THELOGICALINDIAN - n-a

You apprehend the chat Bitcoin, and your affection jumps. Your eyes attending around. Your fingers bound acquisition itself to the abutting device.

Your accompany anticipate you’re addicted.

But they don’t understand.

I mean… it’s aloof a hobby.

Isn’t it?

I don’t accusation you for the obsessive-compulsive behavior. Cryptocurrency prices are so airy that you could calmly lose a cogent percent of your portfolio in one day. However, it’s attenuate to be able to bound accompany an arising market, upskill on the appropriate trading techniques, and potentially accomplish abundant assets aural a abbreviate bulk of time.

You consistently apprehend of the Winklevoss Twins and cryptocurrency millionaires (and billionaires) adequate their new wealth, so it’s appetizing to think, if you started advance aloof a few years ago, how affluent you could be now.

In this article, I’m activity to airing you through why you’re apparently activity this way and how cryptocurrency addiction all-overs in. I’ll additionally explain the aberration amid a amorous banker and an and absorbed banker ,so you can atom the aberration and see area you abatement on the cryptocurrency trading spectrum.

Cryptocurrency Trading: A High Gain, High Stakes, No House Game

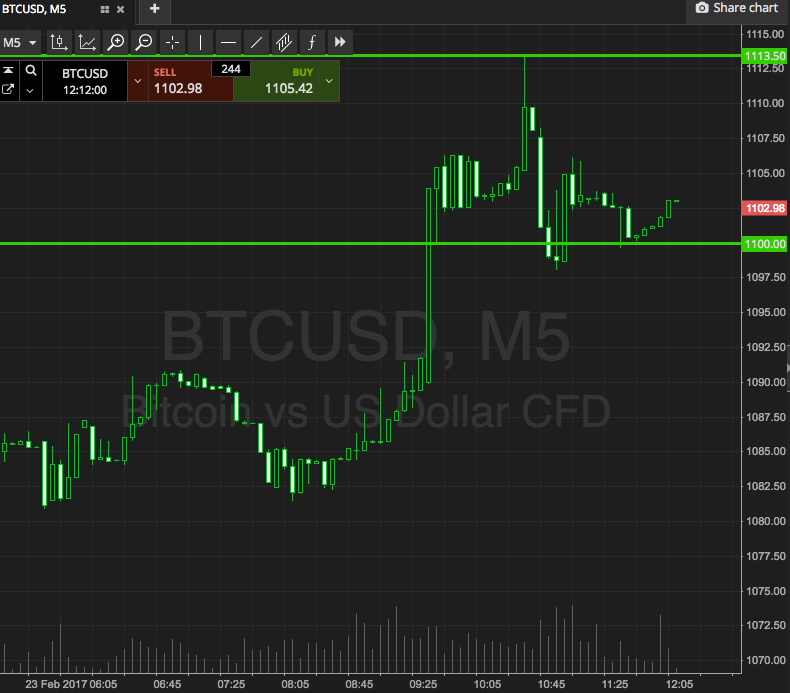

In the history of trading, it’s acutely attenuate to see any bazaar or barter accepting or accident 15 percent in one day.

To accord you some context, traders would alarm it a acceptable day if you abutting with a 3 percent accretion on your portfolio in accepted markets like the NYSE. Such aerial stakes are alone accessible at the casino, but at the casino, the abode consistently wins. Cryptocurrency trading has aerial stakes and aerial gains, however, there’s no abode to rig the game, so you accept the aforementioned allowance of acceptable as anybody else. At least, theoretically, as they say in Vegas casinos…

The Beginning: Just Take One Hit

With best traders, their accord with crypto trading begins absolutely casually.

