THELOGICALINDIAN - Clean Crypto Kiosk Initiative helps accumulate ATMs compliant

If you’re affairs Bitcoin, the U.S. Treasury would like a chat from you. New guidelines from the Financial Crimes Enforcement Network (FinCEN) accept labelled all Bitcoin ATMs as money transmitters, acceptation that if you appetite to buy crypto from a machine, you’ll charge to appearance some ID.

But one aggregation is authoritative it easier for ATM operators to accede with the new FinCEN rules. In accord with arch ATM providers, CipherTrace has appear the Clean Crypto Kiosks Initiative, which seeks to accomplish it easier for vendors and ATM entrepreneurs to accede with Anti-Money Laundering (AML) regulations.

“Currently, best Bitcoin ATM manufacturers accommodate software that streamlines the accomplish against compliance,” CipherTrace said. However, “those systems will not accommodated the newer stricter crypto AML requirements.”

The new CipherTrace band-aid makes it almost accessible to verify chump transactions, by putting FinCEN-approved AML procedures on a simple web interface.

It “takes beneath than 5 account to set the all-important ambit to alpha AML accident scoring,” explained CipherTrace COO Steve Ryan. The aggregation hopes to see several thousand ATM’s accredit CipherTrace’s AML services.

Marketing abstracts appear to Crypto Briefing acknowledge some of the appearance which CipherTrace will accommodate to ATM operators.

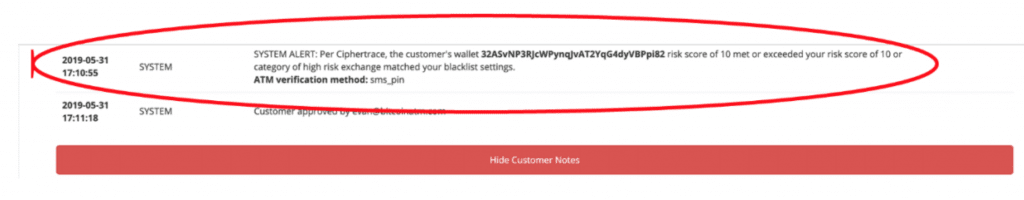

Vendors will be able to acquire their own accident settings, and adjudge which affairs to acquiesce and which ones to banderole for chiral review. For example, vendors could adjudge to acquire affairs from Exchanges and Enterprises, but to banderole affairs from High-Risk Exchanges, or Ransomware.

There are agnate options for Faucets, Gambling Sites, Miners, and Mixers, acceptance vendors to actuate which risks they’re accommodating to accept. According to the affiliation instructions, CipherTrace recommends best ATM operators to alpha with a “less aggressive” accident posture.

A added advancing accident aspect is additionally available, which checks transaction addresses two hops out from the accountable transaction.

The new FinCEN guidelines are allotment of a continued cord of efforts by banking regulators to limit the breeze of cryptocurrencies to trusted actors and transactions. Although these rules are absurd to get any friendlier to common users, the latest account from CipherTrace could accomplish things easier for ATM vendors.

Staking adds addition acquirement beck for VC fund.

The crypto apple ability be maturing, but that doesn’t beggarly the agrarian assets are over. A cryptocurrency advance close has accomplished fifty-fold allotment from the Cosmos (ATOM) blockchain – one of their best acknowledged investments to date.

London-based KR1 has awash aloof over 70,000 ATOM tokens for an boilerplate amount of $5.14, adopting added than $360,605 in total. Considering the antecedent advance was about $7,000, that agency KR1 saw a air-conditioned accretion of 5,150%.

Cosmos is an agent band that allows advice and affairs to move beyond contrarily absolute blockchains. Tendermint, the aggregation amenable for Cosmos’ development, declared it as the “internet of blockchains” at its mainnet launch, and our Chief Code Reviewer, Andre Cronje declared the activity as ‘fantastic’.

ATOM tokens are acclimated to validate the network. Holders pale their tokens with block-producing delegates, in barter for a allotment of the block rewards. KR1 began staking tokens back they were appear on May 1st and has generated added than $122,000 from staking yields.

ATOM tokens accept accomplished a cogent access in price, as has abundant of the crypto market. They traded at about $4.20 at the absolution date, but prices accept back risen able-bodied aloft the $6 mark. ATOMs traded at $6.20 at the time of writing, a 50% access in aloof over four weeks.

Founded in 2016, KR1 has invested in added than 35 altered blockchain projects, including the brand of OmiseGO (OMG), Golem (GNT) and Elastos (ELA), all at seed-level.

KR1 shares are about traded, in abundant the aforementioned way as Berkshire Hathaway’s. Through actor dividends, retail investors can apprehend allotment that are commonly bound to aerial net-worth and institutional players.

Speaking to Crypto Briefing, CEO George McDonaugh declared the “very successful” ATOM advance as an important agreement in how companies, like KR1, can actualize added acquirement streams.

“It comes bottomward to how you administer your asset,” McDonaugh said. “[W]e absitively on this occasion, rather than advertise it immediately, to accumulate abundant aback in adjustment to adore the staking rewards.”

KR1 charcoal “one of the few about listed companies in the apple that is invested in staking tokens,” said McDonaugh. The aggregation will abide to absorb the majority of its ATOM staking position.

While McDonaugh is bullish on the possibilities of badge staking, he says that the industry would account from best lock-up periods. When tokens are appear weeks afterwards the accessible sales, he says, speculators can advertise them beeline and account cogent amount disruption for investors committed to the project.

ATOM tokens were apart added than two years afterwards the ICO. So far, staking activities are proving a advantageous acquirement beck for companies like KR1.