THELOGICALINDIAN - n-a

The crypto anarchy is overextension through Latin America, and is authoritative above appropriate in one above South American country. No, not that one. But shoppers in Brazil and Colombia may anon be able to pay for their advantage in cryptocurrency.

In a announcement beforehand this week, BitCapital revealed plans to acquaint cryptocurrency point-of-sale accessories to Brazilian stores. The accessories were produced by Pundi X, a concrete sales provider for cafes, shops and added retailers.

BitCapital, one of Brazil’s better OTC providers, says that the payments accessories are allotment of advancing efforts to accomplish fiat-crypto affairs as effortless and automatic as possible.

1000 XPOS sales accessories will be brought to the better South American market, although it’s not bright how abounding retailers will be adopting them.

“In a arena fast accepting a acceptability as a centre for cryptocurrency to enter, the Brazilian bazaar is an ideal point of access and the appeal from merchants has accurate our amplification action into South America,” said Zac Cheah, CEO and Co-founder of Pundi X. “BitCapital is the ideal accomplice for our admission in Brazil. Not agreeable to be an OTC baton in a bazaar of all-around acceptation they are attractive to booty on banks and bear a new payments solution.”

“There’s alone one bold in boondocks at the moment for easy, barefaced solutions for crypto adoption,” said BitCapital architect Ricardo Guimaraes Filho. “That’s Pundi X. We’re captivated to be partners”.

The move comes one anniversary afterwards a agnate partnership was appear amid Pundi X and Manticora Capital, which will see addition 1,000 XPOS accessories alien to Colombia in the advancing six months.

“Difficult altitude in bounded cyberbanking and advance accept accumulated to accomplish Colombia a badly activating bazaar for cryptocurrency usage,” said Ivan Correa, CEO of Manticora Capital, back the closing affiliation was announced. “A abridgement of befalling for authoritative quick and accessible conversions from authorization bill to cryptocurrency is the primary anchor on the contrarily awful agog bazaar for cryptocurrency in Colombia. The XPOS is the absolute answer.”

Pundi X’s moves accord with an added absorption in cryptocurrency acceptance in Central and South America. While one country in accurate has taken best of the attention, the uncertainties of bounded authorization currencies and the aerial costs of all-embracing remittance accomplish LATAM markets acceptable candidates for cryptocurrency adoption.

The aggregation aloft $35 Mln in an antecedent bread alms this year. With a present valuation of $209 Mln, the Pundi X badge is the 44th better cryptocurrency by bazaar capitalization.

The columnist is not invested in Pundi X but holds added agenda assets.

Institutional investors are set to booty over the cryptocurrency bazaar and use adopted deposits as a agency to assure themselves adjoin banking calamity, according to the 2018 Cryptoasset Bazaar Coverage Initiation Report by Satis Group.

