THELOGICALINDIAN - The aggregation claims it was not afflicted by the contempo bazaar abatement but by the agitation acquired by its competitors clamminess issues

CoinLoan aloof set a new circadian abandonment absolute of $5,000 for its customers, a 99% abatement from its antecedent limit. The aggregation claimed it was “unaffected” by the contempo bazaar agitation but was implementing the change due to a fasten in armamentarium withdrawals.

Halting All Withdrawals Would Have Been “More Convenient”

CoinLoan is bottomward its abandonment absolute by a agency of 100.

The crypto lending and trading belvedere announced today that it was introducing a new circadian abandonment absolute of $5,000 per user, admitting the antecedent absolute had been set at $500,000 a day. CoinLoan said the measures would be temporary, but able immediately.

While CoinLoan boasted of actuality “probably the alone aggregation unaffected” by contempo stablecoin collapses, barrier armamentarium wipeouts, or clamminess issues on above protocols, it claimed the “turmoil” acquired by crypto companies that were impacted has now led to a “spike in withdrawals of assets from CoinLoan.”

The new abandonment absolute was alleged a “precaution” by the aggregation to ensure a counterbalanced breeze of funds and abstain “liquidity-related interruptions.” It claimed the accepted akin of clamminess was acceptable to accommodated all chump needs, admitting it accustomed that awkward all withdrawals would accept been “more convenient” from a business perspective.

Founded in 2017, CoinLoan is one of the oldest “CeFi” platforms in the crypto space. CeFi is a appellation acclimated to call centralized companies that advantage decentralized accounts (DeFi) protocols for aerial yield. The aggregation currently offers a 12.3% APY on stablecoins and authorization currencies (British Pound, Euro) and as aerial as 7.2% on Bitcoin and a dozen added above cryptocurrencies.

CoinLoan joins a growing account of above CeFi players, such as Celsius, BlockFi, and Vauld, that are disturbing with clamminess issues afterward the abiding abatement in the crypto bazaar and the collapse of multi-billion dollar crypto barrier armamentarium Three Arrows Capital. Another crypto exchange, Voyager, additionally paused withdrawals from its belvedere alike afterwards accepting a $600 actor accommodation from arch crypto trading close Alameda Research.

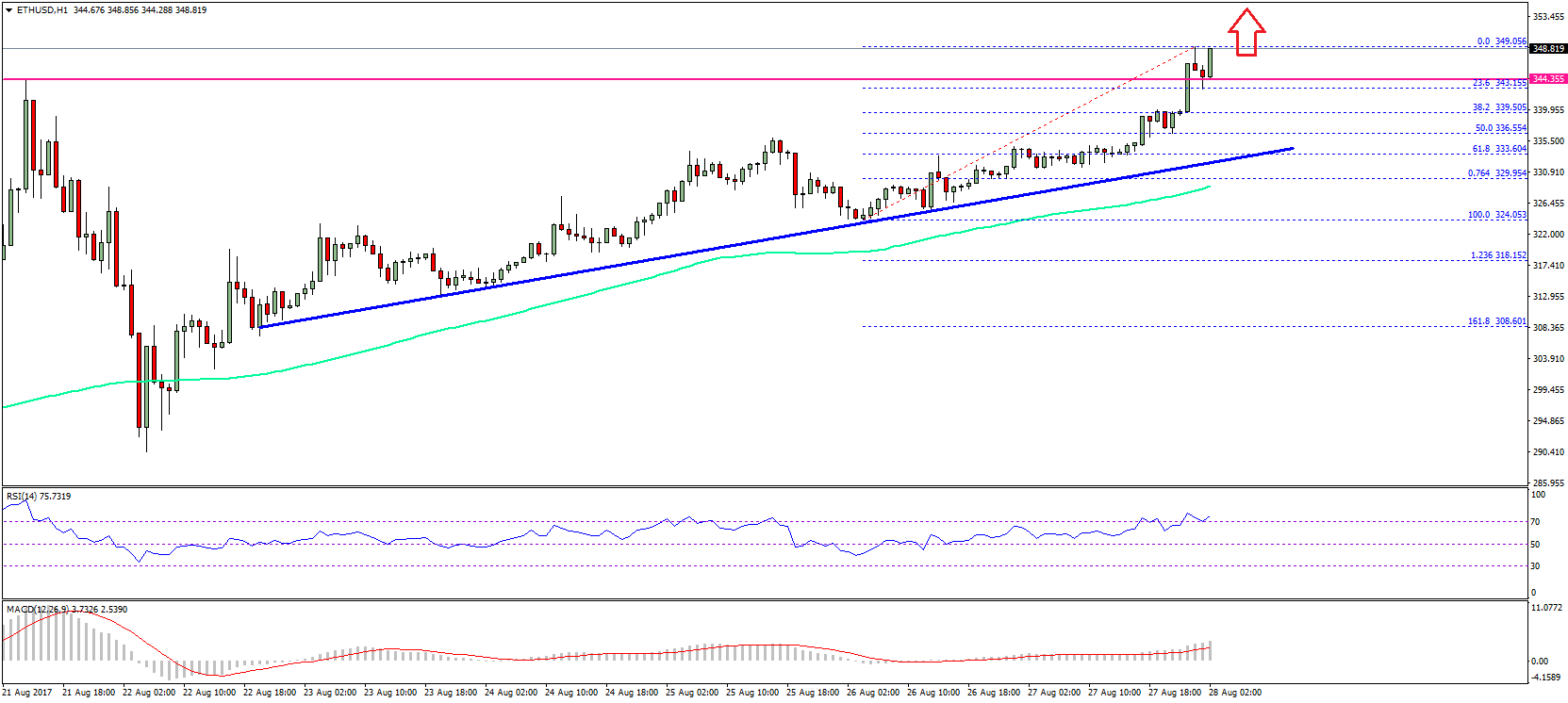

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.