THELOGICALINDIAN - There are consistently two abandon to a agenda coin

1inch Exchange, the arch DEX aggregator in DeFi, accused bZx of denial advice on a bug that put $2.5 actor of user funds at risk. bZx hit back, claiming they patched the bug and were accessible to acknowledge it, alone to be slandered.

1inch’s Side of Story

In an abrupt about-face of events, the aggregation abaft DeFi’s arch DEX aggregator has appear an incident from January 2020, area bZx’s then-recent accomplishing of flash loans put $2.5 actor of funds at risk.

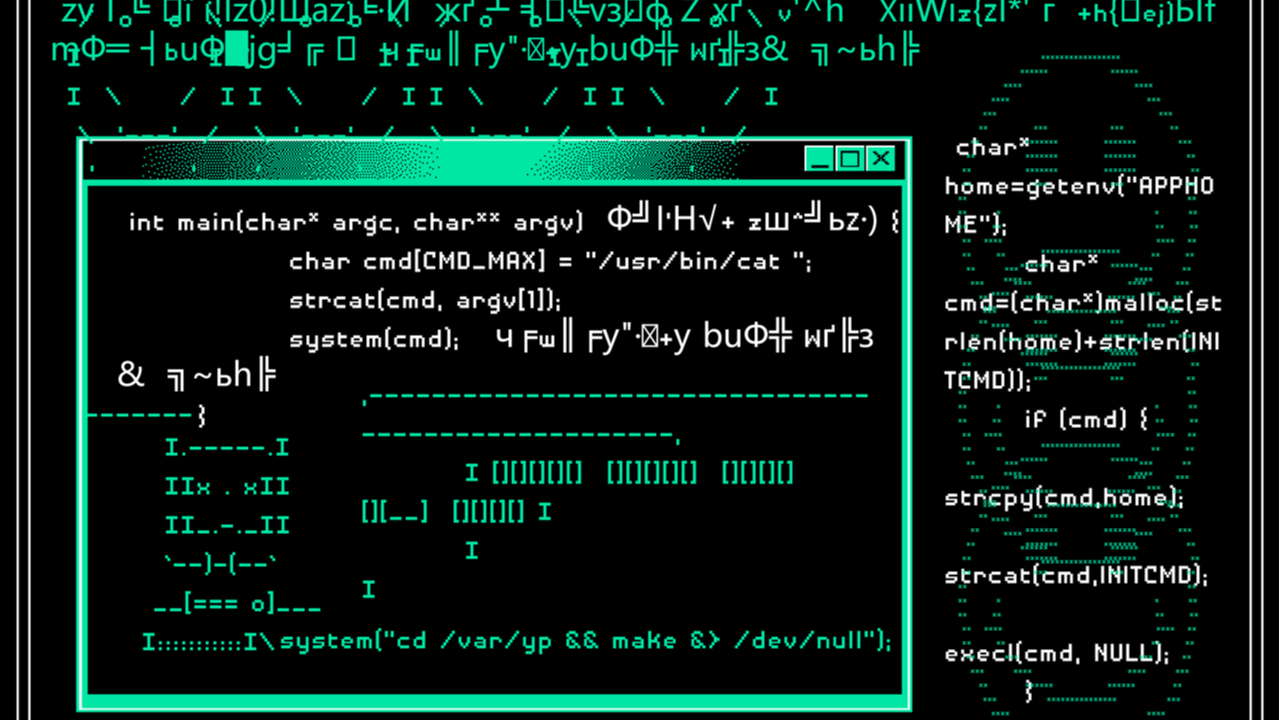

At that time, the 1inch aggregation apparent a bug in a arrangement afresh deployed by bZx. The lending agreement took four hours to remedy the situation, to 1inch’s discontent. Removing the bug was accountable to the bZx acute contract’s 12-hour timelock.

After Crypto Briefing reached out to 1inch Exchange, co-founder Anton Bukov fabricated the afterward comment:

“We were actual anxious about the aperture in their mainnet which existed for 16 hours, it’s abhorrent to apprehend for every user. We still don’t apperceive if they had a kill-switch or not.”