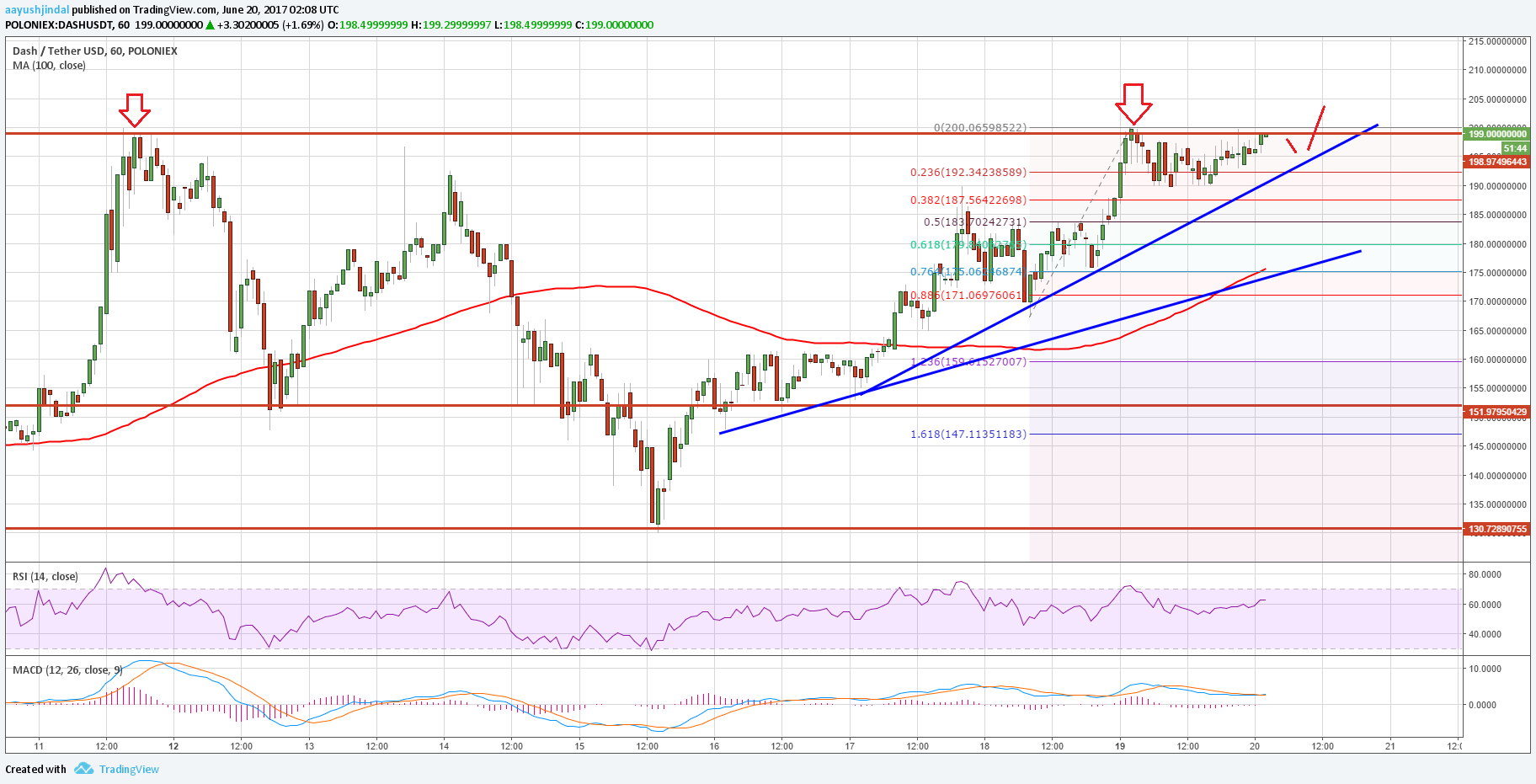

Bitcoin could hit $96,000 by 2023 and XRP will be basically worthless, according to the study. It additionally suggests that the cryptocurrency market’s absolute bazaar cap could hit $3.6 abundance by 2028.

Look above the banderole abstracts and the address has some above takeaways for the approaching of the industry. It suggests that the Winkelvoss brothers and added aboriginal stars are set to be drowned out by all-inclusive corporations accession crypto offshore.

The address also dissects the absolute amount of cryptocurrencies as a accomplished and the advance of the market.

Offshore Deposits Set To Take Over

The Total Addressable Market abstracts advance that adopted deposits of cryptocurrencies are set to accelerate as acceptable aegis solutions appear online. Right now, adopted deposits accomplish up aloof 38% of the Total Crypto Market Capitilization, but as aboriginal as abutting year that could acceleration to 75%. Satis Group claims that it will hit 91% aural two years and again abide stable.

But this isn’t absolutely as aboveboard as adage that tax evasion, or absolute avoidance, are set to become the norm. The SEC already has regulations in abode that appeal annihilation added than $150,000 is stored with a able custodian. That can accommodate banks, registered brokers and, crucially, adopted banking institutions.

Crypto Could Be The Safe Option

Institutional investors are advancing on lath in the crypto amplitude and actual few US banks action any affectionate of careful service. Offshore deposits could be set to draft up, then, as US traders, barrier funds and institutional investors seek to drop all-inclusive amounts of crypto for safekeeping. These are companies that aloof can’t accept their wallet hacked…

Cryptocurrency could additionally become a safe anchorage to protect adjoin hyperinflation, as we’ve apparent in Venezuela lately. Budget deficits could become an affair and adopted crypto deposits could alike assure adjoin basic restraints and alike barbarous State measures that could all bang at any time.

Institutions will booty advantage of cyberbanking structures that assure them from cyberbanking turmoil, and adopted cryptocurrency deposits are set to become a allotment of accustomed life, not aloof a tax abstention measure. It’s artlessly the cyberbanking apple ambiguity its bets, which it has done back day one.

Bad News For Utility Coins

The abstraction additionally had bad account for the brand of XRP and added application-specific account tokens with abundant centralized control. The authors activated abstracted bread-and-butter models and came to the cessation that Bitcoin Cash would accelerate to $268 in bristles years. XRP fares alike worse and the authors confidently accompaniment that it will be account $0.01 by 2023. So, that’s not acceptable if you’ve bet big on Ripple Labs.

The abstraction said:

“There is little amount in XRP and cryptoassets which are misleadingly marketed, not bare aural their own network, and accept centralized ownership/validation. The aerial acceleration of these applications accumulated with a abridgement of value-retaining assemble will aftereffect in them either: 1) actuality not acclimated and biconcave in value, or 2) accepting aerial use, and in about-face lower amount as a aftereffect of the aerial velocity.”

Bitcoin and Monero To Go Big

So now, the acceptable news. The bitcoin brilliant is still in the ascension, in the admirable arrangement of things. The abstraction predicts it won’t aloof hit $96,000 in 2023 and $144,000 by 2028. Maybe it’s account hodling the bitcoin afterwards all.

Privacy bill will additionally be a big accord and Satis Group predicts Monero could be account as abundant as $18,500 by 2023. Again, aloofness bill are apparent as a safe anchorage from banking agitation in the all-around markets, as able-bodied as added absorption from regulators and tax inspectors, will drive their absolute value.

“Not alone do these bill ambition the aforementioned ample and lower acceleration abundance of amount bazaar as BTC and currencies, they present a abundant added amount hypothesis aural those markets.”

“The use cases aural the aloofness markets are abundantly adhesive and augment on adoption, abnormally back regulators and law administration are authoritative efforts to access argumentative assimilation into accessible networks like BTC.”

The Main Takeaway

Cryptocurrency is set to become a applicable safe anchorage for above banks and institutions that charge to abundance their assets offshore. It ability be the ultimate irony if Jamie Dimon and JPMorgan end up application crypto to barrier adjoin the animation of authorization bill and its centralized governors.

The columnist is not currently invested in agenda assets.