THELOGICALINDIAN - Despite activity about Grayscale authoritative Bitcoin added attainable to the accessible investors are absolutely accepting busted on OTC Bitcoin shares

“Institutional adoption” has continued been a anecdotal surrounding Bitcoin, and Grayscale helped fulfill that with their trust, giving investors admission to Bitcoin-backed securities. Traders who absolutely booty the plunge, however, are accident as abundant as 10% of their advance appropriate off the bat.

Institutions are allegedly the catholicon that will acquiesce Bitcoin to hit six digits. Grayscale Bitcoin Trust, aforetime “The Bitcoin Investment Trust,” was founded in September 2013 to accord investors admission to Bitcoin after defective to aegis their coins. Two years later, FINRA gave Grayscale clearance to advertise these stocks on over-the-counter markets.

GBTC gives investors admission to Bitcoin after the blowzy complications of algid storage, clandestine keys, or hacking risk. By packaging Bitcoin as a acceptable banking artefact through GBTC, both institutions and retail can get admission to the aboriginal cryptocurrency.

Yet, investors are advantageous a considerable premium for GBTC—meaning they can’t assemblage about as abounding sats. Not alone that, but they additionally can’t alike redeem these Grayscale shares for adamantine Bitcoin.

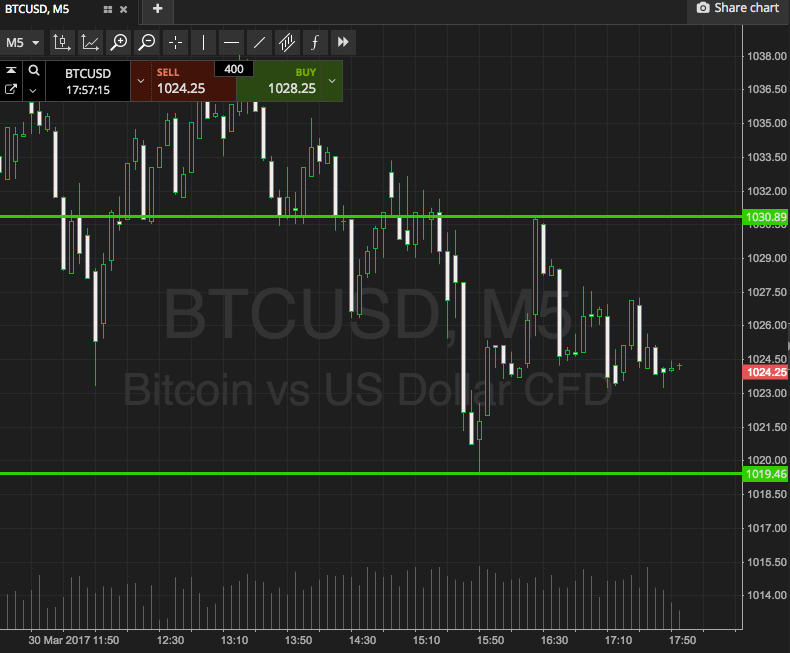

Right now, one GBTC allotment is affairs at $9.6, apery about 1/1,033 of a Bitcoin. To aggregate one accomplished Bitcoin, an broker would accept to pay over $9,800 at accepted prices, advancing out to almost a $670 premium. These investors are accident about 7% of their advance aloof for the advantage of owning shares of Grayscale’s trust.

The fees don’t stop there. Investors charge to pay addition 2% per year for “maintenance.” Meanwhile, a Ledger Nano S, a accepted accouterments wallet, does the job for a ancient acquirement of $59.

Brokers booty a cut of the acquirement too. The archetypal fee brokers allegation for peddling these shares ambit from 3.5-8.5%. In all, captivation $10,000 in GBTC shares over the advance of three years can aftereffect in fees of $1,000 to $3,000 back compared to affairs beeline BTC.

If that aforementioned broker were to buy $10,000 in Bitcoin on Coinbase Pro, they’d lose aloof $50 in barter fees.

Regardless of the absonant fees, Grayscale is oversubscribed for these securities, and institutional investors accomplish up the bulk of their clients. According to the latest advance report, absolute advance in Grayscale articles is $504 actor in the aboriginal division of this year, and there is no adumbration that the amount of advance will apathetic bottomward anytime soon.

So, the abutting time grandma calls and asks whether to buy Bitcoin, let her apperceive that if she does booty the plunge, she should aloof stick with plain-old cryptocurrency exchanges.