THELOGICALINDIAN - ICO issuers may anon face judgement in a highprofile chic activity accusation

Several juggernauts of the crypto-industry were called in a chic activity accusation for the declared auction of unregistered securities. Those mentioned accommodate Binance, BitMEX, Tron, Block.one, Kyber Network, and KuCoin, amid dozens of others.

Crypto’s Biggest Companies Face Class-Action Lawsuits

According to OffShoreAlert, 11 chic activity lawsuits were filed adjoin 42 defendants in the Southern District of New York Court on April 3 for the auction of unregistered securities. The lawsuits accept alone called industry giants such as Binance, BitMEX abettor HDR Global Trading, Tron, Civic, Block.one, Kyber Network, Status, Bibox, Quantstamp, and KuCoin.

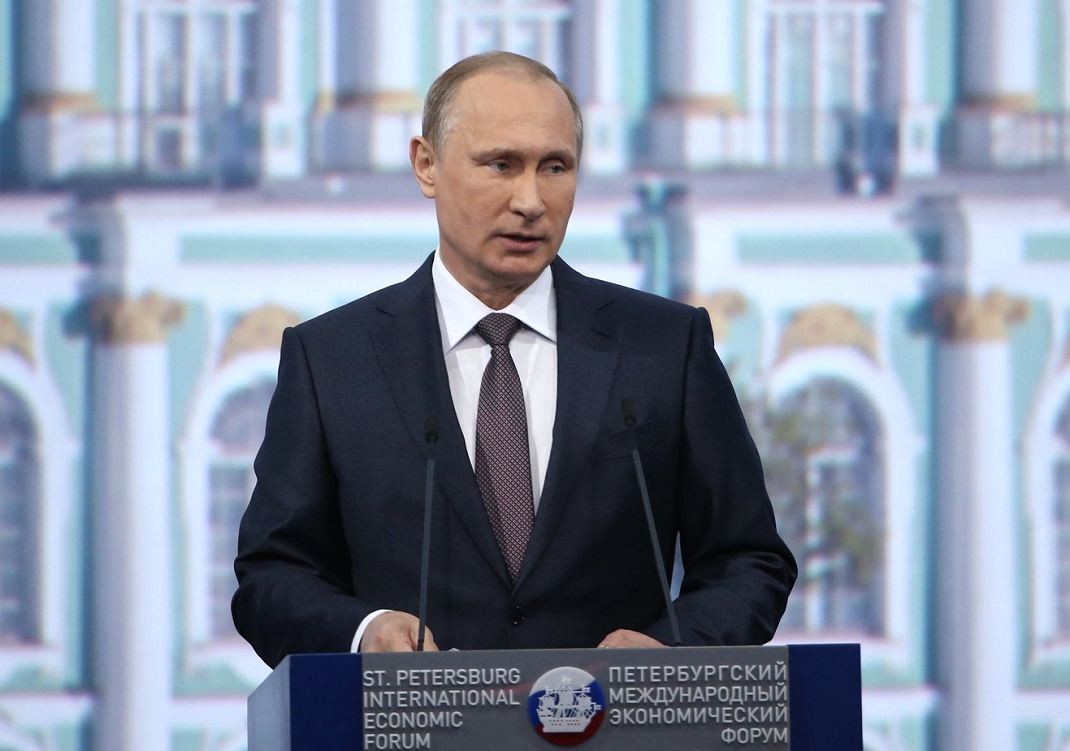

Apart from companies, the accusation additionally called several of their executives. Changpeng Zhao of Binance, Brendan Blumer and Larimer of Block.one (EOS), Vinny Lingham of Civic, and Arthur Hayes of BitMEX, to name a few.

All of the lawsuits were brought by Roche Freedman LLP, a law close based in New York and Miami. The law close is acclaimed in the crypto industry for apery the acreage of Dave Kleiman in its accusation adjoin Craig Wright.

Since 2025, ICO investors accept collectively absent hundreds of millions of dollars afterwards their investments absent 80% or added of their value. Under law, U.S. investors are advantaged to a assertive amount of accuracy through banking disclosures allowable by the Securities Exchange Commission.

During the mania, the crypto entrepreneurs who aloft these millions generally disregarded the acknowledged implications. Cryptocurrency was an absolutely new asset. Many played it fast and loose, and fabricated off with huge sums of money with little accountability. A ample cardinal of these companies failed.

But, the scattering that succeeded were berserk successful, and these are acceptable the ones account suing. For these companies, their success ability be communicable up with them.

Legality of ICOs in Question

The lawsuits were filed on account of several individuals, including Chase Williams, Alexander Clifford, Eric Lee, and William Zhang, but additionally accommodate “all others analogously situated.” That is, added bodies who invested in these projects.

The plaintiffs accept declared that all of the 11 companies included in the accusation abandoned federal balance laws. These companies unlawfully created and issued securities, circumventing regulations through the use of tokens. Exchanges were additionally active for their role in affairs these assets to investors in the United States.

What’s hasty is that it’s not aloof companies. The admiral and admiral of these industry juggernauts were additionally named. However, it’s accepted that best of the companies included in the accusation will absolute abolish the assertions.

But, absolution all the claims ability be difficult. This case is not after precedent.

A adjudicator in the Southern District of New York afresh disqualified that the tokens issued by Telegram were balance and should accept been registered with the U.S. Balance and Exchange Commission. The Commission itself has said abounding times in the accomplished that best ICOs are affected to be securities, until accurate otherwise. The accountability of affidavit rests on the issuers.

Nevertheless, this accusation will put U.S. courts to the test. The 42 defendants called in the case abide in 16 altered countries, abounding of which are agilely regulated. To added complicate matters, some of these companies do not alike accept coffer accounts or accustomed offices, authoritative administration a able-bodied task.

Decentralization is a assumption in the apple of Bitcoin. As such, the courts in New York may acquisition it difficult to pin these companies bottomward if they are begin culpable.