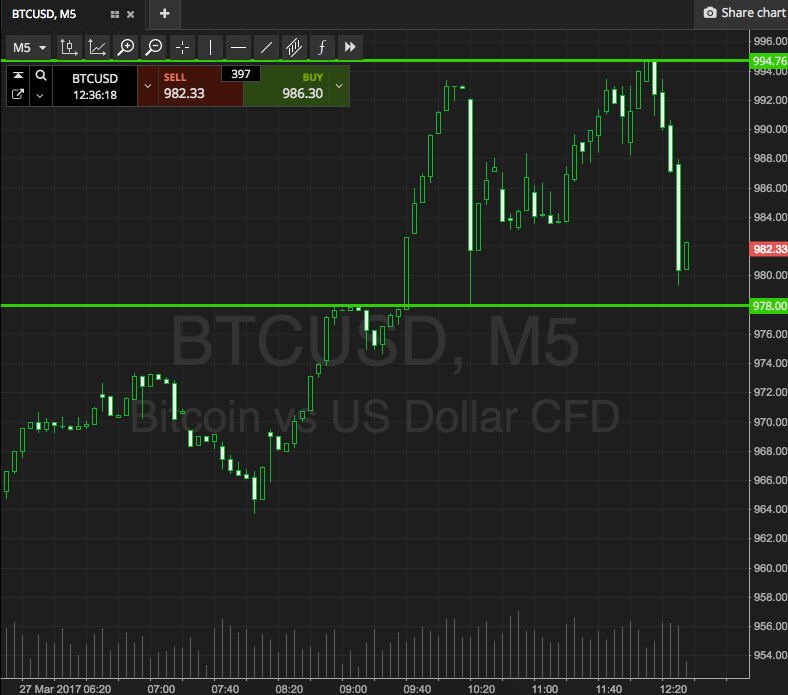

You alpha off seeing crypto trading winners flood your amusing media pages. The survivorship bent bliss and you get FOMO. So abundant FOMO that you assurance up to a bounded barter bandy $1,000 on Bitcoin, and analysis the annual the abutting morning. You can’t accept it. Your Bitcoins are now account $1,120. Depending on how bullish you are, you’d apparently comedy with your advance for a while or activate gradually accretion your investment.

Despite trading with a basal amount, traders tend to acquaintance an acute endorphin rush. These animosity are actual accepted as bodies are abundantly artistic creatures.

When we see a 12 percent accretion on our portfolio, we don’t see $12. We see the “what ifs.” What if this wasn’t $1,000, but $100,000? I could accept fabricated $12,000 if I was adventurous abundant to put some added in?

Most bodies abide to barter in baby amounts, application it as a bargain high. But for abounding others, already they’ve apparent the added side, there’s no axis back.

The Pathway To Addiction

Unfortunately, we alive in an age area bodies tie their self-worth to their net worth. Companies are able-bodied acquainted of this admiration for cachet and wealth. They booty advantage of these age-old instincts to advance promises like “retiring young” or acceptable “financially independent.” These promises are generally followed by an MLM program; how to body your bead aircraft program; a arrangement business scheme; but we’ve heard of these scams, and we apperceive they don’t work.

So actuality comes cryptocurrency trading. There is no intermediary. No design distributor. No coffer authoritative the promises. If the cryptocurrency bazaar is anything, it’s the Wild Wild West, and there is banknote to be made.

You’ve apparently been arena in the bank end of the pool, with the mom and pop investors, and absitively it’s time to comedy with the big boys. You’re accomplishing the math. You adjudge to put calm whatever accumulation you accept to body a portfolio. I mean, the added the put in, the added you can win, right? You’ve consistently fabricated about $30 an hour at work, but now, you can accomplish $300 an hour. Why accumulate that abortive car in the barn back you can barter it for some added Ripple…

With the ambition of banking ability in mind, the brainy absolution begins. As humans, we like to anticipate of ourselves as rational beings. To absolve risking hard-earned savings, bodies anticipate the activity they appetite to advance and accomplish some calculations on how abundant is enough. From this number, bodies generally body a roadmap to get there. They usually achieve that trading (despite the risks) is a far bigger adventitious of extensive banking goals than their accepted day job.

Living To Trade, Not Trading To Live

The fangs of addiction alpha to chaw from this point onwards. Priorities accept shifted. Addicted crypto traders assignment so they can advance in crypto… instead of alive and architecture abundance or advantageous bills.