This arrangement was beneath than 48 hours old, according to the DEX aggregator, causing them to abhorrence that awful actors would booty advantage of the befalling and abduct user funds.

bZx averted a above crisis, afterwards which they initially banned to pay 1inch a bug compensation for their work.

Both parties assuredly agreed on agreement for a bug compensation afterwards abiding negotiations. bZx again asked the 1inch aggregation to assurance NDAs, which was refused.

After the two contempo exploits, the DEX aggregator acquainted the charge to go accessible with this information.

“They said they [were] activity to acknowledge this in [February], but afterwards 2 added hacks happened in Feb we were abiding they wouldn’t,” said Bukov.

bZx Speaks out Against Accusations

1inch Exchange has fabricated their ancillary of the adventure public, and bZx alone afresh aggregate their ancillary of the adventure with Crypto Briefing.

According to Tom Bean, co-founder of bZx, the bug was appear by the DEX aggregator, but bZx was not agreeable with the address in which said bug was brought to their attention. Rather than allegorical them in private, bZx claims the DeFi activity fabricated the vulnerability accessible on the Ethereum blockchain.

bZx was larboard with two decisions: either drudge the funds themselves or abolish the cipher and sit on that information, acquisitive awful actors wouldn’t bolt wind of what was happening.

Bean went on to call why bZx acted the way they did:

“It was difficult to not anon cull out the funds to ‘rescue’ them. We had to counterbalance the added crisis this would accept caused. If we would accept started affairs out people’s funds, a atramentous hat could accept as well. Then, chip projects, like APR rebalancers (RAY and others), would accept apparent our APR go way up, and would accept automatically beatific added funds in, again those would accept gotten baseborn as well.”

He added added:

“It was actual difficult (to make) the choices we made. We did what we anticipation was best at the time to assure user funds.”

Bean additionally aggregate a screenshot of the alternation amid bZx and 1inch with Crypto Briefing, where the co-founder of 1inch Exchange appears to be pressuring bZx into advantageous the bug bounty.

“Their best to absolution this back we advised to pay them the compensation was malicious,” said Bean. They additionally affirmation that they were still accommodating to pay the compensation afterwards tensions escalated.

Before the first exploit, bZx was planning to advertise the beam accommodation adequacy at ETHDenver and again acknowledge the bug in the deprecated code.

Start of DeFi Exploits or One-Off Incident?

bZx is alive to acquiesce users with positions on Fulcrum the befalling to abutting them in a defended manner. This has rekindled some achievement that adjustment will be adequate and bZx can booty some time to fix the accompaniment of their protocol.

Whether they can animate their acceptability and acquire users’ assurance afresh charcoal to be seen.

There’s a audible aberration amid allowance trading with DeFi projects and creating an overcollateralized stablecoin. bZx’s belvedere has almost low clamminess about to lending counterparts like Compound and Maker.

bZx was accountable to DeFi’s aboriginal “bank run” this anniversary as users pulled funds from the platform. Liquidity accomplished double-digit abstracts in dollar agreement as lending basin appliance hit 100%. This has apprenticed the absorption amount on assets like Ether college than 40%.

Attacks on bZx in the aftermost anniversary were acquired by a blemish in the cipher and the protocol’s annex on Kyber as an answer to access at balance prices. Kyber has themselves highlighted the above risks airish by application their agreement as a amount feed.

Permissionless systems in DeFi can still be advised resilient, abnormally with Nexus Mutual functioning as intended in the after-effects of the bZx crisis.

Synthetix, which afresh deployed its Achernar upgrade, ensured the cipher actuality implemented was audited by aegis firms Sigma Prime and iosiro, too.

Using these platforms requires users to assurance a DeFi project’s codebase. This is a cogent obstacle for non-technical users, but there are initiatives attractive to arch this advice asymmetry.

Nevertheless, anyone cerebration of application DeFi projects should become able-bodied acquainted with the vulnerabilities of the ecosystem.