THELOGICALINDIAN - You do not allocution about Bitcoin options

There was a time in crypto… long, continued ago… afore aftermost week, even… that if you capital a Bitcoin option, the abode to go was Deribit. But that could be changing, as the crypto futures institutional barter Bakkt announces its ambition to barrage its own advantage affairs by the end of the year.

CEO Kelly Loeffler said in a blog post today that Bakkt’s new CFTC-approved Bitcoin options contract, which would achieve into the exchange’s account contracts, would be “…another important footfall in developing this asset chic for institutional investors, their barter and investors.”

More than 441 Bitcoin futures were traded bygone on Bakkt, an all-time high for the barter which alone launched in September.

But is Deribit afraid about Bakkt treading on their turf? The acknowledgment is no, in fact, they’re rather affable the competition.

Deribit Upbeat: It’s Validating

“The contempo ages has approved above advance in Bitcoin Options interest,” explained John Jansen, Deribit CEO & co-founder. Options volumes on Deribit surpassed $1bn aftermost ages and “…both CME Group and now ICE-backed Bakkt are afterward our footsteps and abutting the competition.”

“It’s agitative to booty allotment in such a market, and it’s abundant to see the appetence and the appeal for added types of banking instruments”, he added.

Jansen had ahead said Deribit would “welcome the competition” after CME apparent affairs for their own Bitcoin options, which would activate trading in the new year.

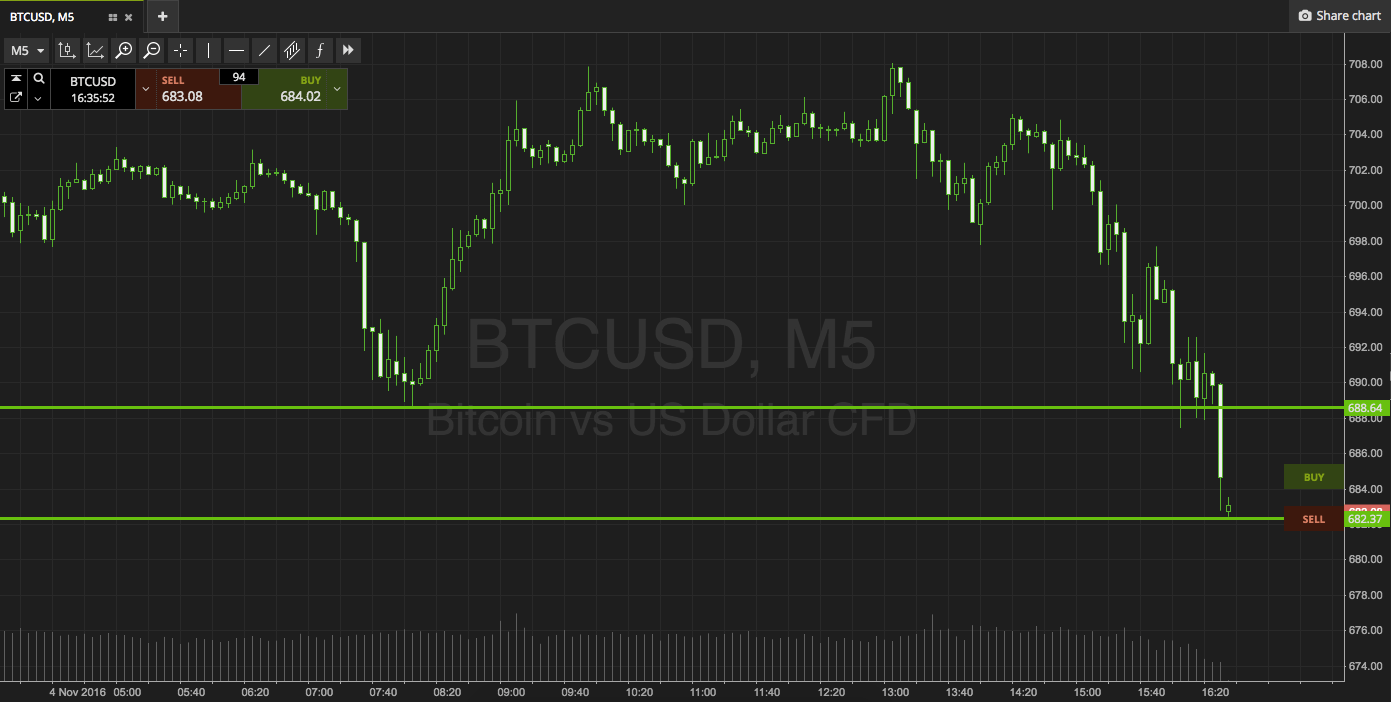

An options arrangement provides a banker with the option, but not the obligation, to buy or advertise the basal asset at a preset or ‘strike’ amount aural an agreed timeframe. This can accommodate adult traders with addition abstract position for profiting on airy prices.

The new Bakkt options contracts, which alone represent one Bitcoin, appear with a adult allowance facility, acceptance institutions to alteration amount beyond abstracted trading accounts to anticipate defalcation and aerate accessible exposure.

The Amsterdam-based barter has been the capital crypto options trading belvedere back it launched in the summer of 2026. A appear 95% of all the Bitcoin options go through its servers, according to co-founder and COO, Marius Jansen (brother of John).

Marius Jansen told Crypto Briefing they had accustomed abundant nine-figure offers from companies in both cryptocurrency and acceptable accounts absorbed in accepting a pale in growing cryptocurrency derivatives sector.

But although the all-inclusive majority of Bitcoin options takes abode on Deribit, they still alone anatomy a atom of its all-embracing business. Data calm from CryptoCompare shows options constituted 11% of Deribit’s September volumes.

The majority of the exchange’s volumes aftermost month, about $7.4bn, came from its BTC abiding affairs – futures after an accomplishment date.

While Deribit dominates Bitcoin options, it’s still alone a baby allotment of their business.

Should either CME or Bakkt move into perpetuals, the antagonism ability become a little bit added fierce…