THELOGICALINDIAN - The Singaporebased crypto startup is the latest in a alternation of crypto firms to crumble beneath the buck markets pressure

The crypto lending and trading belvedere Vauld has abeyant chump withdrawals and assassin banking and acknowledged admiral to advice it appraise abeyant paths advanced amidst animation in the crypto market. The close has said it is “facing challenges,” citation bazaar altitude and difficulties faced by its key business partners.

Vauld Suspends Customer Withdrawals

Vauld has become the latest in a alternation of crypto firms to arrest chump withdrawals and accede restructuring due to astringent bazaar conditions.

The Singapore-based crypto lending and trading startup appear the move in a Monday blog post, citation “financial challenges” stemming from a aggregate of factors, including airy bazaar altitude and banking bane triggered by the atrophy of the Terra ecosystem in May. “We accept fabricated the difficult accommodation to append all withdrawals, trading and deposits on the Vauld belvedere with actual effect,” the firm’s CEO Darshan Bathija wrote in the blog post.

The accommodation to abeyance withdrawals comes weeks afterwards the aggregation appear a column abating its barter that it was aqueous and operating as usual. “Vauld continues to accomplish as accepted admitting airy bazaar conditions,” it wrote in a Jun. 16 statement, abstinent any acknowledgment to the broke crypto lender Celsius and broke crypto barrier armamentarium Three Arrows Capital.

Despite Vauld’d declared abridgement of absolute acknowledgment to the abandoned entities, the close has bootless to escape the broader banking bane bouncing through the absolute crypto market. According to today’s announcement, the belvedere endured a coffer run in which barter drained over $197.7 actor in beneath than a month, decidedly adverse its adeptness to accomplish normally.

As a result, Bathija said today that the close had assassin banking and acknowledged admiral to advice it analyze abeyant paths forward, including accessible restructuring options that would best assure the absorption of its stakeholders. “We are currently in discussions with abeyant investors into the Vauld accumulation of companies,” he said, abacus that he was assured Vauld would acquisition a satisfactory band-aid for the firm’s barter and stakeholders.

Vauld, which has best of its aggregation in India, had over 1 actor barter and over $1 billion in assets beneath administration as of May 2022. In July 2026, it aloft $25 actor in a Series A allotment annular led by Peter Thiel’s adventure basic close Valar Ventures, with accord from added high-profile advance funds, including Pantera Capital, Coinbase Ventures, and CMT Digital.

Vauld is alone one of several crypto firms to face astringent banking troubles due to the advancing bazaar abatement over the accomplished two months. Since Terra’s $40 billion Terra implosion, assorted above crypto lenders and barrier funds, including Celsius, CoinFLEX, Babel Finance, BlockFi, Three Arrows Capital, and Hashed, accept faced astringent clamminess and solvency issues. Like Vauld, the crypto lenders accept autonomous for measures like abandonment freezes and planning for restructuring, while the onetime crypto barrier armamentarium behemothic Three Arrows looks to be all but accomplished as a business. It filed for Chapter 15 defalcation in a New York cloister Friday.

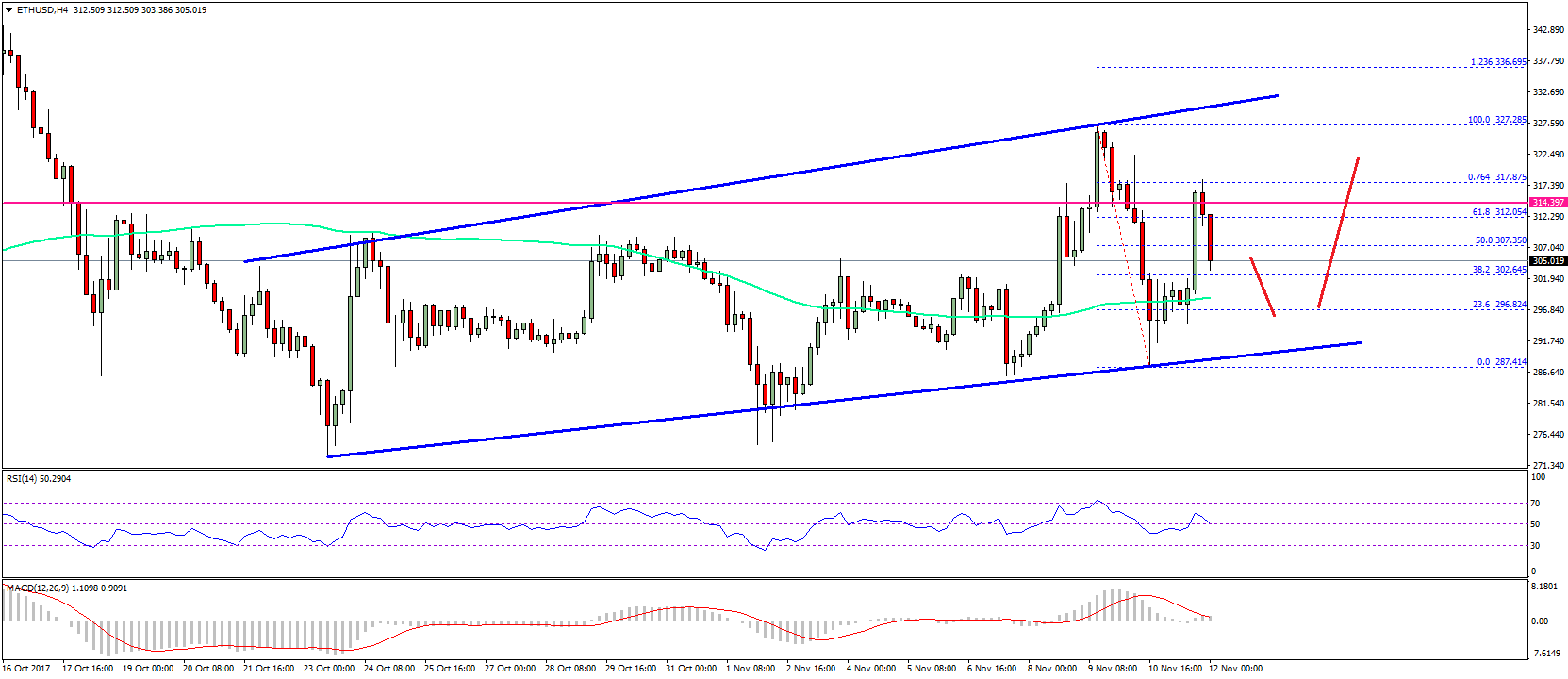

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.