THELOGICALINDIAN - n-a

Hard forks are close times for any protocol. Blockchain updates charge to be implemented seamlessly and harmoniously. Not all work, but the accessible Bitcoin Cash angle is accomplishing the opposite. Prices are on the acceleration as investors about-face their absorption aback to the bread that admirers still alarm “the one accurate Bitcoin”.

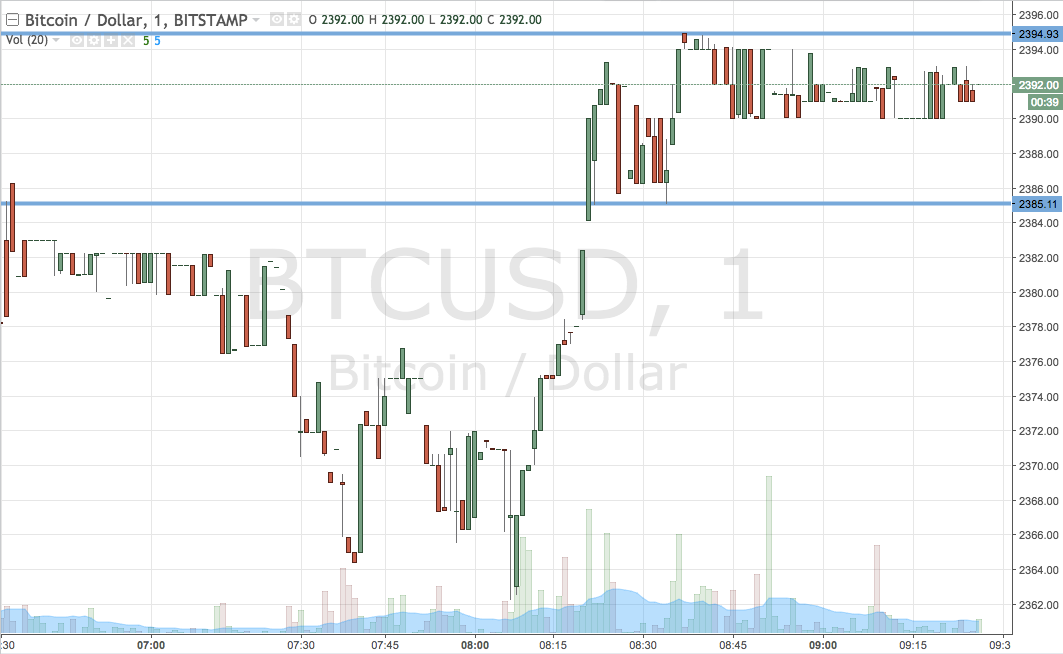

Bitcoin Cash prices accept been brackish back the alpha of the week. Starting Monday at about $415, the amount ranged aural a ten dollar advance appropriate up until Friday afternoon. BCH prices surged at about 13:00 GMT to able-bodied aloft $455 in little added than two hours. Although alone a $20 access per coin, these baby assets comedy out at a $500m access in the coin’s absolute value. It’s like aftermost year’s balderdash run all over again.

The amount acceleration coincides with announcements from some acclaimed exchanges cogent abutment for the upcoming Bitcoin Cash fork, set to booty abode in aloof beneath two week’s time. Chief amidst them was the Binance, the world’s better exchange, which announced at midday that it would abutment the fork. Hong Kong barter OKEx has additionally said it would abutment the arrangement update.

Bitcoin Cash Fork: the details.

Most arrangement adamantine forks advance to the conception of two chains: the aboriginal chain, which stays the same, and the new alternation which includes the arrangement updates. Parties drift to the new chain, abrogation the old one. It still exists, but after any users, it about stops working. It would be absurd for affairs to be accepted on the network.

That’s if it all goes according to plan, and forks don’t consistently do that. The DAO beating aback in 2016, back hackers fabricated off with millions of Ether (ETH) by base a artifice in the codebase, led to the conception of two separate blockchain networks: Ethereum and Ethereum Classic (ETC). The two are technically identical, the capital aberration is ETH doesn’t account the hack, whilst ETC does.

The Bitcoin Cash angle is a way to boldness some of the disagreements amidst the network’s key developers. The altercation is multi-faceted. Whereas all the groups appetite to advance the BCH’s scalability and performance, there’s no agreed way on how to do this.

Some parties, including Bitmain, altercate that changes to the scripting accent will accredit the agreement to handle non-cash transactions, but appetite to accumulate the blocksize at 32 MB. Others disagree. Mining basin and arch BCH advocate, CoinGeek, doesn’t appetite to accredit non-cash affairs but wants to accession the block admeasurement up to 128 MB.

The differences are acutely irreconcilable, and the agitation has become acrimonious over the accomplished few months. The Bitcoin Cash angle is apparent as a way to analysis out and acquisition the best solution. On November 15th the arrangement will breach off into assorted altered chains, anniversary implementing a separate set of arrangement updates. Over the period, abounding exchanges will append BCH trading.

So why the BCH amount rise?

The ambition is the angle will acquiesce the bigger alternation to win out over the others. That said, some abstracts aural the space, including Ethereum architect Vitalik Buterin, accept alike appropriate that the angle could aftereffect in the conception of two abstracted communities. The now asleep ‘BCC’ ticker attribute could be brought aback from the dead.

This is a bright befalling for investors. Whenever a adamantine angle happens, badge holders accept tokens both on the old and new chain. Most of the time this doesn’t absolutely matter. If no one uses the old alternation again the tokens are about worthless. But no one knows how the Bitcoin Cash angle is activity to go; it ability advance to the conception of two new networks.

If that happens badge holders will accept a accomplished set of new tokens that accept value, essentially accompanying their holdings. That exchanges, like Binance, accept appear out in abutment of the angle gives it legitimacy. That they will additionally append trading over the angle window creates a time limit. Investors are accepting in now to accretion acknowledgment and acquire the benefits.

Time’s a’ticking.

The columnist is invested in ETH, which is mentioned in this article.