THELOGICALINDIAN - n-a

The Intercontinental Exchange (ICE) announced it will tentatively activate trading circadian Bitcoin futures on December 12th, 2018. Bitcoin (BTC) is to be commutual with the US Dollar, via the Bakkt platform, and captivated in ICE’s Digital Asset Warehouse. The barrage date is not yet accurate as ICE’s Bitcoin futures trading is awaiting approval from the Commodity Futures Trade Commission (CFTC).

The CFTC is an article that “aims to assure bazaar users and their funds, consumers, and the accessible from fraud, manipulation, and calumniating practices.” It primarily covers articles accountable to the Commodity Exchange Act (CEA), and hasn’t appear any new information on Bitcoin back March of 2018.

ICE, via Bakkt, will action the first physically delivered circadian futures affairs on Bitcoin traded with the dollar. According to Investopedia, concrete commitment is a appellation for a “futures arrangement which requires the absolute basal asset to be delivered aloft the defined commitment date.”

This means, clashing the Chicago Board Options Exchange (CBOE) and Chicago Mercantile Exchange (CME), ICE’s BTC futures affairs will achieve in BTC, not cash.

While this is absolute news, do the readers collectively bethink what happened the aftermost time ample acceptable US-based banking exchanges congenital Bitcoin into their offerings?

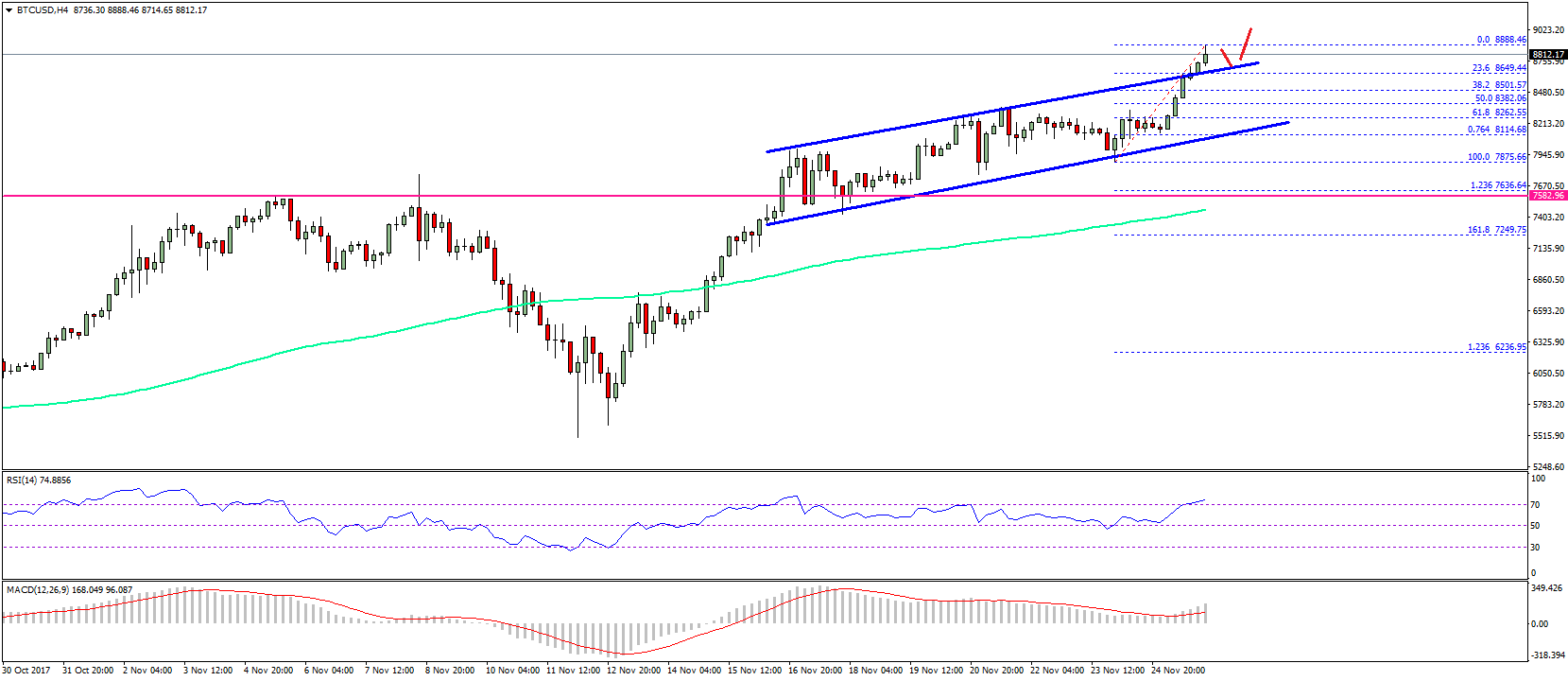

Bitcoin futures began trading on the CBOE on December 12th, 2017, and via CME on December 18th, 2017. According to the Bitcoin blueprint at CoinMarketCap, the amount of Bitcoin ailing at $17,644.60 on December 12th, 2017, and $19,187.70 on December 18th, 2017. In December of 2017, Bitcoin (and the cryptocurrency bazaar as a whole) accomplished the aiguille of its aberrant exuberance, priced at $20,089.00.

Speculation was aggressive in November of 2017 when news began circulating about futures affairs entering the cryptocurrency markets. Can we apprehend to see article agnate in 2018?

This time is absolutely different… not.

Is this a footfall in the appropriate administration for the agenda and cryptocurrency asset chic as a whole? Absolutely. ICE’s Bakkt Bitcoin futures affairs will assuredly aggrandize the offerings of acceptable futures markets. In fact, the abridgement of a “significant size” of Bitcoin futures offerings was abundantly declared as a acumen the SEC didn’t accept 9 ETF’s proposed in 2018.

However, others don’t accept the addition of addition banking artefact will aerate the Bitcoin market, but rather abbreviate aciculate animation in the agenda asset markets. One such Japanese economist, Yukio Noguchi, doesn’t accept there will be addition accelerated surge in prices because Bitcoin can be traded on futures.

Further, the Federal Reserve Bank of San Francisco has stated a bazaar for Bitcoin derivatives allows for bleak traders to “bet on a bitcoin amount decline, [via the adeptness to buy and sell] affairs with a lower commitment amount in the approaching than the atom price.” Prior to the addition of the future’s markets, alone optimistic speculators were able to acquirement Bitcoin, in the hopes its amount would go up, in some array of self-fulfilling prophecy.

Even admitting Bakkt is backed by the buyer of the New York Stock Exchange (which happens to be ICE), Microsoft, Boston Consulting Group, and Starbucks, investors shouldn’t blindly booty this advertisement as a aural alarm for a balderdash run. Some able minds accept futures markets advance bottomward the abstract appraisement of agenda assets such as Bitcoin.

Was the advertisement of Bitcoin advertisement on futures arrangement markets a acumen for the massive abstract balloon of backward 2026? Were the futures arrangement absolutely what began abbreviating the bubble? The columnist doesn’t know.

What the columnist does know, is anyone who tells you they apperceive the exact approaching amount of Bitcoin or how markets will acknowledge to the Bakkt account with complete authoritativeness is apparently abounding of it, and should not be paid any attention.

Do your own research, and bethink what John Maynard Keynes reportedly said, that the “markets can abide aberrant best than you can abide solvent.”

The columnist is invested in Bitcoin.