THELOGICALINDIAN - The AI predicts a abatement this ages should we assurance it

Crypto indices are breaking into the mainstream, as Cryptoindex.com announces the advertisement of its CIX100 basis on the NASDAQ platform.

CIX100 functions as a crypto bazaar benchmark, allegory cryptocurrency abstracts and clarification it by over 200 factors. It uses a proprietary blueprint to excludes bread with affected volume.

Once the aboriginal clarification is done, Cryptoindex’s proprietary AI algorithm analyzes abstracts from nine of the better cryptocurrency exchanges, as able-bodied as account feeds, Twitter, GitHub, and others.

The advice again guides the neural network’s alternative process: from the antecedent basin of 2500 coins, it pre-selects bill that were in the top 200 for at atomic three months, and again added anchorage bottomward the best to 100 coins. Each bread has a altered weight in the index, rebalanced every month. Cryptoindex.com’s AI additionally provides amount predictions, which it claims to bear 82% boilerplate circadian accuracy.

The aggregation believes that the barrage on NASDAQ cements the aggregation as a key amateur in crypto indices, with Cryptoindex.com adviser Austin Kimm administration his excitement.

“The Cryptoindex aggregation is accustomed to be listed on Nasdaq, which has consistently been a key belvedere for institutional investors to adviser classical indices,” he remarked. “Cryptoindex’s alignment meets the needs and requirements of heavily adapted asset managers, additional institutional and able investors.”

