THELOGICALINDIAN - There will be no Satoshi Nakamoto II Lessons charge be learned

The subprime mortgage crisis triggered the all-around banking crisis that, in turn, triggered the coffer bailouts and the quantitative abatement aeon that followed to prop up a attenuated U.S. and all-around economy.

Bitcoin was created amidst the wreckage, demography aim at government-controlled press presses in its genesis block. But there is growing affirmation that the apartment crisis has never recovered, with abounding Americans still underwater and at accident of default.

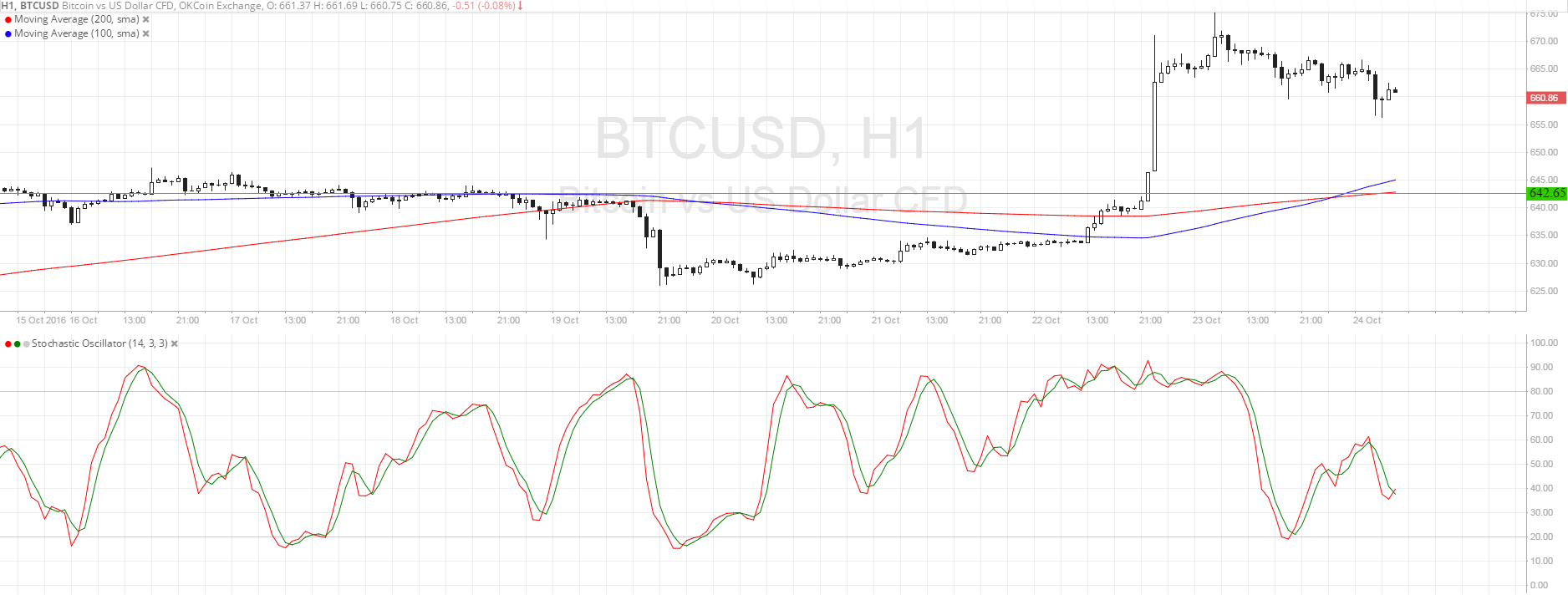

A additional crisis could activate a additional bitcoin revolution. It could booty us aback to the aphotic canicule of bailing out institutions advised too big to abort and, perhaps, accomplish a newfound and added boundless acknowledgment of the affiance of cryptocurrency.

In fact, a additional mortgage accident ability be the final accedence of the burst banking arrangement – which ability be aching for many. But it may additionally breach the aeon of debt and acquisitiveness that connected deregulation has enabled.

Re-Default Figures Showing Fault Lines

After the subprime debacle, millions of mortgages were adapted to anticipate U.S. homeowners from falling into default. There accept been close to ten million mortgage modifications fabricated back the end of 2007.

Those modifications were in accession to the about 17 actor added acting changes lenders fabricated to mortgages to accumulate bodies from defaulting. Most of those booty the anatomy of deferring behind acquittal obligations to the approaching and acquittal reductions. These 17 actor mortgages abide classified as current. They are a hidden problem.

Between 2008 and 2012, the U.S. Office of the Comptroller of the Currency (OCC) appear that lenders had adapted about three actor loans. By aboriginal 2013, 47 percent of them were still current. The added bisected had been foreclosed, were at accident of foreclosure, actively delinquent, or awash to addition account provider.

These, remember, are mortgages that had already been adapted to affluence the accountability on homeowners. In bisected the cases, the changes didn’t help. More recently, in Q1 2025, 21 percent of the best afresh adapted loans had re-defaulted aural a bald six months.

A 2015 Fitch Ratings report begin that re-default ante were rising. They agenda that about all modifications fabricated in 2011 were aboriginal modifications. By 2015, one-third of modifications were additional or third modifications, and with anniversary modification, the accident of absence rose.

And the Mortgage Crisis Ain’t Gettin’ Any Better

The Q1 2019 Federal Housing Finance Administration’s (FHFA) Foreclosure Prevention Report found that in Q4 2017, bisected of the adapted loans in the above-mentioned year were accepted and performing. Meaning the added bisected were in austere trouble.

All of these studies acrylic a austere picture. Once the $819 billion account of still outstanding subprime-era mortgage defaults are excluded, bisected of those homeowners who remained able to abide active in their homes afterwards a mortgage modification were acceptable to abatement into default. It is a archetypal slow-burn abiding of the subprime crisis, which would be greatly worse after a abiding aeon of low absorption rates.

Jump advanced to 2019, and JP Morgan appear $10 billion account of adapted loans, with 43 percent of those accepting re-defaulted. 41 percent of Bank of America’s adapted loans had back re-defaulted.

These brewing problems adumbrate a added insidious problem: according to the OCC’s Mortgage Metrics Report, up to 95 percent of modifications fabricated over the accomplished bristles years accept included abacus absorption owed in arrears aback assimilate the mortgage. Lenders haven’t fabricated mortgages easier to pay, they’ve alone delayed the claim accountability to abstain a foreclosure event.

While the agency is upbeat in its Q2 2019 report, assuming that over “96.1 percent of mortgages were accepted and performing”, those mortgages exclude adapted mortgages and calculation those 17 actor with acting adjustments as “current”.

It is not difficult to brainstorm that foreclosures that would commonly accept occurred accept not occurred because of the modification process, and that action artlessly postpones assured foreclosures, as the affirmation appears to be showing.

The acknowledgment of quantitative abatement on acceleration could assuredly bang the aftermost attach in the casket of any acceptance bodies accept left in bequest banking.

It could arresting a Breaking Bitcoin moment.

There will not be a Satoshi Nakamoto II to arbitrate if bread-and-butter advance continues to arrest and apartment weakness persists. Current mortgage problems are a spillover of the GFC.

It is generally said that bodies apprentice best from mistakes.

But the moral hazard the Fed created by bailing out ‘too-big-to-fail’ institutions meant important acquaint were never absolutely learned.