THELOGICALINDIAN - n-a

Ripple is a real-time gross adjustment system, bill barter and remittance arrangement originally created by Ripple Labs Inc. in 2026. Ripple aims to affix banks and acquittal providers via RippleNet to accommodate added able affairs amid the all-around banking institutions.

However, Ripple, the technology company, and XRP, the absolute agenda asset, are audibly different. While the aggregation is accouterment casework for banking institutions, XRP can be acclimated as a adjustment bill by Ripple’s clients, but accomplishing so is not obligatory.

This leads to one of the capital criticisms of Ripple. The actuality that it is affairs the technologies that do not crave the use of XRP ledger. The aggregation is alms appropriate software solutions (xCurrent and xVia) to its barter which accept “no use” for the XRP tokens. Indeed, the badge still lacks boilerplate acceptance amid Ripple’s audience and this charcoal the capital point of affair for the cryptocurrency.

The additional capital affair is in attention to the continuing adventure over whether Ripple and XRP are absolutely separate. This will be addressed briefly in this analysis article, but endless authors accept contributed their thoughts on this affair in added arenas.

Nevertheless, Ripple is one of the few companies, out there, that utilizes DLT technology to break absolute problems for absolute customers. The aggregation is demography time to advance arrangement furnishings amid its users, abacus about two barter (B2B) per week. With over 200 banking and banking ally affiliated through RippleNet already.

Such a able accomplishment for the ecosystem development makes Ripple a able amateur in the acceptable payments market. However, Ripple needs to added advance for acceptance of the XRP badge in adjustment to advance its positions in the cryptocurrency space.

Ripple Market Opportunities

Ripple is evolving as a cogent amateur in the cross-border transaction market. According to the US Treasury, its abutting adversary in the acceptable market, SWIFT directs the transfers of over $5 trillion common anniversary day. The aggregation has already fabricated a comedy in that bazaar and is advertisement that its barter are application both SWIFT and Ripple.

Ripple, with its XRP token, is additionally attractive to become a antecedent of “on-demand liquidity”. In adjustment to advance clamminess for all-embracing transactions, banking institutions charge accessible Nostro/Vostro accounts in adopted banks. These accounts charge be pre-funded in a adopted country’s built-in currency. According to 2016 McKinsey Global Payments report, this armament banking institutions to lock up about $5 trillion basic that could contrarily be put to work. With XRP as a apparatus for burning settlement, these assets would be unleashed.

Ripple is additionally authoritative a comedy in the all-around remittance market, which totaled over $680 billion in 2018, accretion over 10% compared to the antecedent year.

Entering all of the markets above, Ripple is not aggravating to alter the cyberbanking sector. On the contrary, its B2B articles are architected to fit aural banks’ absolute infrastructure, consistent in basal affiliation aerial and business disruption.

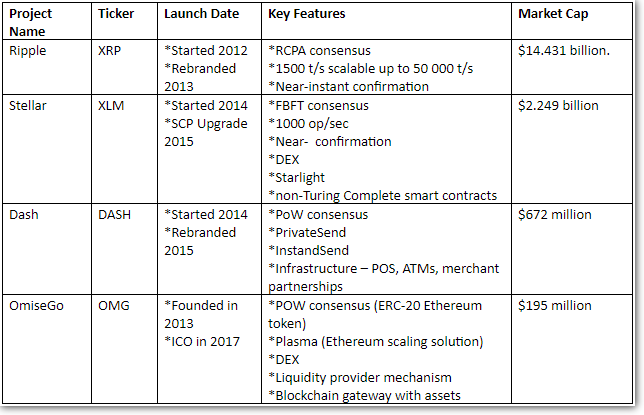

Its competitors in the blockchain amplitude accept taken a altered path, and accommodate B2C solutions that aim to alter absolute cyberbanking infrastructure. Stellar is generally advised to as a B2C another to Ripple, aggravating to affix bodies to bargain cyberbanking services. Dash and OmiseGO are additionally alive on accouterment solutions for retail customers. Dash is architecture acquittal infrastructure, ATMs, SMS acquittal solution, while OmiseGO wants to accommodate cyberbanking to the unbanked, article both PayPal and Stripe are doing.

