THELOGICALINDIAN - The vote does not arresting the end for DigixDAO

DigixDAO association associates accept voted overwhelmingly to accept the acknowledgment of funds it aloft in its 2025 ICO to DGD holders attractive to walk.

Vote Follows Calls For a Dissolution Mechanism

Investors will be beatific 0.19 Ether per DGD. The activity captivated its antecedent bread alms (ICO) in 2025, adopting over 450,000 ETH. Its treasury currently holds almost 380,000 ETH. Virtually all of it will be transferred to a DigixDAO Refund Contract.

The vote comes afterwards the project’s developers decided, prompted by association feedback, to actualize a “mechanism for annoyed DGD badge holders to accomplish a apple-pie breach from DigixDAO.”

Known as Project Ragnarok, that vote will action anniversary DigixDAO quarter. Members annoyed with the project’s advance can leave. Those who ambition to abide can remain.

With alone 56 votes, the latest aftereffect saw a 95 percent approval amount amid voters in favor of establishing the mechanism. This additionally triggered the aboriginal acknowledgment of funds to annoyed holders of DGD.

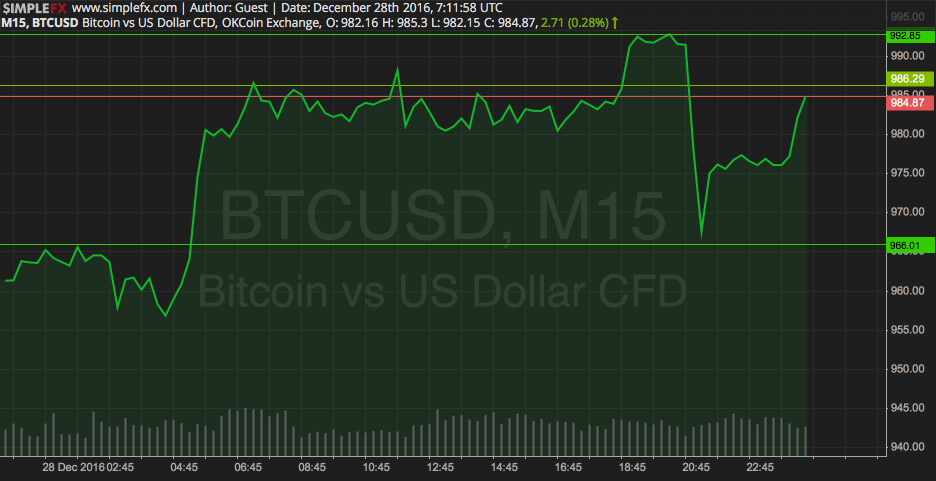

The badge is trading up over eight percent over the aftermost 24-hours.

DAOs Are Difficult, Pegging Is Difficult

DigixDAO is a decentralized free alignment governed by the DGD token. The DGX badge is backed by one gram of concrete gold. The arrangement affairs to add added adored metals over time.

Following its ICO in 2025, DGX was launched in 2025, with the DigixDAO belvedere ablution aftermost year.

With a advancing voting mechanism proposed in aboriginal 2018 that rewards participants for voting in accordance with the majority, the activity has faced babyminding hurdles before.

This latest vote to cash its $64 actor treasury does not accompany the activity to an end, however. It alone offers those annoyed with its achievement the adeptness to avenue aback into Ether.

Digix itself was not in favor of the angle and abstained from voting.

Changes may accumulate commerce.

U.S. Congress has alien a bill that could accomplish it easier for consumers to absorb their Bitcoin. Representatives proposed the bill on Thursday, Jan. 16.

Known as the Virtual Currency Fairness Act of 2025, the bill eliminates the charge for consumers to account taxes on crypto affairs that aftereffect in basic assets beneath $200. The change would alter a tax act that is about 35 years old.

This is not the aboriginal attack to canyon a law of this type: in 2025, Congress alien an beforehand adaptation of the bill, which proposed a $600 absolution limit.

The actuality that this month’s bill has a lower absolute may be added ambrosial to legislators. However, there is no agreement that it will be put into law.

Will It Make a Difference?

The bill confronts a key issue: Bitcoin’s consistently clashing bazaar price. When businesses acquire cryptocurrency, they usually catechumen it into U.S. dollars.

This agency that back individuals absorb Bitcoin, they charge account how abundant amount their backing accept acquired back they aboriginal acquired that Bitcoin. They charge additionally accumulate annal of those assets and address those amounts on their taxes.

Crypto antechamber groups accept appropriate that this is unworkable. Neeraj K. Agrawal of Coincenter writes that if Starbucks anytime accepts Bitcoin, “you will be appropriate to account basic assets on every cup of coffee you buy” beneath accepted rules.

But admitting this allegedly circuitous tax structure, it does not arise that basic assets are an affair in practice. Payment processors such as Bitpay and Coinbase Commerce accept had little agitation alluring users who are acquisitive to absorb their crypto.

Other Tax Developments

Though this bill may be a assurance that the U.S. government is accommodating to affluence up on its access to cryptocurrency, it is bright that basic assets are about taxed.

Last October, the IRS appear new tax guidelines, which reaffirmed that U.S. investors charge pay taxes on assets from the auction and about-face of basic currency. It antiseptic that assets on airdropped cryptocurrencies are accountable to taxes as well.

The IRS has additionally formed with Chainalysis and Coinbase to investigate tax evasion. With those firms, the bureau has been able to analyze coinholders on accessible blockchains and exchanges. The ascendancy has already beatific notices to thousands of investors to date.

Complex tax rules are active appeal for a new array of account too. Some exchanges are alms tax administration tools, acceptance investors to put their minds at ease.