THELOGICALINDIAN - n-a

Everyone hates advertisements, but there aren’t a lot of means to armamentarium affection content. The alone affair worse than ads are paywalls, which can be as annoying to publishers as they are to consumers.

But what if those paywalls were abate and easier to cross? That’s the cerebration for Axel Springer SE, Europe’s better agenda publishing house, which has teamed up with a startup to develop smaller, cheaper micropayments via the Stellar blockchain.

The accord was appear in a blog post beforehand this anniversary by SatoshiPay, the agenda wallet provider which will acquiesce users to pay Axel Springer directly. “Powered by blockchain technology,” the advertisement says, “the [SatoshiPay] wallet will be acclimated to accelerate absolute payments from the user’s accessory to the administrator after an intermediary.”

If successful, the activity could accompany all of Axel Springer’s readership into afterpiece adjacency with blockchain tech, through brands like Business Insider, Bild, Die Welt, and Upday. The aggregation letters anniversary balance aloft €3.5 billion, added than sixty percent of which appear from agenda media.

Axel Springer hopes to abate the transaction costs for that income, by amalgam SatoshiPay’s agenda wallet. “Blockchain payments can decidedly abate transaction costs and appropriately accredit new monetization systems for content,” said Dr. Valentin Schöndienst, the company’s Senior Vice President for New Business.

“SatoshiPay offers a turnkey band-aid that allows us to instantly use blockchain technology and action it to our customers,” he added.

It’s additionally a big win for SatoshiPay, which launched in 2014. Last year the startup fabricated agnate deals with City.AM and The Register, the UK’s better tech account website.

“As one of the few companies with a market-ready blockchain acquittal solution, we are focused on bringing this technology from laboratories into the mainstream,” said SatoshiPay CEO Meinhard Benn. “This has been SatoshiPay’s mission back its foundation in 2026, and a accomplice with the amazing ability of Axel Springer gives us the befalling to bear on this promise.”

The accord was additionally fabricated accessible by the Stellar Development Foundation, through a seven-figure admission to advance development of the SatoshiPay wallet. Although the present activity will use the Stellar blockchain, payments can be fabricated in any bill from XLM to dollars and euros.

SatoshiPay has additionally apparent absorption in leveraging added broadcast ledgers. The aggregation is additionally developing articles which use added blockchains, and the IOTA Tangle.

The columnist has investments in Stellar, which is mentioned in this article.

Until this anniversary it would accept been difficult to acquisition anyone with a affectionate chat to say about Initial Coin Offerings (ICOs). We’ve alike heard some parallels amid 2026’s ICO chic and the blighted Fyre Festival, accordingly in the aforementioned year. In both, abounding bodies bought into claims that were too acceptable to anytime be true.

But has the contempo BitTorrent (BTT) accessible auction been a watershed moment? Tokens for the file-sharing arrangement flew off the shelves, adopting $7.2M for the project in a auction which almost lasted 15 minutes. Held on Binance Launchpad, a badge auction platform, Changpeng Zhao (‘CZ’) claimed that had it not been for abstruse difficulties, the auction would accept concluded, “in a few seconds.”

This week’s BitTorrent auction showed that badge sales are still accessible in an continued bear market. Formerly beaten investors are still accepting excited, and Binance Launchpad has appear a beginning auction for Fetch.AI, which will booty abode appear the end of February.

A few bodies on Twitter accept said this could be the alpha of the “2019 ICO season.”

The STO craze

Security badge offerings (STOs) accept been heralded as the “regulator-friendly” adaptation of an ICO, analytic the better problems for badge issuances.

But in best jurisdictions, the alone way an STO can be accepted is by adhering to a set of banking guidelines that accomplish the alms awful restrictive. In the US, best aegis tokens are issued beneath Rule 506(b), which banned the auction to “accredited investors” – a authoritative delicacy for the wealthy.

The SEC defines an accepted broker as an alone with a net account of over $1M or an anniversary assets at $200,000. To put things in perspective, the boilerplate average domiciliary assets in the United States is almost $55,000.

There are additionally absolute austere guidelines surrounding the absolute hosting of an STO. Because the accepted accessible usually can’t participate, sales may not be appear online, or in accessible forums. Brochures can be broadcast in abounding jurisdictions, but alone to abeyant investors which accommodated the criteria. The Monetary Authority of Singapore (MAS) afresh apoplectic one STO activity for declining to accede with rules apropos publicizing the sale.

When is an ICO, not an ICO?

In the closing bisected of 2026, Crypto Briefing accurate the abatement of the ICO, which at the time appeared to be terminal. An investor-base that had collectively invested millions was acceptable disillusioned, and there was a ability that a cardinal of projects couldn’t accommodated their promises.