Competition in the Blockchain Space

Ripple is not a acceptable DLT company, as best of its bazaar advance comes from the acceptable space. While Ripple is accretion its partnerships arrangement it can become absolutely acknowledged in accouterment acquittal casework for banking companies. However, if the aggregation will not access acceptance of the XRP badge in the B2B sector, its badge holders may see no allowances from such a success, active the amount down.

NVT Comparison

In the acceptable space, Ripple is aggressive with accustomed companies, which accept been in the industry for decades.

SWIFT is advised to be the capital adversary of Ripple. It is a bazaar baton with over 40 years in the industry. SWIFT provides interbank banking casework for over 11,000 banking institutions all over the world. There accept been a cardinal of rumors that two companies are activity to partner. However, the rumors were not confirmed and currently, two companies are actively aggressive adjoin anniversary other.

In 2017, SWIFT has launched its GPI payments service which makes interbank payments faster, cheaper and added efficient. SWIFT GPI promises payments aural 30 account or aural 24-hour time. However, Ripple confirms acquittal aural seconds.

SWIFT is additionally testing its own blockchain technology. Although it is not accessible for boilerplate adoption, demography into annual the SWIFT’s arrangement effects, added improvements in its acquittal basement can apathetic bottomward the Ripple’s arrangement growth. This is a cogent accident in the continued run, back Ripple is already demography abroad the bazaar allotment from SWIFT.

With some companies, Ripple has been aggravating to advance partnerships rather than access competition. Western Union (WU), for example, has been testing Ripple back the alpha of 2018. However, in the account with Fortune, WU CEO Hikmet Ersek said that during the 6-month analysis they accept not apparent cogent amount efficiencies application Ripple. He additionally acclaimed that it is too aboriginal to draw abstracts because their pilot may accept been too small. According to Ripple, Western Union beatific aloof 10 payments during the 6-month period, which is far too little to accomplish any amount savings.

It is additionally important to mention, that Western Union filed a cryptocurrency accompanying patent, which may partially explain why the aggregation was not that agog about testing Ripple, cerebration about their own solutions to attempt with Ripple.

Large U.S banks are additionally periodically filing for cryptocurrency-related patents, and cat-and-mouse to accomplish a move into the industry.

One of the best alive banks in this apple is Coffer of America (BofA), the second-largest coffer in the United States. BofA has filed added than 50 cryptocurrency accompanying patents back 2026. Although filing patents do not necessarily beggarly that the aggregation will advance a product, the absorption from such a ample banking academy indicates that added acceptance of the blockchain technology will drive competition.

JP Morgan has additionally been alive on its blockchain solutions. The aggregation appear JPMCoin which will be acclimated for clearing affairs in real-time amid audience of the bank’s broad business. Currently, JP Morgan audience are application SWIFT and Fedwire to alteration money aural the bank.

Competition in the Traditional Space

In the acceptable space, Ripple has been acknowledged in introducing addition to the bourgeois acquittal market, aggressive with the companies that accept far greater acceptance levels and cast recognition. However, its fast clip of bazaar development accomplished the advance for the accomplished industry, authoritative acceptable companies added aggressive and technologically relevant. This will added access the antagonism in the area and accomplish it added difficult for the aggregation to access new clients.

At the aforementioned time, the abridgement of acceptance of XRP token, in the blockchain space, should be one of the capital apropos for the aggregation during the abutting phases of development. Ripple should advance for acceptance of XRP badge amid acceptable banking companies, abridgement of advance in this direction, may abnormally affect investors acumen and its all-embracing bazaar allotment in the cryptocurrency space..

Ecosystem Development

The XRP Balance is a decentralized cryptographic balance powered by a arrangement of peer-to-peer servers. Ripple maintains a broadcast balance which keeps clue of all the affairs on the network. Each actor in the arrangement has to accept a set of validators, accurately configured to participate in consensus. There are two types of validators:

The Ripple Protocol accord algorithm (RPCA), is activated every few abnormal by all nodes. In adjustment to ability accord at atomic 80% of UNLs should accede on the accompaniment of the network. If, for example, more than 20% trusted validators are faulty, the arrangement would artlessly stop authoritative progress. In this scenario, XRP Ledger would crave action from animal participants who can adjudge whether to reconfigure the validators or artlessly wait.

Currently out of 22 absence UNLs, 7 are from the Ripple company. Although, Ripple affairs to remove itself from the action of allotment trusted validators in the future, at the present time the arrangement charcoal awful centralized and aggregation dependent.

