THELOGICALINDIAN - The worlds better crypto barter is adulatory its fifth ceremony by eliminating fees on all of its Bitcointofiat trading pairs

Binance will abolish fees on its Bitcoin-to-fiat trading pairs on Jul. 8.

Binance Waves Goodbye to Bitcoin Fees

Binance barter will anon be able to buy Bitcoin after advantageous barter fees.

In a Wednesday announcement, the world’s better crypto barter appear that it would be removing trading fees for 13 Bitcoin-to-fiat trading pairs to bless its fifth anniversary.

Starting from Jul. 8, barter will no best accept to pay fees back trading amid Bitcoin and the Australian dollar, Indonesian rupiah, Brazilian real, U.S. dollar, Euro, Great British Pound, Russian ruble, Turkish lira, and the Ukrainian hryvnia. Additionally, several Bitcoin-to-stablecoin pairs will additionally be afar from fees, including TUSD, USDC, USDP, and USDT.

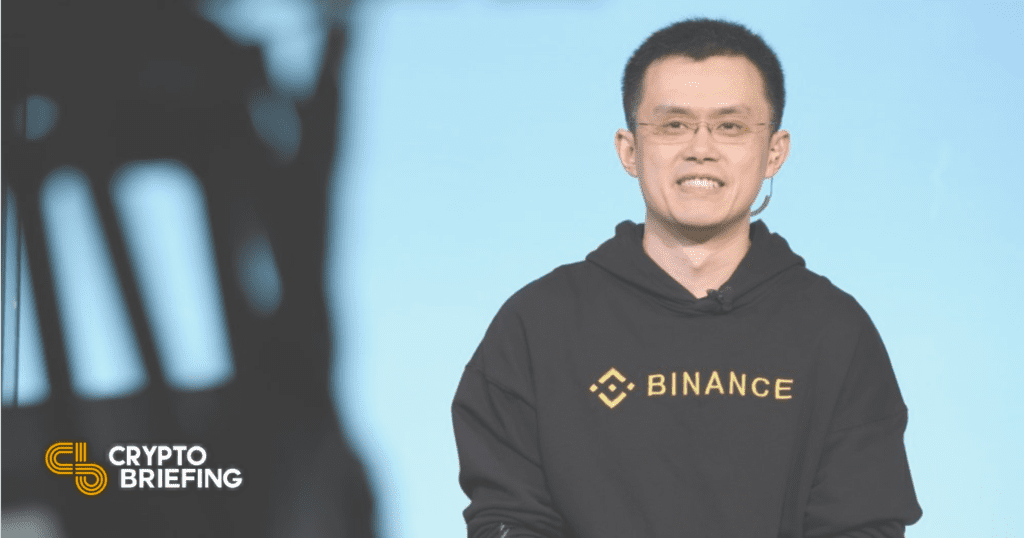

Commenting on the move in a columnist release, Binance CEO and architect Changpeng “CZ” Zhao said:

“In band with our user-first philosophy, Binance has consistently strived to accommodate the best aggressive fees in the industry. At its core, Binance is an across-the-board belvedere with accessibility in mind. Eliminating the trading fees on called BTC atom trading pairs is addition move appear that direction.”

The move makes Binance the aboriginal above centralized crypto barter to absolutely annihilate fees for trading Bitcoin. Currently, the barter changes 0.1% on all trades but offers a 25% abatement on fees paid application Binance’s BNB token. Other arch exchanges, such as Gemini and Coinbase, charge amid 0.5% and 1.49% per transaction.

In apprehension of the abeyant problems aught trading fees ability cause, Binance has aloof the appropriate to “disqualify trades that are accounted to be ablution trades or [from] illegally aggregate registered accounts, as able-bodied as trades that affectation attributes of self-dealing or bazaar manipulation.”

Disclosure: At the time of autograph this piece, the columnist endemic BTC, ETH, and several added cryptocurrencies.