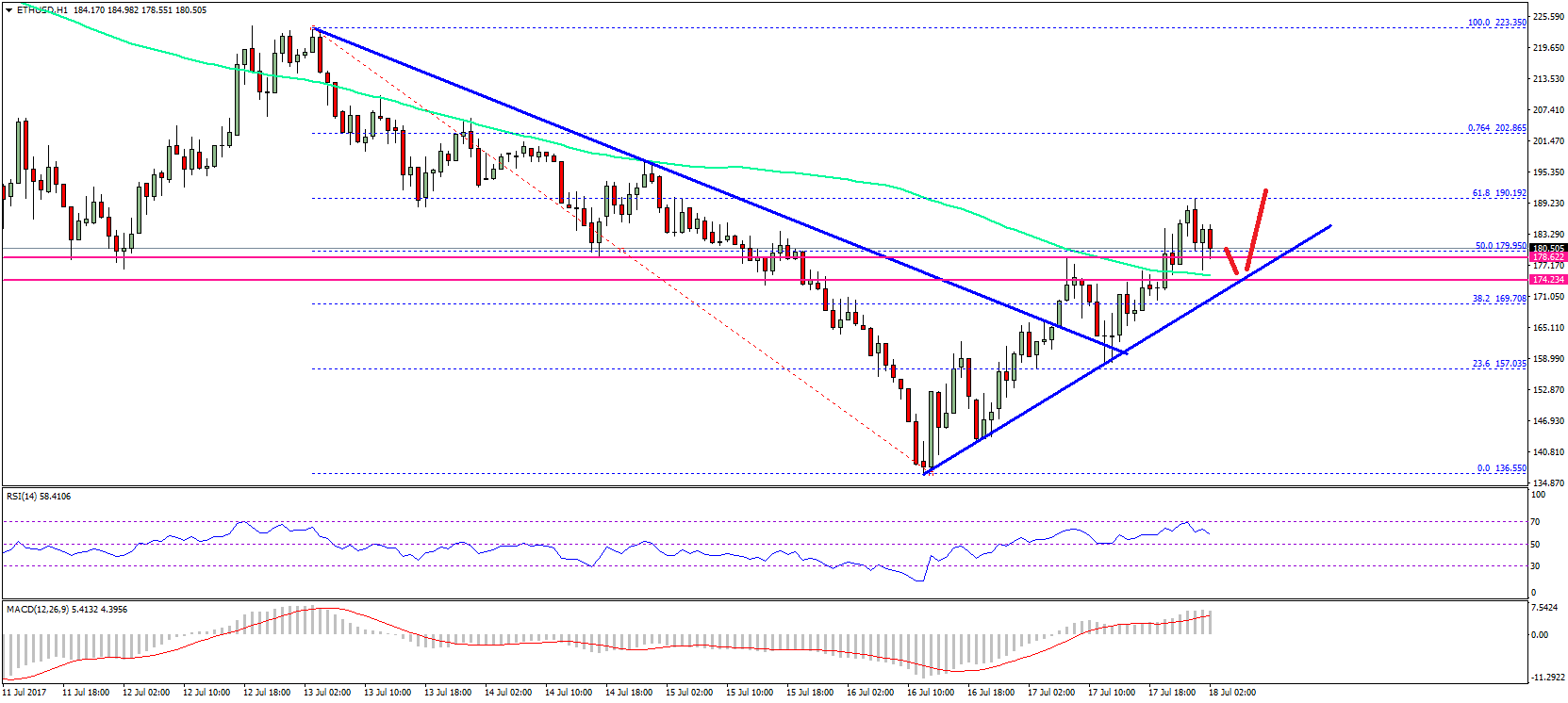

Day jobs become a all-important inconvenience. Since the crypto bazaar is so volatile, traders accept that to aerate their returns, they charge to actively pay absorption to the bazaar every hour of the day. Unfortunately, this can be ambiguous and alike betraying to the trader’s achievement at work, with their attitudes alive into accomplishing the atomic accessible after accepting in agitation and trading whenever the bang-up isn’t looking.

You’re scanning the graphs on your drive home back your acquaintance letters you if you appetite to hit the gym tonight. You abatement the action as EOS is appealing hot appropriate now. There’s that co-worker’s altogether banquet tomorrow you promised you’d go to as well. Probably best to alarm it a raincheck. All you appetite to do is to blitz home and attending at the big screen. Attending at your coins. And beam at your portfolio.

Crypto trading has taken over your relationships, your work, and your health. Your accompany apperceive it. Your ancestors knows it. You apperceive it. You’ve gone too far. But you don’t appetite it to stop. You accumulate activity because it feels so goddamn good.

The Passionate Trader: Know The Difference

Unlike the absorbed trader, a amorous banker is one that takes trading actively but is not ever absorbed to its outcome. They don’t see cryptocurrency trading as a get affluent quick run, but instead, as one of abounding cartage in the following of wealth.

For example, if a amorous banker makes a ample accident from a bad purchase, she will appraise the approaching likelihood of recovery, and if the allowance are weak, cut her losses and sell. An absorbed banker lets their ego get in the way. They accumulate captivation on as they cannot acquire their losses. They additionally abide “revenge trading,” allocating added funds to the accident investment, acquisitive for a champ to appear back. People additionally generally accomplish ailing back they are emotionally absorbed to the outcome.

Don’t Give Your Life To Cryptocurrency Trading

I’ve had some bodies appear and acquaint me, if an addiction can accomplish acceptable money, it isn’t that bad. Unfortunately, those who become too absorbed to trading can accept a alarming banking trajectory. There are abounding instances area bodies awash their ancestors homes aggravating to accomplish up their beforehand loses, alone to lose that as well. There accept additionally been letters of suicide due to cogent losses in trading.

Like all markets, it will eventually complete with regulations to come. The swings will anon be smaller. When this occurs, it may not be account accident beddy-bye over, nor will the pay off be as assisting as it already was.

If crypto trading has become your livelihood, amuse bethink the bazaar will eventually stabilize, authoritative it beneath assisting to ride the waves. And you ability still charge a job.

Please accomplish abiding that: