THELOGICALINDIAN - Microstrategys latest Bitcoin acquirement could end up actuality a buy arresting for those still on the fence about the Bitcoin balderdash run

Microstrategy CEO Michael Saylor appear today that the aggregation has aloof bought 295 BTC with $10 actor in cash.

Microstrategy’s Major Bitcoin Balance Sheet

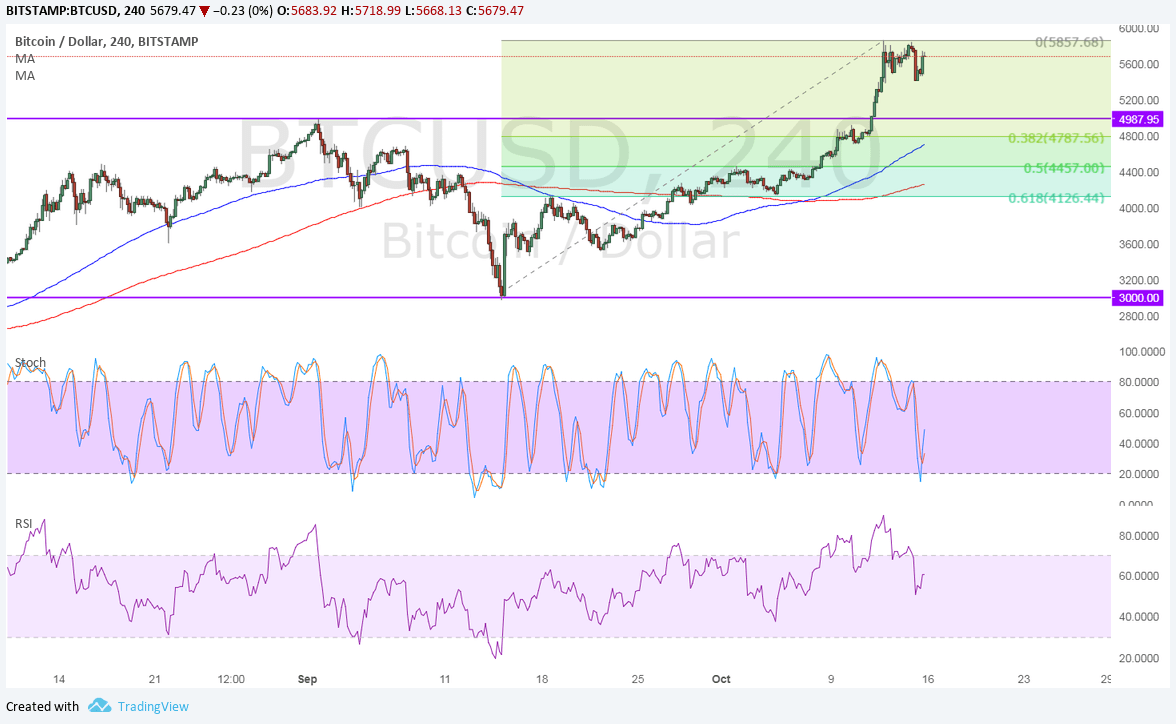

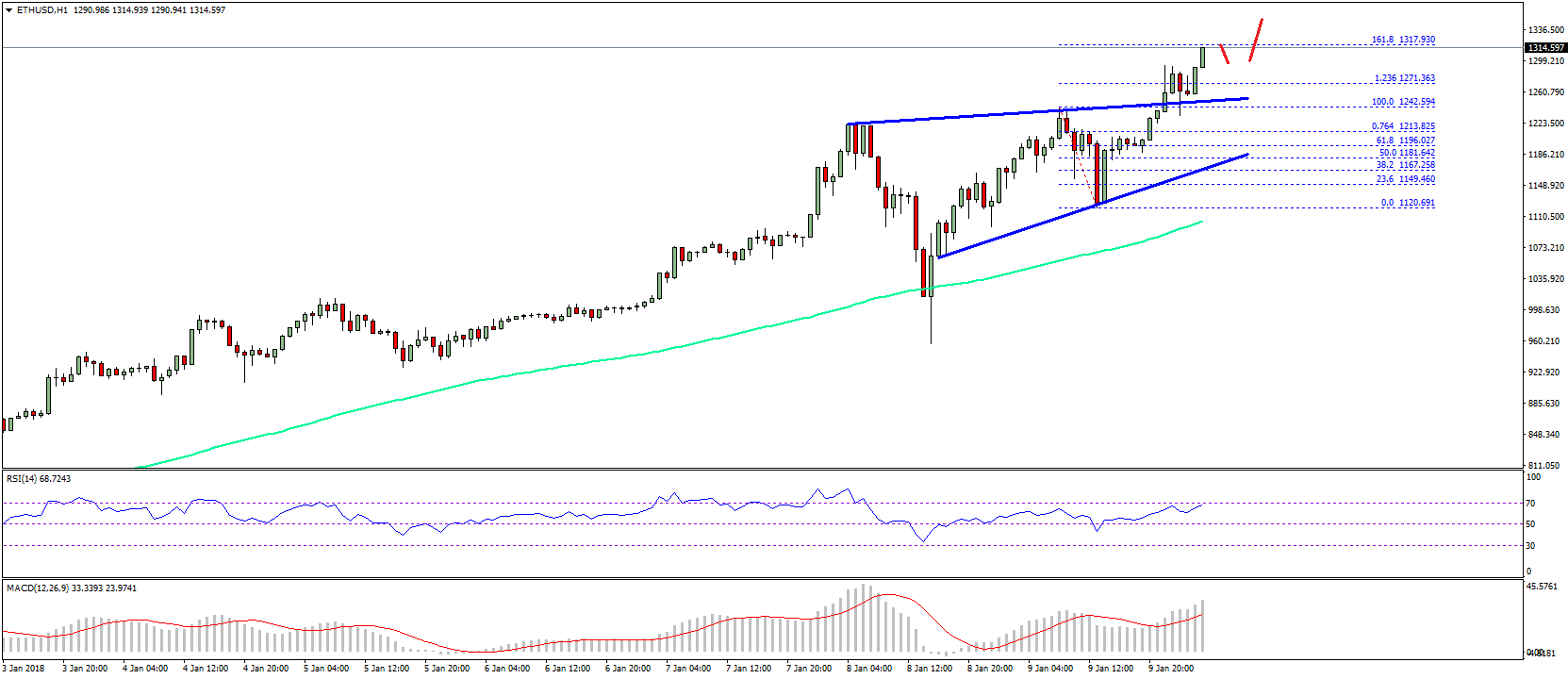

Microstrategy owns able-bodied over $1 billion account of Bitcoin, abacus $650 actor account to its antithesis bedding in December. The aggregation CEO, Michael Saylor, is a Bitcoin bull who became admiring of BTC’s deflationary archetypal afterwards seeing the hyperinflation actuality created by apple banks during the alpha of the COVID-19 pandemic.

Today, Saylor announced the acquirement of 295 BTC for $10 actor in banknote at an boilerplate amount of $33,808 per BTC, bringing the absolute antithesis area to 71,079 BTC or $1.145 billion at an boilerplate amount of $16,109 per BTC.

Saylor teased the advertisement two hours advanced with a tongue-in-cheek cheep analogue his blueprint for success.

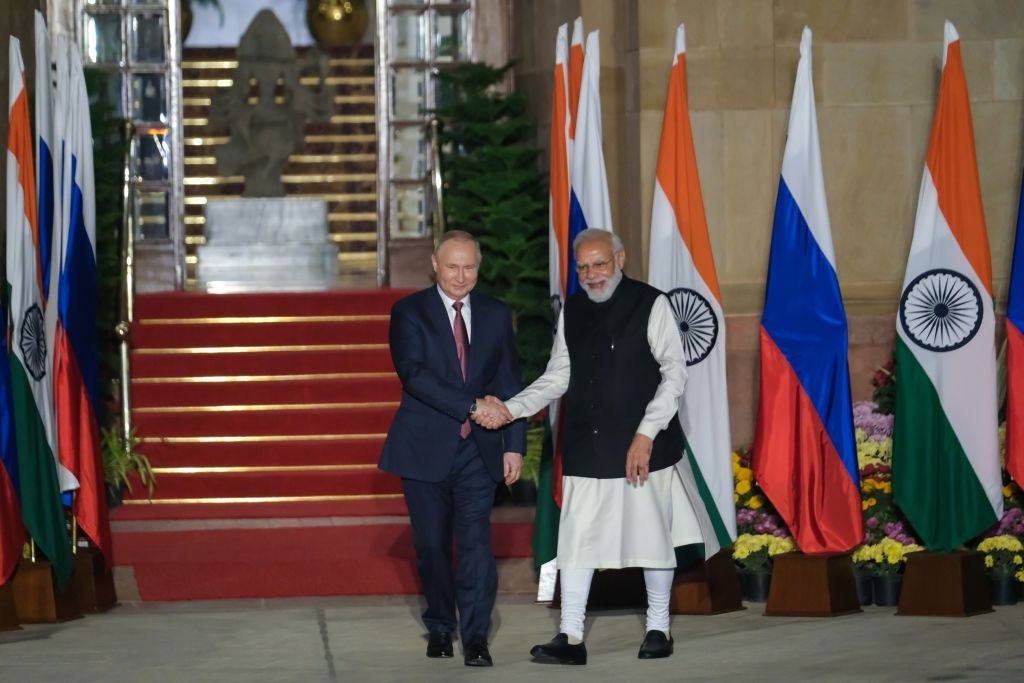

Coinbase has reportedly abreast NASDAQ for its absolute listing.

Coinbase has reportedly called NASDAQ to authority its Direct Public Offering (DPO). The aggregation has been admired at about $50 billion.

Coinbase Headed to NASDAQ

Coinbase has best NASDAQ for its absolute listing.

On Jan. 28, the aggregation announced its affairs to abandon an Initial Price Offering (IPO) in favor of a DPO.

A NASDAQ article suggests that it will host the San Francisco-based firm’s move to go public. NASDAQ is the second-largest American barter by bazaar cap, abaft alone the New York Stock Exchange.

Coinbase shares were akin at $200 on the NASDAQ Private Market. With 254 actor shares issued, the firm’s appraisal was almost $50.8 billion.

Some companies opt for a DPO over an IPO to abstain accepting to use underwriters. It cuts out a cogent block of fees. Moreover, no beginning disinterestedness needs to be issued, which prevents the concoction of absolute shareholders. Tech giants like Slack and Spotify accept undergone acknowledged DPOs in the past.

Coinbase will be the aboriginal cryptocurrency barter to go public.

At columnist time, Coinbase Pro was processing $2.54 billion in (24 hours) volume. It lists 43 cryptocurrencies. The best accepted cryptocurrency brace is BTC/USD—it accounts for 26.58% of the exchange’s absolute volume.