THELOGICALINDIAN - Rcent assay shows that highvalue investors abide to buy the Bitcoin dip while retail investors agitation sell

Bitcoin prices accept apparent four double-digit corrections in the aftermost seven weeks, with the biggest—23.3% attempt to lows—happening this morning. Despite the carnage, ample whales are affairs the dip.

Bitcoin Whales Buy the Dip

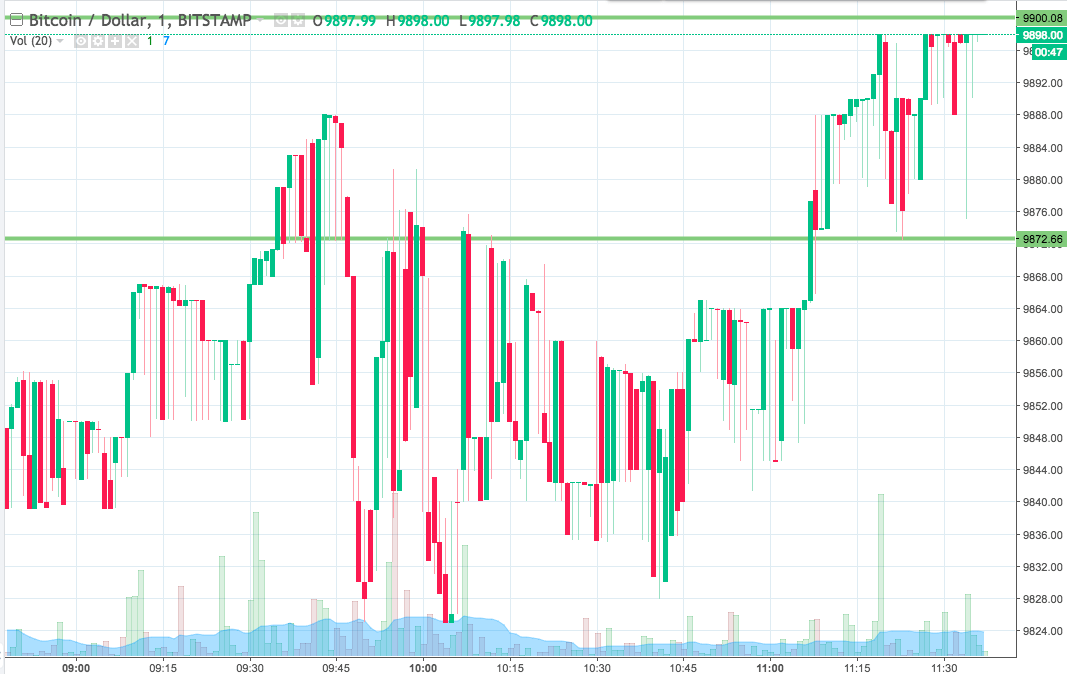

BTC alone to lows of $32,329 aboriginal Monday during the Asian trading hours, falling 23.3% from ira best aerial of $42,000.

Bitcoin “whale” addresses—wallets with added than 1,000 BTC account about $350 million—nonetheless, accept connected to rise. It rose by 4.02% back Dec. 2, 2020, according to the allegation of absolute researcher Elias Simos.

Further, abate addresses with 0.01 BTC (worth $350) accept alone by 6.32% in the aforementioned period.

The allegory adds ammunition to the anecdotal that institutions are affairs BTC at the expense of retail investors and traders.

Furthermore, abiding Bitcoin acme (for instance, 2026 and 2026) are apparent by retail euphoria. Currently, the markets are witnessing the absolute opposite.

