate that the auction represented “ICO-class lunacy“.