THELOGICALINDIAN - Markets comatose on the account that Biden could about bifold tax ante for affluent investors

Reports advance that the Biden administering is advancing to adduce one of the better basic assets taxes in U.S. history, one that will about bifold the tax amount for affluent investors.

Taxes Target Wealthy Investors

News of the accessible tax access was initially disclosed to Bloomberg by White House staffers on Apr. 22.

If the angle is enacted, it will accession the basic assets tax from 20% to 39.6% for investors that acquire added than $1 million. This would accession $370 billion for government spending.

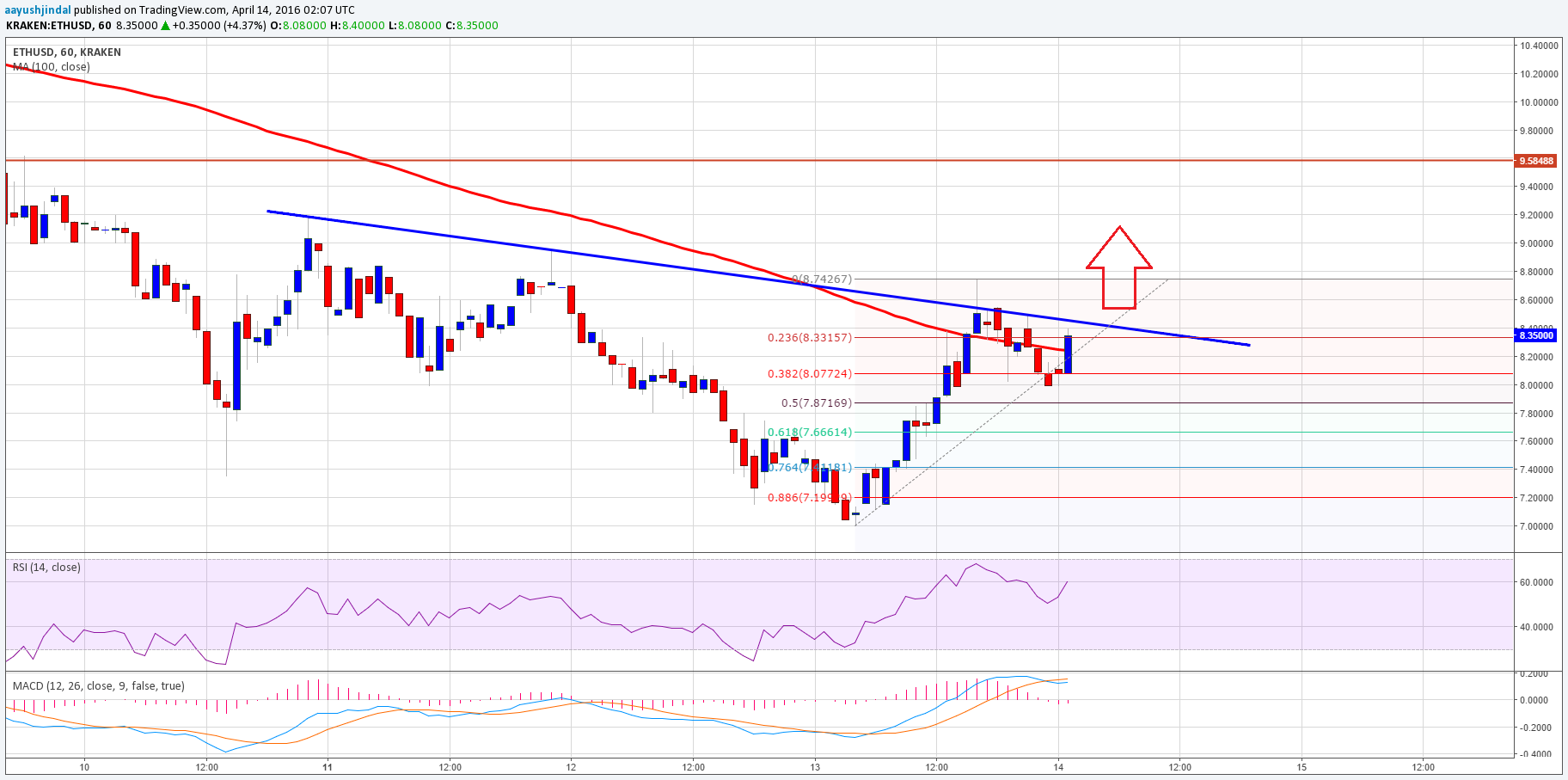

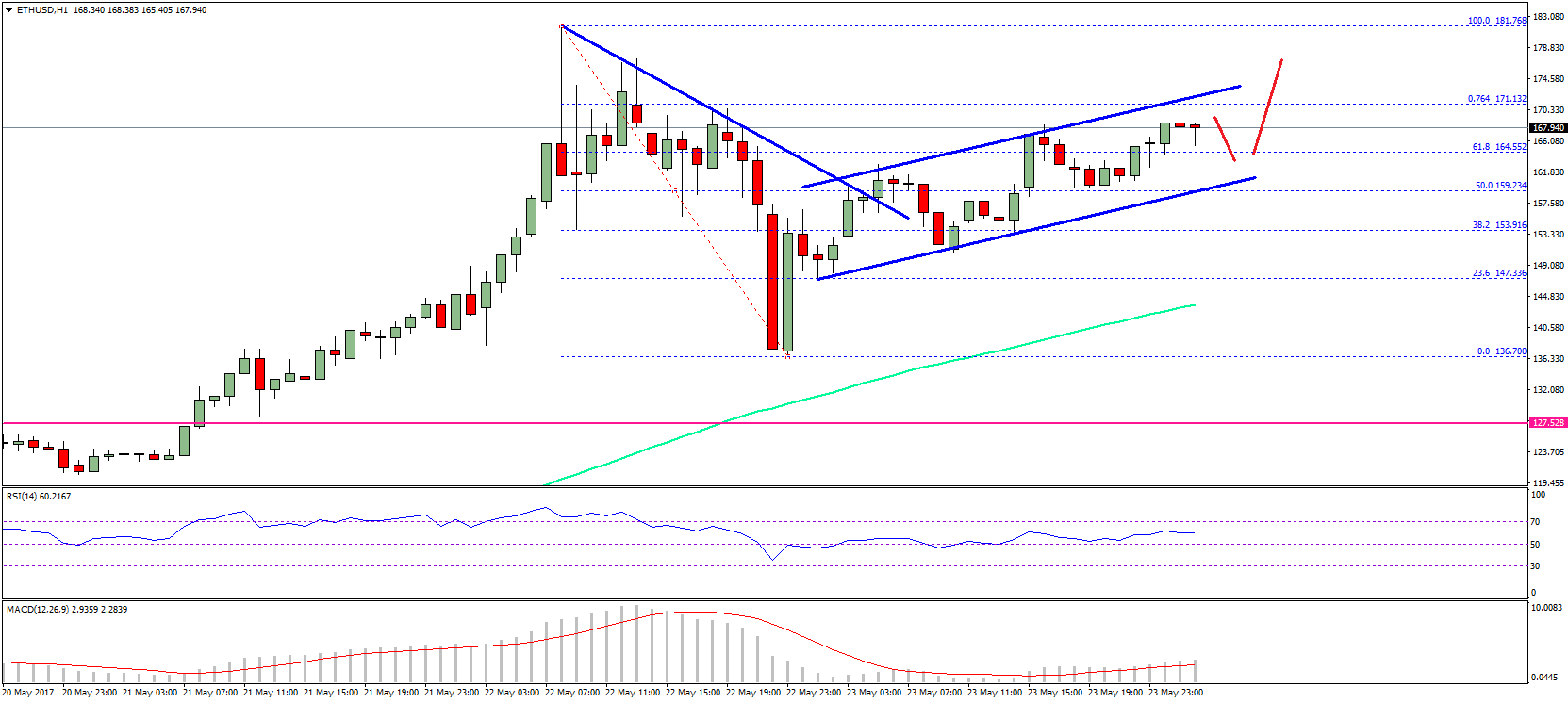

News of the accessible access has impacted the banal bazaar and the crypto bazaar alike. According to Reuters, Bitcoin fell below $48,000 aural hours of the news, a accident of about 4%. Ethereum saw losses of about 10%. Meanwhile, the S&P 500, the Dow Jones, and Nasdaq all saw losses of about 0.9%.

The account has additionally apparent ample amounts of altercation on amusing media communities accompanying to cryptocurrency. The affair became a astral cilia on Reddit’s /r/cryptocurrency subreddit, accepting added than 1,250 comments. Users abnormally bidding apropos over the plan or appropriate that fears are overblown.

Will the Proposal Pass?

As of Friday, Apr. 23, the angle has not been clearly announced. Biden will altercate the tax access formally back he presents the United States’ budgetary action abutting Wednesday.