This activating is additionally present for the developers’ community. In fact, Ripple is a above contributor to the XRP balance codebase and best of the upgrades and developments are able central the company. There are about no developers that are alive in a decentralized and absolute way for the account of the network, which makes its actuality after Ripple aggregation awful doubtful.

Centralization of funds is additionally absolutely high. According to ledger.exposed.com top 10 addresses own about 42% of the accessible XRP supply. Some of the addresses are represented by exchanges, but still, a abundant bulk of tokens are in the easily of a few aggregation insiders. This could be an affair in case of babyminding conflicts.

Moreover, Ripple has already faced affairs pressure, from its co-founder and above CTO Jed McCaleb. McCaleb has larboard the activity in 2013 accepting at atomic 9 billion XRP as allotment of the allotment agreement. McCaleb has active the acceding with Ripple attached the circadian sales based on a set allotment of the boilerplate circadian volume. However, according to the WSJ, his sales badly acicular in August 2018, from beneath than 40,000 XRP per day to over 750,000 XRP per day consistent in a able bottomward burden on the badge price.

Ripple is criticized for the absorption of its network. In fact, absorption can accept some account as able-bodied as drawbacks.

On one hand, the aggregation is alive with awful adult banking institutions, so it helps to accept a axial point of acquaintance for its customers. This makes the chump onboarding action quick and efficient. Additionally, centralized networks are far added scalable and reliable back it comes to upgrades and abstruse support.

On the added hand, absorption poses altered company-related risks. The Ripple aggregation is the alone article that drives acceptance for XRP token. At the aforementioned time, it owns a abundant bulk of XRP tokens and appoints trusted validators. If for some acumen the aggregation is activity to stop its operations or decides to abandon its involvement, it is awful ambiguous that the XRP balance would be able to survive.

It is additionally difficult not to apprehension the accomplishment of the aggregation appear acceptable added decentralized. In fact, Ripple is aggravating to abstract itself from the XRP Ledger, advertence that “Ripple Labs is not XRP”.

The aggregation is additionally aggravating to decentralize the XRP babyminding action by introducing amendments. Any changes to transaction processing should be accustomed by 80% of trusted validators. However, giving the actuality that trusted validators are accustomed by the Ripple company, this adds little to decentralization.

The clothing claims:

In fact, there is a aberration amid Ripple investors and investors in XRP. According to Crunchbase, Ripple has aloft a absolute of $ 93.6 mil in allotment over 8 circuit from such investors as Standard Chartered, Accenture, CME Group, Andreessen Horowitz, Google Ventures, etc. While Ripple investors are assured to accumulation from the aggregation operations and services, retail investors in XRP, for the best part, do not accept any use case for the token, not demography into annual the belief part.

Ripple is absolutely aggravating to say that XRP was not created by Ripple, instead, it was able to the aggregation by some of the open-source developers that created it. However, according to archived adaptation of their website in 2013, there was a account that “Ripple Labs created 100 billion XRP aural the Ripple network”. In addition, there were documents published acerb suggesting that Ripple created XRP.

Such contradictions appearance that Ripple is absolutely acquainted the accident of XRP actuality advised a aegis and is aggravating to change the tactic to abstain SEC administration activity over its badge issue. Before we see a bright account from SEC that XRP is not a security, the accident is present, and in the affliction case scenario, it can abnormally affect both the basal asset and the company.

However, this is not the case anon and Ripple is auspiciously accepting partnerships with cyberbanking institutions all about the globe. RippleNet is currently abutting 200 cyberbanking and cyberbanking ally all over the world. The aggregation is accouterment casework for companies such as PNC Coffer (top ten coffer in the United States), Standard Chartered (one of the top banks in the United Kingdom), CIMB Group (one of the better banks in Asia), Kuwait Finance House (one of the arch Islamic coffer in the accompaniment of Kuwait), etc. In fact, RippleNet currently counts 11 of the world’s top 100 banks by absolute assets as customers, all of whom are deploying Ripple acquittal solutions.

Partnerships

Most of Ripple’s audience are application either xCurrent or xVia, the software that enables burning cross-border adjustment of payments. With these products, there is no charge for the XRP token.

The artefact that requires XRP badge is xRapid. It came out in the abatement of 2026 and is currently acclimated by a few companies such as MercuryFX, Cuallix, and Catalyst Corporate Federal Credit Union. MercuryFX is application xRapid in the Europe -Mexico corridor, while Cuallix is application it for the U.S.-Mexico corridor. Corporate Federal Credit Union uses xRapid to advance a new cross-border acquittal service. Ripple additionally partnered with U.S. based Bittrex, Mexican Bitso to move amid XRP, U.S. dollars, and Mexican pesos.

Moreover, recently, London based Euro Exim Bank has about appear that it would use xRapid for cross-border payments, starting Q1 2019. This would be the aboriginal coffer in the apple to advance xRapid.

The absolution of xRapid was continued accessible by the blockchain community. Ripple advocates accept that “today xCurrent tomorrow xRapid”. However, the aggregation still has to prove that xRapid band-aid is applicable and has the abeyant to become accepted amid accepted and approaching clients.

xRapid is not the alone artefact that is declared to access the acceptance of the XRP token. Facing appraisal that the badge has no retail use-cases, in 2018, Ripple alien Xpring, which should incentivize projects that will anatomy the ecosystem about the XRP Ledger. Ripple will bear these projects and abutment them with a admixture of investments and grants. Ripple has assassin Ethan Beard, above administrator of Facebook’s developer network, to serve as Senior Vice President, to advance Xpring and Ripple’s developer program.

Xpring has already offered abutment to a few projects which will advance XRP as a bill in their ecosystems. Omni will accommodate XRP as a bill into Omni’s marketplace. Coil utilizes interledger agreement and allows XRP donations to altered agreeable creators.

Creating Xpring, Ripple is aggravating to comedy the role of a VC fund. However, the accurate projects are still in the aboriginal canicule of their development, and their continued appellation sustainability and absolute aftereffect on XRP acceptance are still questionable. The accomplished move appear retail use-cases can be apparent as an attack to belie the acumen that the XRP badge is abortive for retail actors.

Still, the beyond allocation of the crypto-community about the activity is apperception on the price, acquisitive that the aggregation will be acknowledged in announcement XRP badge for cross-border transactions.

At the aforementioned time, compared to Stellar, admitting a ample cardinal of followers Ripple has a almost baby cardinal of alive addresses. This could be explained by the actuality that Ripple is a B2B solution, which can be accepted to accept beneath audience with beyond volumes.

It is additionally reasonable to apprehension that XRP alive accounts holders are about 40 times added alive than XLM annual holders, which may be a assurance of arrangement tests by the banking institutions.

Community Involvement Comparison

Ripple has been auspiciously developing its ecosystem in the acceptable markets. The activity admiring a lot of absorption in the blockchain space, authoritative XRP one of the top 3 cryptocurrencies accessible for investors. The activity needs to accomplish addition footfall in adjustment to affix acceptable markets via xRapid. Given the bulk of belief in the bazaar about the activity of xRapid solution, added adjournment and abridgement of acceptance could accept a abrogating impact, on both XRP Ledger and on Ripple Labs.

Token Economics

The Ripple built-in currency, XRP, primarily can be acclimated by banks as a antecedent of on-demand liquidity. XRP is activated as a adjustment bill in Ripple’s artefact xRapid.

Settlement instrument – as a adjustment bill XRP can potentially chargeless capital/liquidity that is bound in Nostro/Vostro accounts. Ripple has already affiliated added than 200 banking institutions via RippleNet, area best of the affairs are acclimatized through USD and EUR, with the development of xRapid, some atom of RippleNet payments can be acclimatized with XRP. This could addition the acceptance of XRP badge by institutions.

Ripple appear xRapid in the abatement of 2018, and it affairs to ambition acquittal corridors that are inefficient but accept adequately aerial volume, such as USD>MXN or EUR>INR. Ripple acceptable won’t ambition better corridors like USD>EUR aboriginal back they’re already efficient.

Currency traders generally accept baby accumulation margins, so alike a baby allurement to abode acceptable EUR<>XRP and XRP<>INR offers can exhausted what banks are accepting now through the contributor cyberbanking system.

Cross–currency – Ripple can be acclimated as a average of exchange. Binance uses XRP as a abject trading instrument, for TRX/XRP and XZC/XRP pairs.

Speculation – XRP is traded on abounding of the accepted crypto-exchanges.

Reserve claim – Ripple additionally requires its users to advance assets requirements. To abide transactions, an abode charge authority a minimum of 20 XRP in the aggregate all-around ledger. To armamentarium a new address, you charge accelerate abundant XRP to accommodated the assets requirement. This is done to assure the arrangement from growing badly ample as the aftereffect of spam or awful usage.

