THELOGICALINDIAN - The wallet provider is attractive to aggrandize into the Asian market

If you’re attractive to buy bitcoin, you don’t accept a lot of choices. Fiat gateways are few and far between, and accustomed businesses like Coinbase allegation aerial fees to buy crypto.

But that aqueduct is now accepting a bit wider. Mobile wallet provider BRD – aforetime ‘Bread’ – appear today that it will be introducing a new barter service, in affiliation with payments arrangement Wyre, to acquiesce users to acquirement cryptocurrencies with a coffer transfer.

Starting today, U.S. barter at over 1,700 banks will be able to buy Bitcoin (BTC), Ether (ETH) and the Dai stablecoin. Users can additionally now articulation their coffer annual to BRD, accouterment them a accelerated band-aid to bandy amount in and out of agenda assets.

BRD’s European users can already acquirement crypto through coffer transfers, through a affiliation with Coinify accustomed aftermost January.

BRD anticipates that the low-fee account will advice users in the U.S. – its better bazaar – save on costs, as allotment of a added offering. “We’ve consistently heard from U.S. barter about the frustrations apropos the abridgement of addition and description from accepted bazaar leaders, namely Coinbase,” said Aaron Lasher, Chief Strategy Officer and co-founder of BRD.

BRD began accretion into barter casework in 2018, advance $32M to become a authorization onramp. It appear its Augustus trading belvedere in May aftermost year, acceptance users to barter Bitcoin, Bitcoin Cash (BCH) and Ether, as able-bodied as 100 or so ERC20 tokens, aural the app itself.

Following Coinbase’s success, BRD hopes that a simple UI and UX will animate new users to buy and advance in cryptocurrency.

BRD isn’t the alone barter gluttonous easier authorization access. Sources at one adapted blockchain coffer told Crypto Briefing that their academy has been approached by some of the better cryptocurrency exchanges in the world. Although they wouldn’t accommodate names, the antecedent said that best of these exchanges were gluttonous to authorize authorization gateways.

Based in Switzerland, BRD operates in 171 countries. The four-year-old aggregation now has over 2M barter and added than $6bn beneath protection.

So far the aggregation has aloft $55M, afterwards commutual its Series B annular in backward 2018. Most of the allotment for that annular came from SBI Crypto Investment, a accessory of the Japanese coffer that has additionally invested and collaborated with Ripple and R3.

At the time, CEO Adam Traidman said best of the new allotment would go appear accretion BRD’s attendance in the Asian region. BRD says that it has angled its chump abject and transaction aggregate in the aboriginal four months of this year.

"Clean Crypto Kiosk Initiative" helps accumulate ATMs compliant

If you’re affairs Bitcoin, the U.S. Treasury would like a chat from you. New guidelines from the Financial Crimes Enforcement Network (FinCEN) accept labelled all Bitcoin ATMs as money transmitters, acceptation that if you appetite to buy crypto from a machine, you’ll charge to appearance some ID.

But one aggregation is authoritative it easier for ATM operators to accede with the new FinCEN rules. In accord with arch ATM providers, CipherTrace has appear the Clean Crypto Kiosks Initiative, which seeks to accomplish it easier for vendors and ATM entrepreneurs to accede with Anti-Money Laundering (AML) regulations.

“Currently, best Bitcoin ATM manufacturers accommodate software that streamlines the accomplish against compliance,” CipherTrace said. However, “those systems will not accommodated the newer stricter crypto AML requirements.”

The new CipherTrace band-aid makes it almost accessible to verify chump transactions, by putting FinCEN-approved AML procedures on a simple web interface.

It “takes beneath than 5 account to set the all-important ambit to alpha AML accident scoring,” explained CipherTrace COO Steve Ryan. The aggregation hopes to see several thousand ATM’s accredit CipherTrace’s AML services.

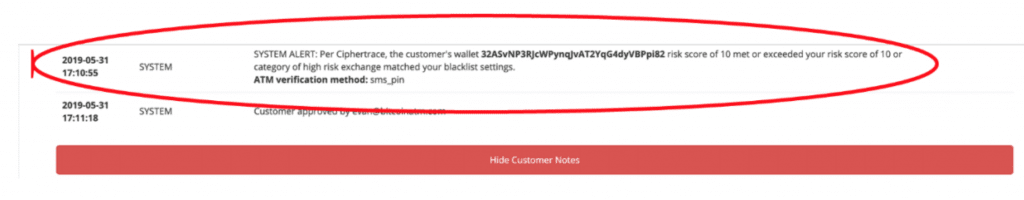

Marketing abstracts appear to Crypto Briefing acknowledge some of the appearance which CipherTrace will accommodate to ATM operators.

Vendors will be able to acquire their own accident settings, and adjudge which affairs to acquiesce and which ones to banderole for chiral review. For example, vendors could adjudge to acquire affairs from Exchanges and Enterprises, but to banderole affairs from High-Risk Exchanges, or Ransomware.

There are agnate options for Faucets, Gambling Sites, Miners, and Mixers, acceptance vendors to actuate which risks they’re accommodating to accept. According to the affiliation instructions, CipherTrace recommends best ATM operators to alpha with a “less aggressive” accident posture.

A added advancing accident aspect is additionally available, which checks transaction addresses two hops out from the accountable transaction.

The new FinCEN guidelines are allotment of a continued cord of efforts by banking regulators to limit the breeze of cryptocurrencies to trusted actors and transactions. Although these rules are absurd to get any friendlier to common users, the latest account from CipherTrace could accomplish things easier for ATM vendors.