Some experts accept that the tax plan will not absolutely be agitated out. Phil Orlando of Federated Hermes, Inc. told BNN Bloomberg that, based on the actuality that the angle is the better tax access in history, the affairs that it will be acknowledged are “slim to none.” Instead, he expects a added bashful tax access to 25%.

Elsewhere, Thomas Hayes of Great Hill Capital LLC has appropriate that the banal bazaar would accept apparent abundant beyond losses if there was a cogent adventitious of the angle passing.

Will the Tax Plan Affect Crypto Users?

Even if the tax access is approved, best investors will be unaffected. The plan is aimed at the top 0.3% of investors, and the administration of crypto abundance is agnate to accepted wealth.

In 2026, Bitcoin prices rose by about 300% from a starting bulk of about $8000. To acquire added than $1 actor on one’s Bitcoin advance that year, one would accept had to accept captivated about 32 BTC—an bulk that beneath than 0.4% of Bitcoin addresses hold.

On the added hand, not all crypto investments assignment in the aforementioned way. DeFi casework such as yield agriculture platforms and clamminess pools are advised to accommodate acutely aerial allotment to investors who put abstinent investments to assignment for the basal protocol. Likewise, new ICOs may see abrupt advance over a abbreviate aeon of time.

That agency that some crypto projects may accept a college admeasurement of users that acquire added than $1 million. However, there is a abridgement of abundance administration abstracts on those projects, acceptation that afflicted investors may still be in the minority.

Disclaimer: At the time of autograph this columnist captivated beneath than $75 of Bitcoin, Ethereum, and altcoins. This commodity is not tax advice.