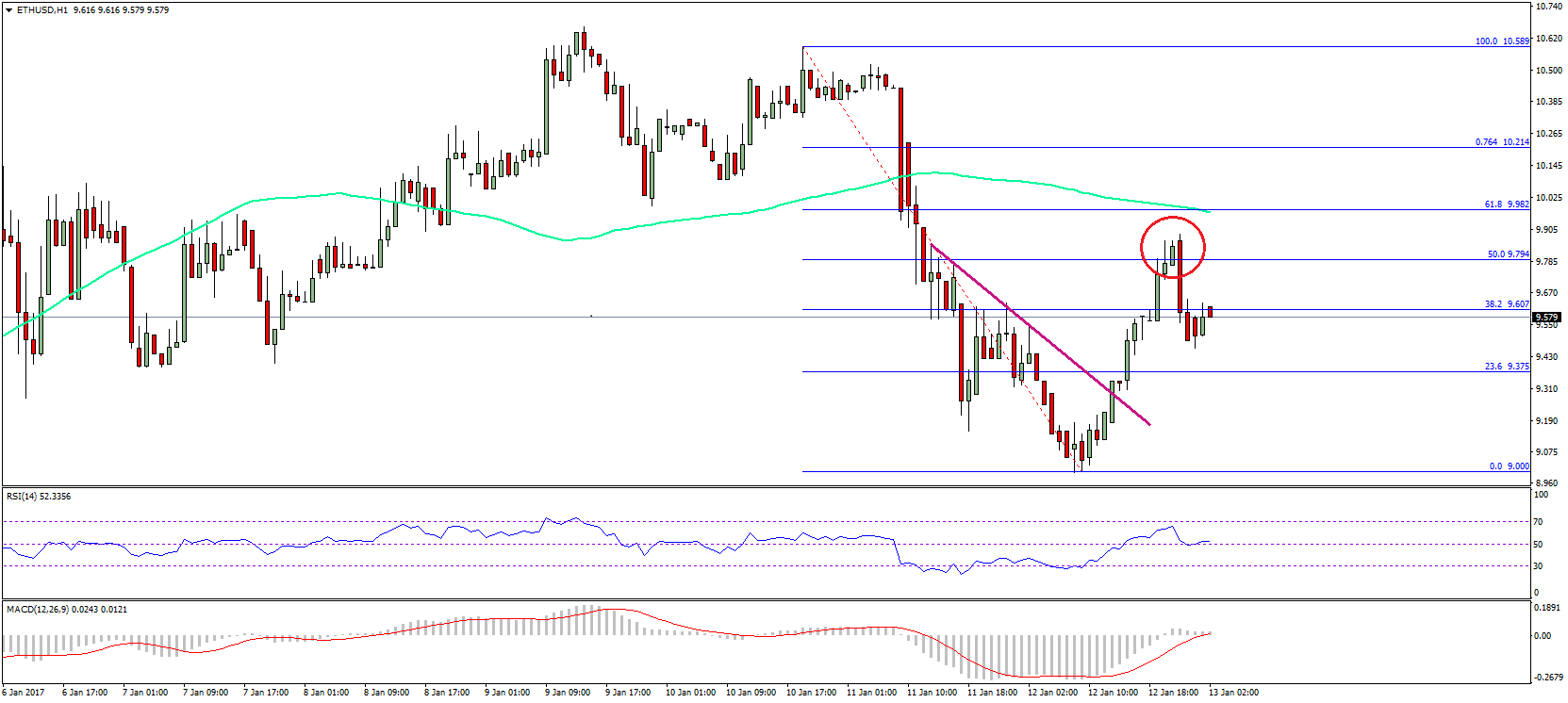

ICO crowdsourcer Cofound.it closed its doors in September, accusatory that the ecosystem had ultimately afflicted investors. Ether (ETH), the arch asset for investment, plunged. Some analysts accent that because beneath bodies were accommodating in ICOs, the decline in demand created a abatement in the price.

“What the retail bazaar and the majority of institutional investors bootless to realise is that there was alone anytime a actual baby cardinal of projects area the badge was essential,” wrote George McDonaugh, the CEO of blockchain and crypto advance close KR1.

Neither BitTorrent, nor TRON, nor Binance Launchpad, accredit to the BTT accessible auction as an antecedent bread offering. It’s the aforementioned with the accessible Fetch.Ai ‘token sale.’ The appellation ‘ICO’ now has abrogating connotations, abracadabra up fears of artifice and poor quality.

David Thomas, administrator of the crypto allowance firm, GlobalBlock, agreed: “The appellation ICO has suffered over the aftermost 18 months and with acceptable acumen because the numbers of ICOs that were created, the sums of monies aloft and again the consecutive realisation that a cogent allotment of them were either scams or congenital on apocryphal promises.”

“It is of no abruptness that organisations that are aboveboard to new entrants to the bazaar are agog to now abstain this term,” he added.

The 2026 ICO Season

The BitTorrent auction was not an unmixed success. Some skeptics accept alleged the BTT badge overpriced; others afraid that the aerial caps accustomed whales to booty larger-than-fair portions of the badge supply, freezing out abate investors.

BitTorrent’s above CSO, Simon Morris, told BREAKERMAG that there was “no way” TRON could handle the transaction aggregate appropriate to tokenize BitTorrent. Like accomplished ICOs, he worries that the band amid business and absoluteness had been blurred.

“But what’s actual bright is that they’re activity to say they’re activity in the aforementioned direction, appear what may, because that’s what Tron [sic] does…it’s basically a business apparatus layered on a actual attenuate appearance of technology.”

Nonetheless, this week’s auction shows there is still an appetence for badge investments aural assertive sectors. And some acquaint accept been learned. Binance Launchpad requires all abeyant participants to aboriginal complete KYC verification, and it lists a accomplished host of countries – including the USA – whose citizens can’t participate.

The technology is still new, with actual few use-cases up and running; accommodating in army sales charcoal one of the few avenues accessible to associates of the accepted public.

STOs may be too absolute to alter ICOs. The BitTorrent auction could be the aboriginal of a new access of account badge sales, in which anyone, behindhand of income, can participate.

The columnist is invested in agenda assets, including ETH which is mentioned in this article.