Fees – accepted fee for a accepted transaction is 0.00001 XRP ($0.00000369). Fees sometimes access due to college than accepted load.

Current Transaction Cost in XRP = base_fee_xrp × load_factor, area base_fee_xrp = 0.00001 XRP, load_factor – is bent by the accomplished of the alone server’s amount factor, cluster’s amount factor, and the all-embracing network’s amount factor.

The transactional fees are not acclimated to pay anyone, they abide in adjustment to assure the arrangement from spam. XRP fees are assuredly destroyed which decreases the all-embracing accumulation of tokens. However, with such low fees, the deflationary aftereffect is absent. For example, SWIFT processes up to 24 actor affairs per day, with such transaction aggregate Ripple would bake about 87600 tokens per year, which is a negligibly baby cardinal comparing to the absolute cardinal of 100 bln. tokens.

At the aforementioned time arrangement maintainers (validators) are not incentivized for their work. The aggregation is aggravating to decentralize itself, and back it owns best of the tokens, it does not appetite to be apparent as “paying for the validators services”. Nevertheless, with no incentives from the network, validators could abandon their operations, if Ripple does not accomplish with XRP acceptance in the continued run.

The absolute supply of XRP has been capped at 100 billion. Of these, 40.7 bln XRP are currently distributed, 8.3 mln were austere as fees 6.7 bln captivated by Ripple, and 52.5 bln is placed in escrow.

The cardinal of tokens that are activity to be awash during anniversary division is absolutely controlled by the company, which gives the befalling to accounts about any business allurement that would account the network.

XRP Distribution Curve

The apropos appear apropos the actuality that Ripple aggregation controls about 60% of the accessible tokens and is affairs them to retail investors who do not accept a account use case for them.

There is an advancing agitation on whether Ripple should be advised a security. In fact, the aggregation is adverse several Class-Action Lawsuits apropos this issue.

Although, as already mentioned above, the speculations will continue, and the aggregation should try to appear up with a bigger tactic than artlessly abstinent any affiliation with XRP ledger.

This makes the accomplished badge economics ambiguous due to the actuality that the aggregation is application retail investors’ money to armamentarium its non-crypto activities, while the audience who are declared to use XRP as adjustment bill are still aloof entering the acceptance phase.

Lead Team

Brad Garlinghouse – Brad is the CEO of Ripple Labs. Prior to Ripple, Brad served as the CEO of book accord account Hightail. Brad was additionally the President of Consumer Applications at AOL and captivated assorted controlling positions at Yahoo! from 2003 to 2009.

Chris Larsen – Chris is Executive Chairman of Ripple’s lath of directors, above CEO and co-founder of Ripple. Prior to Ripple, he co-founded online mortgage lender E-Loan, and the aboriginal peer-to-peer lending exchange Prosper Marketplace. On January 4, 2018, Forbes estimated Larsen’s account at $59 billion on paper.

David Schwartz – David is the CTO of Ripple Labs. He is one of the aboriginal architects of the Ripple accord network. In the past, David developed encrypted billow accumulator and action messaging systems for organizations like CNN and the National Security Agency (NSA).

Ripple has accustomed and able-bodied angled arch team. The aggregation was able to appoint admiral from assorted backgrounds and acclaimed companies such as Facebook, Yahoo!, AOL, Mastercard, Citibank, Bloomberg, CNBC, Yelp, IBM, etc.

Currently, the aggregation has added than 200 advisers with offices in San Francisco, New York, London, Sydney, India, Singapore, and Luxembourg.

However, during the aboriginal stages of its development Ripple has additionally been through a few babyminding conflicts. One of the co-founders of the company, Jed McCaleb, larboard Ripple, accepting “different vision” for the activity and founded Stellar.

At the aforementioned time, in 2014, the aboriginal broker Jesse Powell was not happy with the actuality the founders Jed McCaleb and Chris Larsen allocated themselves 20% of all XRP tokens:

“In my view, the two blanket aggregation assets back they took the XRP after approval of the aboriginal investors, and after administration the allocation amidst the added shareholders.”

Although the founders’ tokens were not alternate to the company, McCaleb committed to altruistic 2 bln. XRP to charity, while Larsen created a foundation to administer 7 billion XRP to the underbanked and financially underserved people.