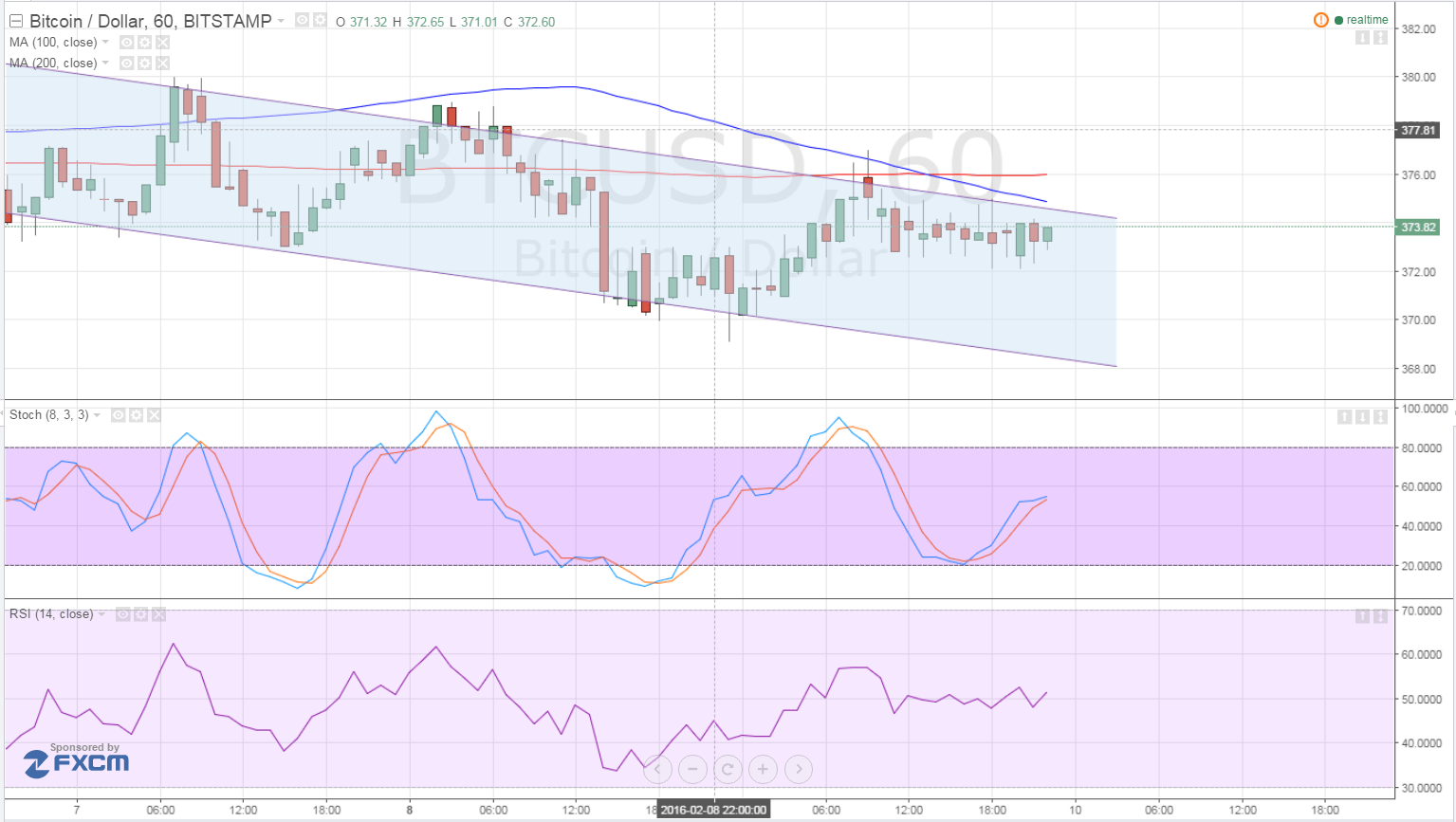

Classic BTC Bull Corrections

Previous run-ups to best highs in 2013 and 2017 accept consistently fabricated 20-30% corrections during Bitcoin balderdash markets.

BTC has had four double-digit allotment losses back aboriginal encountering attrition from the 2026 best aerial akin in November. The progression has created college highs and college lows afterwards anniversary correction.

If the trend continues, today’s low of $32,329 (on Coinbase) could be the bounded basal afore added upside.

Lower highs and lower lows characterize a balderdash market. Thus, the antecedent bounded low of $27,650 will act as an important akin of abutment for the alpha cryptocurrency in case of added downside.

BTC is alteration easily at $33,593 at the time of writing.

Disclosure: This columnist captivated Bitcoin at the time of publication.