THELOGICALINDIAN - Is the DeFi top in

For the aboriginal time ever, there is over $2 billion bound in DeFi protocols. As the yield agriculture craze continues, investors should be alert as abounding top DeFi tokens are assertive for a slight downturn.

DeFi Propels Crypto Sentiment

It’s been a little over a ages back the area re-attained $1 billion in assets, and the crypto alcove has back accomplished berserk growth. Incentivized crop advance – or as the air-conditioned kids alarm it, yield farming – has been the primary agitator for this growth.

MakerDAO was the arch DeFi belvedere by accessory captivated for able-bodied over a year. That is until Compound launched its built-in token, COMP, and pushed itself into the arch position.

Of the top ten protocols, all but one (Flexa) accord to crop agriculture in one way or another.

Compound, MakerDAO, and Synthetix are the top three DeFi protocols and cumulatively annual for $1.57 billion in assets or 78% of the sector’s absolute assets.

Of accurate agenda is the rise of WBTC, which hit $100 actor of bound BTC accessory this week. Republic Protocol (REN) beyond the $30 actor beginning back its mainnet barrage in backward May 2020.

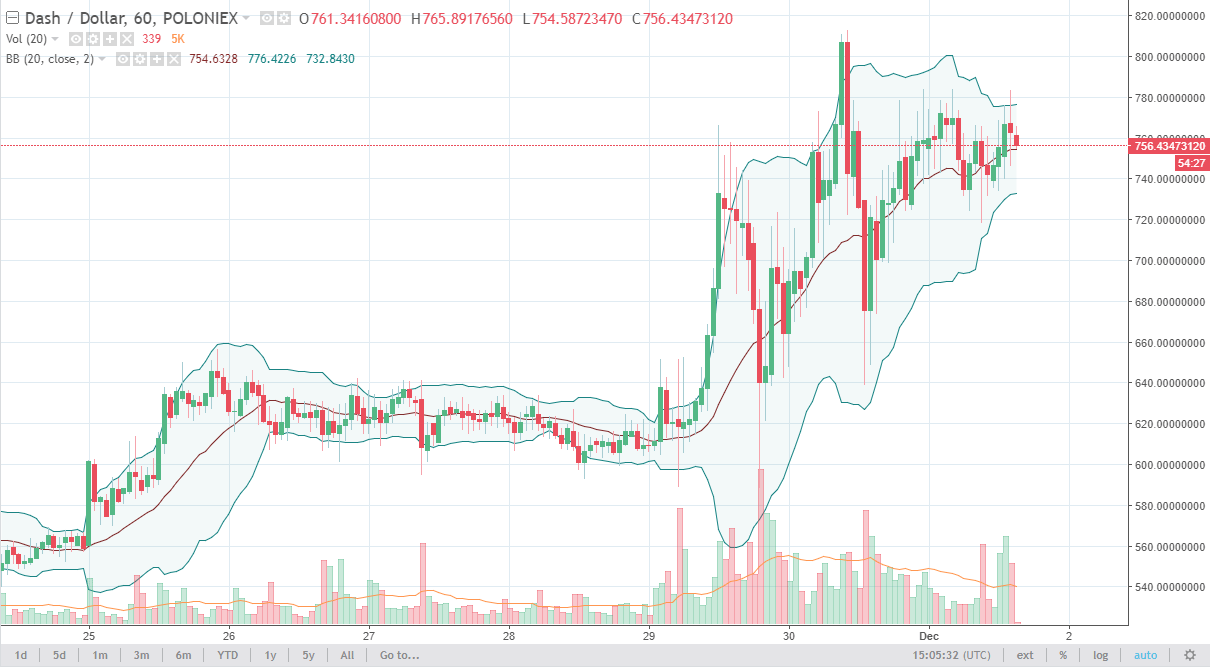

However, this accepted bliss is possibly the arresting for a acting top as DeFi tokens attending beat afterwards an atomic June. Ethereum’s built-in ETH could be in for downside as well.

Sudden bearish impulses tend to hit aback metrics are bullish above belief, and there is no assurance of appraisal advancing aback bottomward to Earth. This doesn’t beggarly a alteration is necessary, but investors should exercise attention and attending at both abandon of the bread afore authoritative decisions.