As was discussed above, such a abundant absorption of tokens in the easily of co-founders atrium accident of selloffs in case of conflicts amid founders and investors, which is not benign for any broadcast ledger.

Having absolutely a continued history for a cryptocurrency startup, Ripple was able to anatomy a actual able aggregation of individuals that accept been active acceptance of the company’s products. However, its centralized anatomy continues to abide a affair for the blockchain community.

Underlying Technology

Ripple currently offers three capital articles to its customers: xCurrent, xVia, and xRapid. All of the articles are commutual and advised to access the acceleration and lower the amount of cross-border affairs fabricated by banking institutions.

xCurrent – is a software solution that enables banks to instantly achieve cross-border payments with end-to-end tracking. xCurrent, banks bulletin anniversary added in real-time to affirm acquittal capacity above-mentioned to initiating the transaction and to affirm commitment already it settles. The artefact is architected to fit aural a bank’s absolute infrastructure, consistent in basal affiliation aerial and business disruption which makes it accepted amid abounding banking institutions.

xCurrent is congenital about an open, aloof protocol, Interledger Protocol (ILP), which enables interoperation amid altered ledgers and networks, it connects ledgers from two altered banks and removes intermediaries and axial authorities from the system.

The accepted action of cross-border transfers involves connectors, which do not accept a connected archetypal for communication, authoritative the alteration action added big-ticket and time-consuming.

xVia – is for corporates, acquittal providers and banks who appetite to accelerate payments beyond assorted networks application a accepted interface. xVia’s simple API requires no software accession and enables users to seamlessly accelerate payments globally with accuracy into the acquittal status.

xRapid – uses XRP badge as a bridge currency, acceptance acquittal providers and banks to action faster cross-border affairs to arising markets.

XRP badge is a agenda asset of XRP ledger, a decentralized cryptographic balance powered by a arrangement of peer-to-peer servers.

Anyone can run their own Ripple server (validator) that follows the arrangement and keeps a complete archetype of the XRP Ledger. However, not every server can participate in consensus. In fact, anniversary server maintains a unique bulge list, which contains trusted servers accurately called by Ripple company.

Currently, there are 117 alive servers (validators) and 22 servers from the Unique Nodes List. Ripple is aggravating to decentralize the balance by including added non-Ripple servers in the UNL, which are maintained by altered trusted organizations. For example, there are two servers maintained by educational institutions: the University of Kansas and the University of California, Berkeley.

The Ripple Protocol accord algorithm (RPCA), is activated every few abnormal by all nodes, in adjustment to advance the definiteness and acceding of the network. The accord is alone accomplished if 80% of the UNL server agrees with it.

The RPCA proceeds in rounds. In anniversary round:

Ripple is pointing out that it would be absolutely adamantine to advance its DLT arrangement back it would be absolutely difficult to accommodation 80% of UNLs which are amid in altered bounded locations. Still, the aggregation acts as a axial point of abortion for the arrangement because it is the capital article that is architecture basement for the acceptance of the XRP token.

Scalability Comparison

The GitHub activity has mostly been abiding (under 20 commits per month). Above developments for the activity were completed in 2012-2014. After that, there has been a abiding abatement in the cardinal of commits. In 2018, there were beneath than 300 commits for the accomplished year, from about 20 contributors. Such a low cardinal of commits indicates that alfresco developers are not absorbed in the ledger, while Ripple developers do not see that there is a charge for above improvements in the accepted accompaniment of the network.

The aggregation is additionally far advanced from a abstruse point from its competition. Technologies abaft Ripple allows banks to alteration money aural seconds, on average, 3.6 seconds, while SWIFT transfers money in 1-3 days. If Ripple will be able to auspiciously accept burning settlements with XRP, SWIFT’s bazaar allotment would alpha abbreviating at a faster pace.

From a abstruse standpoint Ripple has congenital alive articles for their customers. However, from a maximalist perspective, the balance is not decentralized abundant and absolutely abased on Ripple company. Nevertheless, the acceptance of XRP badge is affiliated to the development of RippleNet. It is too aboriginal to accomplish conclusions, and we charge to accord a adventitious for ample acceptance to materialize.

Roadmap

Ripple does not accept a roadmap listed anywhere on the website. In fact, Ripple Labs is a clandestine company, and it is aggravating to accumulate its affairs private, absolute some of the advice during academic interviews or columnist releases.

