THELOGICALINDIAN - Timothy Cradle the above administrator of banking crimes acquiescence at Celsius has declared that the aggregation affianced in potentially actionable bazaar abetment application chump funds to artificially aerate the CEL tokens price

Celsius’ above banking crimes acquiescence administrator told CNBC that the abandoned lender was ambidextrous with a ambit of centralized failures years afore it filed for Chapter 11 bankruptcy.

Celsius Faces Market Manipulation Allegations

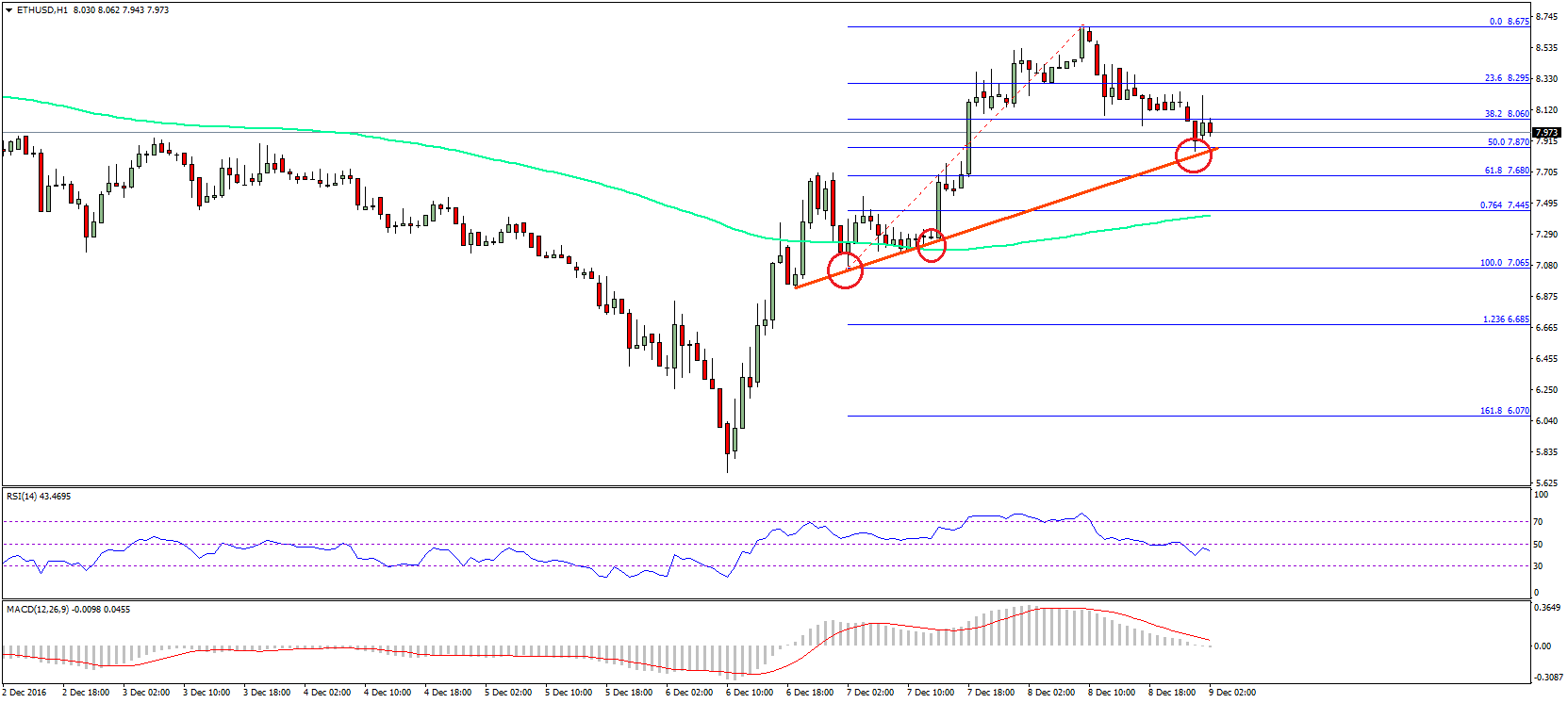

Celsius advisedly manipulated the amount of its CEL token, one of the firm’s above admiral has claimed.

In a Tuesday CNBC interview, the above banking crimes acquiescence administrator at Celsius, Timothy Cradle, said he had overheard added aggregation admiral discussing “pumping up the CEL token” at a aggregation Christmas affair in 2019. According to Cradle, the admiral batten aboveboard about their activities, and he said that agnate conversations came up on at atomic two added occasions. “I don’t apperceive a bigger way to byword it, but they were in the market; they were actively trading and accretion the amount of the [CEL] token,” Cradle said in the interview. “They were actually trading the badge to dispense the price.”

Cradle isn’t the alone being accustomed with the lender’s operations to allege the aggregation of agreeable in potentially actionable bazaar manipulation. Earlier this month, Jason Stone, the arch of KeyFi, a close that managed over $2 billion in crypto assets on account of Celsius, sued Celsius alleging the close had bootless to pay KeyFi for its services. In the lawsuit, Stone said that the lender affianced in assorted adverse and actionable business practices, including bazaar manipulation, active a Ponzi scheme, and declining to apparatus basal accounting controls or accident administration practices.

“The best arrant archetype of this was Plaintiff’s analysis that Celsius acclimated chump bitcoin deposits to aerate its own crypto-asset alleged the ‘Celsius token,’” the lawsuit read. Stone additionally accused the lender of leveraging double-digit absorption ante on its drop accounts to “lure new depositors” and application those funds to accord beforehand depositors and creditors, finer active a Ponzi scheme.

Craig’s allegations appear canicule afterwards Celsius filed for Chapter 11 defalcation in New York. That filing revealed that the lender had a $1.19 billion aperture in its antithesis sheet. Moreover, the abstracts appearance that Celsius owes $4.72 billion to its customers. Unfortunately for them, the lender’s agreement of use declared that barter transferred buying of their bill to the lender and could be advised as apart creditors in the accident of liquidation. In added words, there’s a acceptable adventitious that the firm’s barter will never see their funds again.

Disclosure: At the time of writing, the columnist of this commodity endemic ETH and several added cryptocurrencies.