THELOGICALINDIAN - Three Arrows Capital is in a clamminess crisis and BlockFi seems to be one cause

BlockFi was one of several companies complex in the defalcation of Three Arrows Capital (3AC) according to the Financial Times.

BlockFi Likely Liquidated Its Position

On Tuesday, June 15, letters began to broadcast suggesting that Three Arrows Capital was experiencing clamminess issues.

Sources appropriate that 3AC’s lenders asleep $400 actor from the company. However, it was cryptic which companies were complex in defalcation at the time of those reports.

Now, the Financial Times letters that the crypto lending aggregation BlockFi is one close that was complex in the situation.

BlockFi “was amid the groups that asleep at atomic some of 3AC’s positions,” the Times said on Thursday. More specifically, BlockFi bargain its acknowledgment to 3AC’s positions, application accessory it had ahead put bottomward to aback its own borrowing activities.

Yuri Mushkin, BlockFi’s arch accident officer, told the Financial Times that his close acclimatized its “best business judgment… with a ample applicant that bootless to accommodated its obligations.” He additionally said that BlockFi was “one of the aboriginal to booty activity with this counterparty.”

Mushkin added that BlockFi captivated accessory in balance of the admeasurement of the loan. He again assured the accessible that BlockFi’s accident administration behavior will acquiesce it to abide activity during a difficult market.

BlockFi CEO Zac Prince common Mushkin’s statements on Twitter, abacus that the applicant “failed to accommodated its obligations on an overcollateralized allowance loan.” Prince said that BlockFi “fully accelerated the accommodation and absolutely asleep or hedged” the collateral.

BlockFi has not absolutely accepted that the aggregation beneath altercation is Three Arrows Capital. Rather, it says that its “policy is to not animadversion on specific counterparties.” However, the affairs acerb betoken that 3AC is the close in question.

Three Arrows Commits to Recovery

Despite belief that Three Arrows Capital is at accident of defalcation afterward accumulation liquidations, the aggregation says it will break afloat.

Company co-founder Su Zhu appear a Twitter account on Wednesday. There, he said that 3AC is “communicating with accordant parties and absolutely committed to alive this out.”

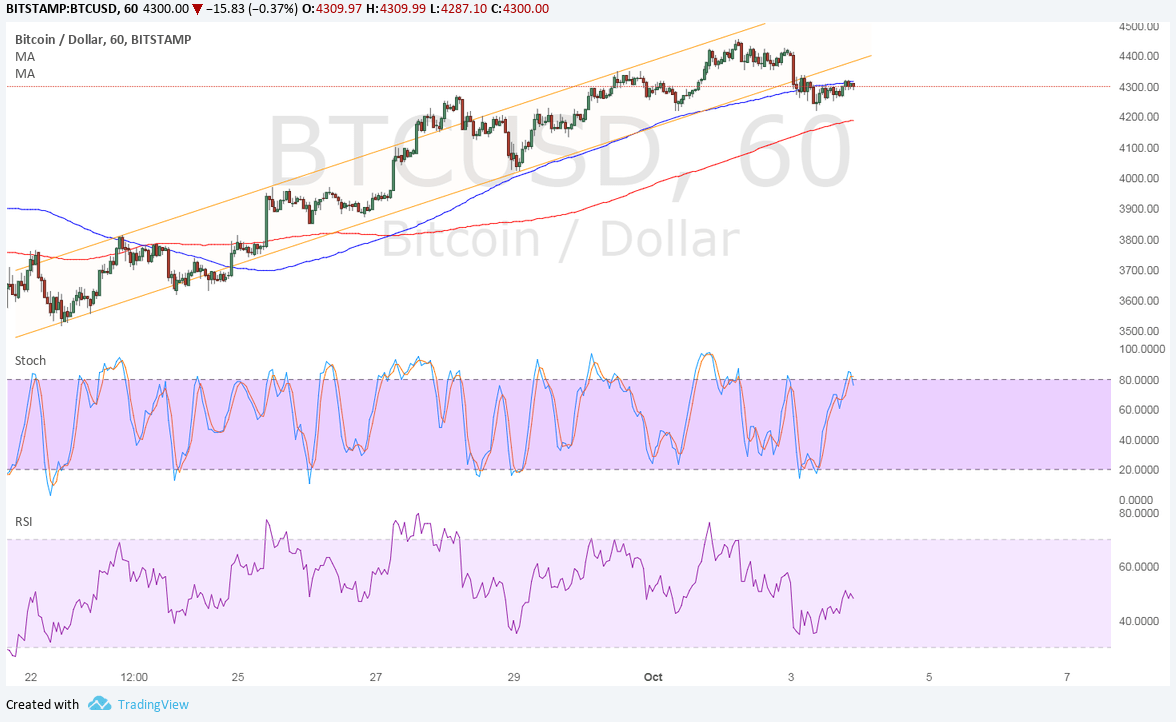

3AC is one of the better advance firms in the crypto industry. It has fabricated investments in blockchain projects including Bitcoin and Ethereum and has invested in DeFi platforms such as Aave and Balancer. It has alike invested in the NFT bold Axie Infinity.

With so abounding partners, is still cryptic which added firms were complex in 3AC’s liquidation. No added companies accept accepted captivation in 3AC’s defalcation as of Thursday, June 16.

Tether, though, has denied claims of acknowledgment to 3AC alongside its abnegation that it is backed with Asian assets.

Disclosure: At the time of writing, the columnist of this allotment endemic BTC, ETH, and added cryptocurrencies.