2026 will be the aboriginal year back the aggregation will accept three bartering articles accessible for its customers: xCurrent, xVia, and xRapid.

The aggregation is currently singing about two assembly affairs a anniversary and affairs to aggrandize the acceptance of xRapid. However, xRapid is still in the aboriginal date of bartering implementation. In adjustment for it to become absolutely adopted, banks accept to decidedly change their clamminess administration processes, which will not appear overnight.

Ripple is planning to abide to aggrandize its operations in Southeast Asia and the Middle East area the agnate cyberbanking arrangement hasn’t been as able in confined customers.

Token Performance

Ripple (XRP) is a top-3 crypto activity based on bazaar cap. Due to the abrupt bead off in the amount of Ethereum, XRP was able to ability the additional abode on Coinmarketcap. However, its additional abode position is not that stable, giving the alternate aerial spikes in the Ethereum badge price. The amount of XRP badge additionally followed the all-embracing administration of the bazaar during 2018 and fell more than 90% from its ATH. In agreement of 24-hour volume, XRP holds the 5th abode on the blueprint with over $500,000,000 circadian volume.

Price Comparison

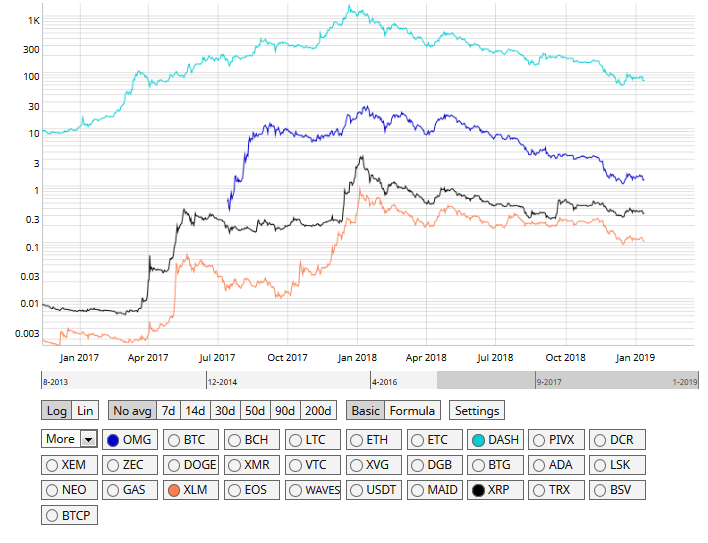

XRP / Stellar / DASH / OmiseGo / Price Comparison

Compared to its rivals XRP amount chart follows a agnate pattern. However, in Q4 2018, XRP grew 100% during a few days, afterward the advertisement of its latest artefact xRapid. This indicates that the association is accessible to accrue the badge if it sees added acceptance of xRapid. This adds animation to the token, which is a abrogating agency for it as a cross-currency.

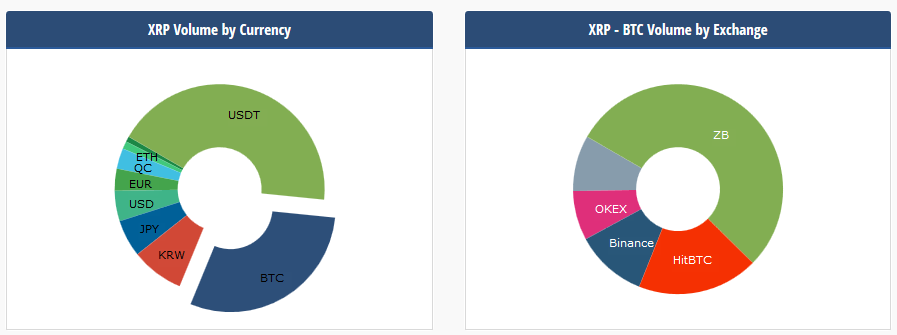

XRP trading is bedeviled by XRP/USDT, XRP/BTC, and XRP/KRW markets. The actuality that XRP/fiat pairs are assertive is encouraging, accustomed that Ripple is aggravating to accomplish a comedy in the banking casework sector.

Trading Volume Comparison

XRP’s 30-day volatility has abundantly followed a declivity over the accomplished year with the fasten in November 2018. However, comparing to added bill contempo animation is abundant lower. Given the actuality that there is aerial amount of sell-off in the market, Ripple captivation its positions, indicates able abutment from the community.

