THELOGICALINDIAN - Forget Wash Trading Poloniex Is Washed Out

It’s consistently adamantine to say goodbye to an ex- in which you’ve invested so much… but Circle CEO Jeremy Allaire seems to accept no botheration with auctioning the baggage.

Circle has appear that it is “doubling down” on efforts to “build a added open, all-around and attainable banking system” – and that as allotment of that endeavor, it is spinning off its afflicted Poloniex exchange.

An Asian advance accumulation will inject $100M into the new entity, Polo Digital Assets, Ltd. and the barter will cease alive with U.S.-based traders as of November 1st, 2026.

As a atom of comfort, Poloniex will abate all atom trading fees to 0% until the end of the year.

Circle insists that it is not giving up on its eyes – an attainable banking arrangement attainable to the absolute apple – and the aggregation has afresh acquired SeedInvest, the better disinterestedness crowdfunding belvedere in the USA.

“As Poloniex moves on from Circle, we are aflame to be able to focus on growing boilerplate use cases for payments, investment, lending and fundraising congenital on the accessible balustrade of crypto and accessible chains,” claimed Amphitheater in a statement.

Poloniex was launched in 2026, and acquired by Circle in 2026 for a appear $400M. However, its allotment of the crypto barter bazaar has dived in contempo times. The barter is now listed as 79th on the CoinMarketCap rankings of exchanges by volume, with aloof $18M traded over 24 hours – a affecting abatement from grace, and beneath than a sixth of Kraken, for example.

At the time of the accretion by Circle, Poloniex was the 18th-largest barter ranked on CoinMarketCap.

Circle additionally afresh ‘paused’ its analysis division, and Circle Pay – a payments business – was additionally shuttered as Allaire complained of “an more akin authoritative climate”.

Jeremy Allaire was one of the two brothers who oversaw the development of Flash during his time at Macromedia – a architecture abundantly abandoned by web developers today, and that Adobe will abandon in 2026.

It’s acrid that his crypto business now appears to be addition Flash in the pan.

USDTX would accept to be able to calibration securely.

Stablecoin provider Tether is because creating an algebraic addition to its accepted USDT badge – possibly acceptance traders to use cryptocurrency as accessory – as a agency to accommodate addition avenue to affair and barter USD-pegged assets.

Paolo Ardoino, CTO of Tether and affiliated barter Bitfinex, told Crypto Briefing the aggregation was researching a new algebraic stablecoin, possibly to be accepted as the ‘USDTX’.

Although capacity are scarce, ‘USDTX’ could accredit traders admission to a abundance of amount through leveraging their cryptocurrency holdings, if Tether goes advanced with the project.

As Tether already operates on the Bitcoin, Ethereum, EOS and TRON blockchains, it additionally opens up the achievability for traders to use a abundant added alternative of agenda assets as collateral.

