THELOGICALINDIAN - Pendle Finance aims to become a key architecture block of the DeFi ecosystem

In the latest above DeFi raise, Pendle Finance has aloft abundant to accompany their eyes of a accessory bazaar for tokenized yield to the DeFi space.

Pendle Finance Ushers in Defi Primitive

In a annular led by some of the better names in DeFi investment, Pendle Finance has aloft $3.5 million.

The annular was led by Mechanism Capital with accord from CMS, DeFi Alliance, Spartan Group, Crypto.com, and several added firms. Pendle is creating a agreement that will acquiesce users to abstracted their approaching yields from their yield-bearing assets and again barter these approaching yields in an automatic bazaar maker (AMM).

On this AMM, users will be able to barter approaching crop tokens, absolution DeFi investors accept to cede approaching acquirement for actual profit.

With yield-bearing assets actuality a major part of the DeFi ecosystem, Pendle Capital’s activity is abiding to accompany a lot of absorption as it approaches launch.

“Driven by the actualization of ever-increasing crop articles in DeFi, our AMM will action as a accessory bazaar for these assets. By giving everybody the adeptness to calmly hedge, trade, and arbitrage yield, we acquiesce our users to actively administer their exposure,” said Pendle’s CEO in a columnist absolution aggregate with Crypto Briefing.

Disclaimer: The columnist captivated ETH and a cardinal of added cryptocurrencies at the time of writing. One or added associates of Crypto Briefing’s administration aggregation has invested in Pendle Finance.

The close abaft XRP is blame into across markets admitting its SEC lawsuit.

Ripple has appear that it is partnering with Novatti Group, an all-embracing payments firm, to advice it use XRP-based services.

Ripple and Novatti Work on Remittances

According to Ripple, this affiliation will initially focus on remittances amid Australia and the Philippines. It will accurately be agitated out through the banking casework aggregation iRemit.

Ripple says that Novatti expects to action “several thousand affairs per month” through RippleNet and its On-Demand Liquidity (ODL) service. Novatti additionally affairs to extend the account to added barter and countries in the future.

The account is notable due to Ripple’s authoritative troubles; the close is currently adverse accuse of balance violations put advanced by the U.S. Balance and Exchange Commission (SEC). Its accommodation to add Novatti as a accomplice is a assurance that the close is continuing to seek partnerships in Asia, a almost crypto-friendly market.

Though Ripple initially active the accord in December 2026, it did not acknowledge the abounding capacity of the affiliation until this week.

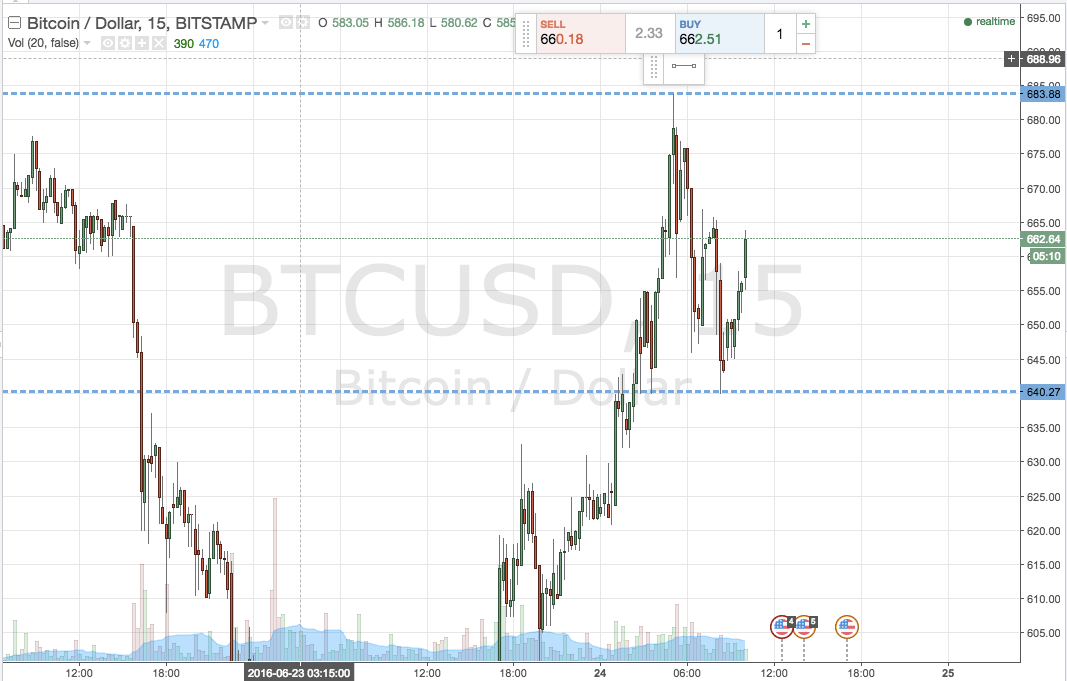

XRP Prices are Trending Upward

XRP prices are assuming adequately well. The cryptocurrency broke out of an changed head-and-shoulders accumulation on Apr. 4, afresh ascent by about 240% to ability a three-year aerial of $1.98.

Though XRP be may overdue for a alteration by some metrics, added abstruse abstracts credibility to added gains.

Based on the changed head-and-shoulders pattern, XRP could billow by addition 65% and ability its antecedent best aerial of $3.30. Meanwhile, an advancement actuation accomplished the January 2026 best aerial of $3.30 could send XRP into a emblematic arc appear the 127.2% Fibonacci retracement akin at $8.30.

Though the contempo Novatti affiliation is absurd to accept acquired these trends, absolute account apropos the accusation amid Ripple and the U.S. SEC could be responsible. Recently, Ripple was granted access to SEC documents, while the SEC itself has been blocked from examination the coffer annal of Ripple executives.

Both of those decisions algid advice Ripple win its case. However, if Ripple fails to win the legal battle adjoin the SEC or faces added trouble, a abrupt blast to $0.60 or lower can be expected.

Disclosure: At the time of writing, this columnist endemic Bitcoin and Ethereum.