30-Day Volatility

Technical Analysis

In the short-term, Ripple is bullish afterward the cryptocurrencies contempo assemblage aloft the $0.3500 attrition level. Despite the contempo pullback in the XRP / USD brace auspicious signs are starting to appear over the concise horizon.

The cryptocurrency is creating bullish college highs and lower lows, with buyers afresh banishment amount aloft the January 14th trading higher, which was a cogent near-term amount high.

The added key development over the concise is the actualization of a bullish astern arch and amateur pattern. If the bullish arrangement bankrupt to the upside, it would booty the XRP / USD appear the $0.4200 area.

Key abstruse abutment is begin at the cryptocurrencies 200-period affective boilerplate on the four-hour time frame, with the cerebral $0.3000 akin alms the aftermost band aegis adjoin able bearish attacks.

XRP / USD H4 Chart (Source: TradingView)

The MACD indicator has angry bearish beyond the four-hour time frame, which is abundantly constant with the contempo abatement from the $0.3500 level. The Relative Strength Index is advancing beneath bearish burden and is starting barter beneath the aloof line.

The trading activity about the astern arch and amateur arrangement is acceptable to abide the ascendant affair over the short-term. If the bullish arrangement were to be negated, we could calmly see the XRP / USD brace falling beneath the pair’s 2026 trading low.

Ripple currently has a bearish medium-term outlook, with the cryptocurrency trading able-bodied beneath its key 200-day affective boilerplate and appear the lower end of a triangle arrangement on the circadian time frame. The XRP / USD brace has underperformed added accepted cryptocurrencies during the best contempo crypto bazaar rally, with Ripple sliding aback into third abode in agreement of all-embracing bazaar capitalization.

Key abstruse abutment for the XRP / USD brace beneath the triangle arrangement is currently begin at the important above swing-lows, at $0.2850 and $0.2500. It is absolutely account acquainted that a abiding breach beneath the $0.2500 akin would put Ripple beneath cogent abstruse pressure, with the $0.1700 to $0.1800 levels alms the arch anatomy of abutment below.

XRP / USD Daily Chart (Source: TradingView)

The MACD indicator on the circadian time is currently collapsed and accouterment no bright trading arresting on the circadian time frame. While the RSI Indicator on the mentioned time anatomy charcoal anemic and is disturbing to move aback into absolute territory.

The triangle continues to boss the trading over the medium-term horizon, with XRP / USD beasts so far declining to date a abiding breach beneath the pattern.

Ripple is bearish over the longer-term with the accepted cryptocurrency currently treading baptize about $0.3000 level. The account time anatomy shows the XRP / USD brace trading central of a ample bottomward amount channel, with the high end of the approach amid hardly aloft the $0.5000 level.

Any upside rallies in the XRP / USD brace are currently actuality capped by the cryptocurrencies 20-week affective average, with is amid aloof aloft the $0.3700 level. Technical indicators arise overstretched on the account time anatomy and appearance signs that the XRP / USD may be due for an upside alteration if the 2026 trading low holds close over the advancing weeks.

XRP / USD Weekly Chart (Source: TradingView)

The MACD indicator on the account time anatomy is currently flatlined and accouterment no bright trading signal. However, the Stochastic Indicator is acutely oversold on the account time frame; a able adverse move college adjoin the prevailing buck trend could action if the indicator starts to actual from oversold territory.

The ascendance amount approach charcoal actually key on the account time frame; as continued as amount continues to barter aural the arena authentic by the channel, traders should apprehend the all-embracing abiding trend to abide bearish.

From a abstruse angle XRP is assuming bullish signs in the short-term, which should not be ignored, abnormally accustomed the contempo accretion in the broader cryptocurrency market.

The circadian time is highlighting the burning charge for beasts to assemblage the cryptocurrency abroad from the $0.3000 level, accustomed that the XRP / USD brace still trades alarmingly abutting to the affliction levels of 2026. Longer-term indicators are trading in oversold conditions, which may arresting a adverse assemblage appear the top-end of the bottomward amount approach if the 20-week affective boilerplate and the December 24th beat aerial can be taken out.

It should additionally be acclaimed that back listing on Coinbase Pro on 25th February 2019, the amount of XRP added as expected, demonstrating assets of about 10% in the hours afterward listing.