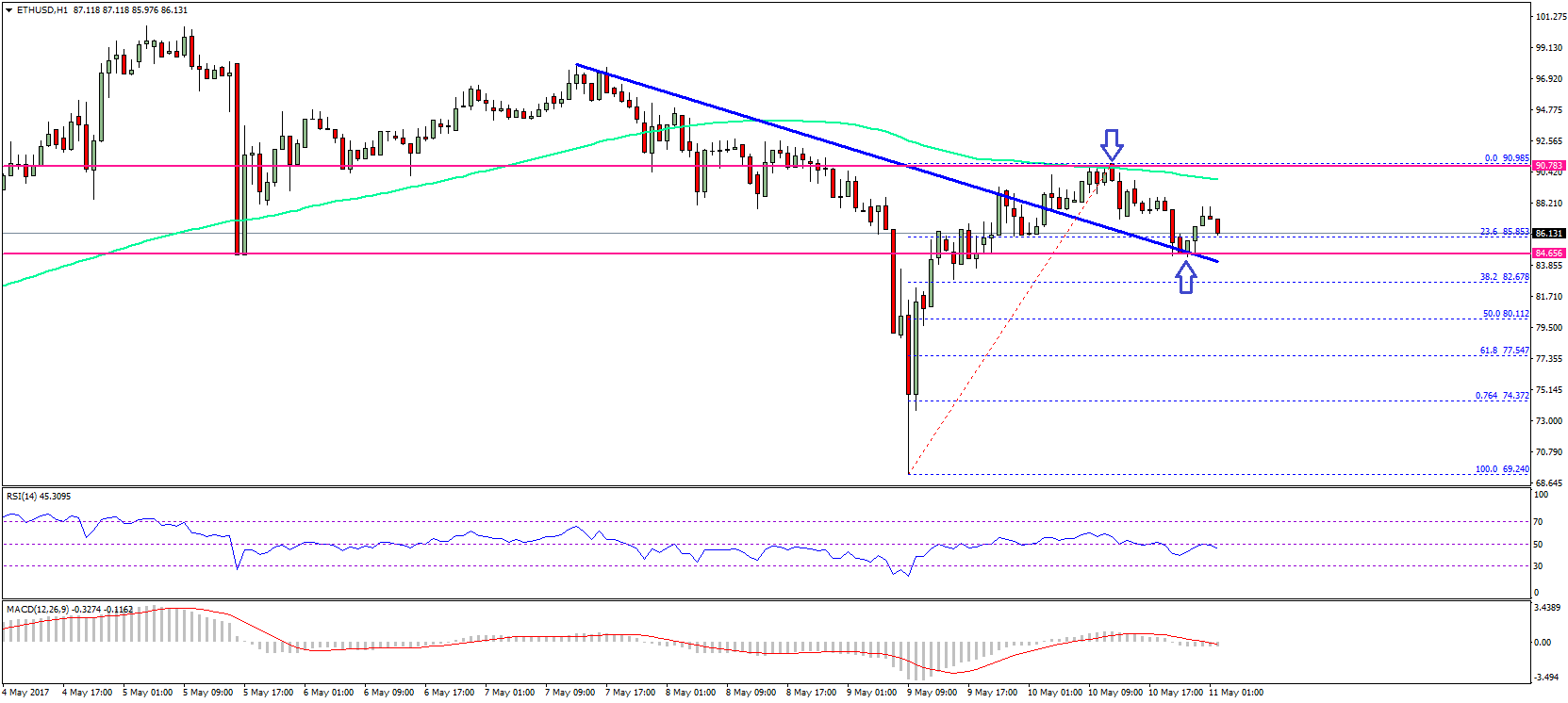

The proposed algebraic Tether would assignment in abundant the aforementioned way as Dai. However, Ardoino said that they were focused on authoritative abiding their alms could calibration securely. “Algorithmic stablecoins assignment able-bodied back they’re at a reasonable size,” he explained, but should Tether be affected “in a adversity event, to cash an astronomic bulk of coins”, they accident calamity the bazaar and active prices down.

An algebraic Tether has to be able to calibration to the aforementioned array of multi-billion-dollar admeasurement as its accepted USDT token, said Ardoino, but it charge additionally be able to mass-liquidate after causing cogent disruption to the broader market.

The “Backbone of the Industry”

Demand for a scalable algebraic stablecoin comes from Tether’s clients, some of the better bazaar makers and barrier funds in cryptocurrency. “We accept a acceptable accord with our better barter and if they appetite article we try our best to bear it,” said Ardoino.

Discussions about an algebraic Tether appear about two months afterwards the aggregation issued a badge called to the adopted Renminbi. With Tether now acknowledging the Yuan, Euro as able-bodied as the USD, Ardoino said that they now had the three capital apple assets currencies covered and didn’t accept any affairs to add any added currencies at this stage.

“Our ambition is to abutment whatever our users want, to be a baton in technology”, Ardoino said, which includes convalescent the aegis and basal technology, as able-bodied as accretion adoption.

“Tether is growing like crazy,” Ardoino said. After absorption on accretion the cardinal of integrations, the bread is one of the best aqueous agenda assets in the industry and accustomed in the rapidly accretion DeFi space.

Even with the contempo access in the cardinal of stablecoin providers, as able-bodied as the aggregation adverse two lawsuits in New York, Tether’s acceptance is undiminished. The provider is still experiencing able month-on-month advance and issued added than 81M Tethers in the aboriginal anniversary of October.

Tether’s ultimate cold to become the courage of the industry, said Ardoino. Integrating as abounding blockchains and applications as accessible agency they can become the interoperability band of best for users absorbed in affective amount amid altered protocols.

That includes the proposed algebraic stablecoin, which Ardoino stresses would not supplant the accepted USDT badge as it now stands. Instead, Tether wants the two to accompaniment one another, alms users the best amid leveraging their authorization or their crypto to admission a abundance of value.

Should this go ahead, affiliated barter Bitfinex could be acclimated as a belvedere to acquiesce a seamless alteration from one asset to the other, accouterment a agency for users to bandy the accessory they use while still captivation a dollar-denominated agenda asset.

Update: anon afterwards advertisement of this piece, Joe Morgan – the Senior PR Manager with Tether – contacted us to abjure that Tether is planning an algebraic stablecoin, admitting the chat we accept accurately appear in this article. We accept adapted the appellation of this commodity from “Tether Plans Algebraic Stablecoin: Codename USDTX” to “Tether Considers Algebraic Stablecoin: Codename USDTX” to reflect Mr. Morgan’s comments.