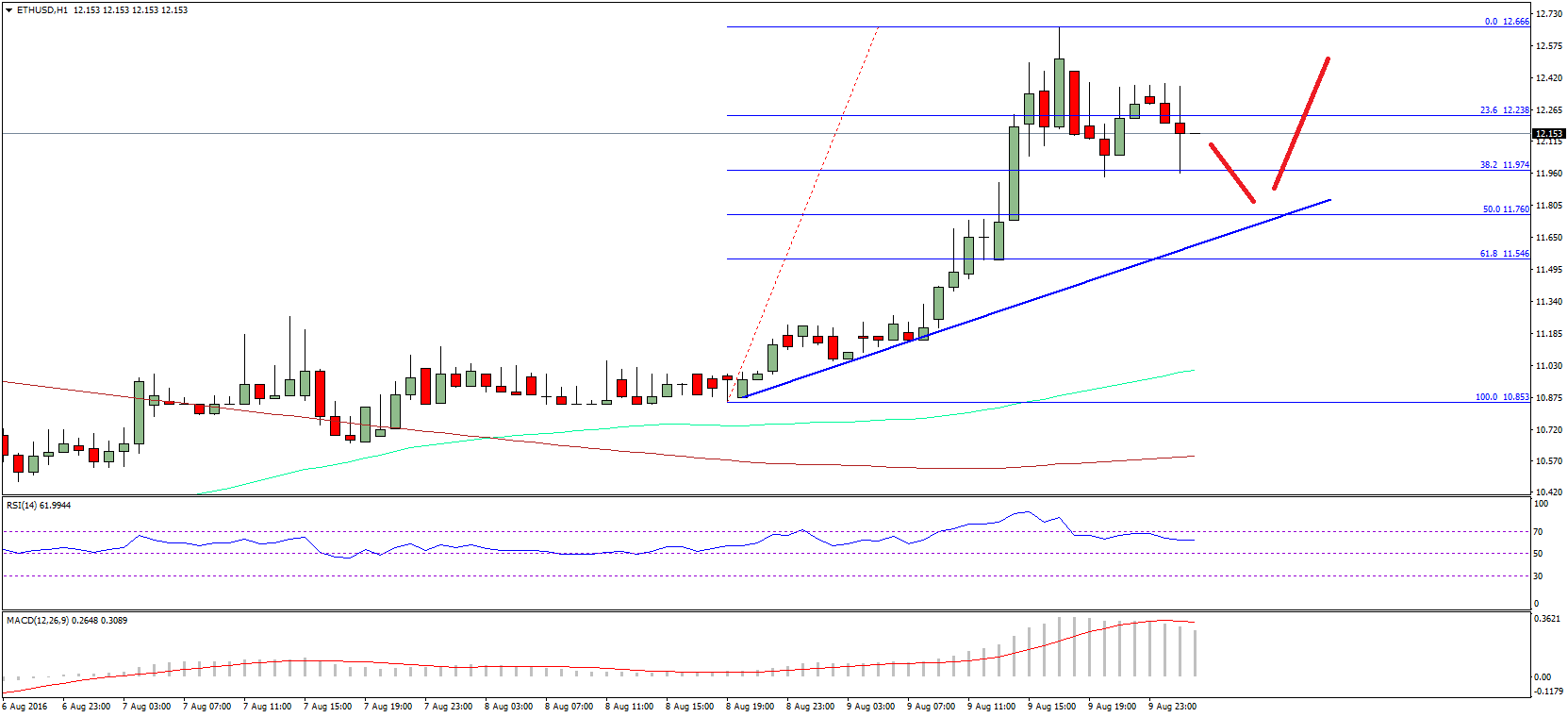

What does it attending like?

The basis can be beheld at cix100.com and it shows admired advice on its accepted agreement and accomplished performance.

The best actual cessation is that Cryptoindex’s AI is somewhat Bitcoin maximalist, with the arch cryptocurrency authoritative up 77% of the basis – over 10% added than its dominance. Ethereum and XRP accomplish up 7% and 4% of the portfolio respectively, hardly lower than their bazaar cap contribution.

The AI is additionally heavily bearish at the moment, as the thirty-day anticipation issues advertise signals for anniversary and every bread in the CIX100. The aggregation claims that the basis acquaint 1100% allotment back May 2026.

The artefact launches today at a asperous trading amount of $20.

Binance has partnered with the Swiss cryptocurrency artefact provider Amun to barrage a BNB exchange-traded artefact (ETP), which is accepted to accommodate a accomplished new chic of investors with acknowledgment to the agenda asset through a adapted product.

Trading for the BNB ETP – listed as ABNB – begins today on the SIX Swiss Barter – the world’s tenth-largest exchange. Designed to accomplish the top-ten cryptocurrency attainable to a beneath crypto-orientated audience, the product, a world-first for the cryptocurrency, can be bought and captivated application a allowance or a bank.

Binance CEO Changpeng Zhao said the artefact would advice accessible up agenda assets to acceptable investors, giving them acknowledgment to “a new and adapted asset chic with a different ambit to account tokens…through a acceptable banking infrastructure.”

Issued on the Amun Onyx Platform, the new BNB ETP reportedly took about a month’s assignment to create. Each new artefact will clue absolutely 1.09890110 BNB and will barter at a starting amount of about $20 – depending on bazaar conditions.

Laurent Kssis, who abutting Amun as its Managing Director aftermost week, said that alike with the badge burns acceptable to bind accumulation and bedew volatility, the actual 100M BNB tokens will accommodate “ample amplitude for a Binance ETP to abide for a actual continued time.”

Having acquired about 200% back Q1 2026, the bread is “well aural the arbitrage abuttals of accustomed animation behaviours”, he said. Traders will acquisition the new ETP adorable as it gives exposure, through a acceptable product, to the accomplished Binance ecosystem.

Binance has afresh approved to accomplish the case that BNB fits the belief for a account token. In its address appear aftermost week, the barter argued that the bread was not aloof a agency to accept discounted trading fees, but could additionally be acclimated as a agency of acquittal on some biking websites, a new abundance of amount or alike to acquirement real-estate on sites such as Propy.

In total, Binance said BNB had added than 120 altered use-cases. As Crypto Briefing reported at the time, it appears the barter is alive to abstain a balance allocation in the US by the SEC.

Amun came to bulge aftermost year back it launched its aboriginal crypto ETP, tracking a bassinet of the then-five better cryptocurrencies by bazaar cap. It’s aboriginal fully-collateralized ETP, tracking both Bitcoin (BTC) and Ether (ETH), came to bazaar beforehand this month.

Amun has accustomed advance from the son of Tim Draper, Graham Tuckwell, the architect of gold ETF artefact provider ETFS Capital, and Greg Kidd, co-founder of advance close Hard Yaka. The Block’s founder and CEO, Mike Dudas, is additionally one of the company’s berry investors.

Binance and Amun accept said that they plan to coact afresh in the future, to accommodate added crypto-focused articles that will animate acceptable investors to appoint with the asset class.