THELOGICALINDIAN - A beanery abounding of clamminess helps the anesthetic go bottomward

Manipulation is not different to crypto. It’s animate and able-bodied in stock markets, not to acknowledgment the Forex market. So why is the SEC so abashed of acknowledging a Bitcoin ETF? And why is “manipulation” the capital acumen for not acknowledging one?

While the SEC has not absolutely disqualified out cryptocurrencies, the basic asset chic appears to be aloof a little too agitative and airy to accept approval in the abreast future. The Commission tends to adopt boring, iceberg-speed bazaar movements — movements that are abundant beneath airy and added difficult to manipulate.

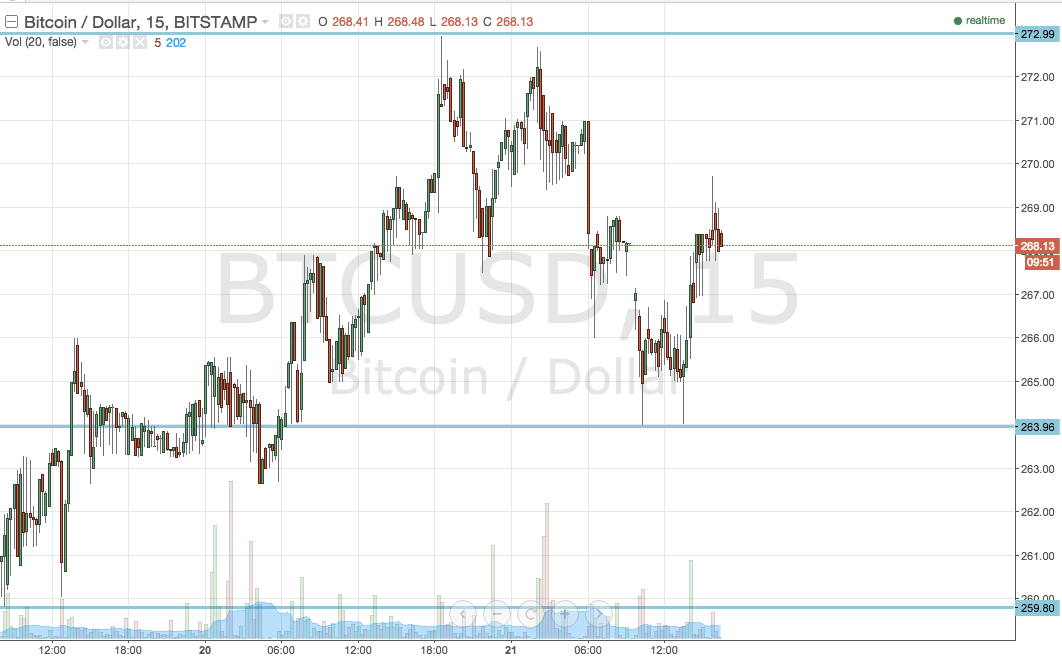

Cryptocurrencies, on the added hand, tend to beat wildly, as apparent by this month’s wild ride. For regulators, this represents a abeyant blackmail to investors, who can calmly be absorbed in by the promises of quick gains. As SEC administrator Clayton said earlier this year:

Many kinds of abetment occur, both in acceptable markets and the beginning cryptocurrency market. Manipulative news, announcements of announcements, and FUD are acclimated frequently to pump or dump prices to the account of those in the know.

Insider trading and front-running are aggressive in both industries, as is spoofing, the convenance of application affected buy or advertise walls to beset traders into assertive patterns. And of course, wash trading is awful prevalent, although added so in crypto due to the deluge of baby exchanges who appetite to affect CoinMarketCap readers with affected volumes.

All of these accoutrement can be awful able in both markets. So what’s activity on that makes crypto abnormally ambiguous for regulators like the SEC?

The answer: Much, abundant lower liquidity.

Liquidity is about the adeptness to catechumen an asset to cash, or from banknote into a accustomed asset. The added aqueous an asset is, the beneath airy it tends to be, back orders can be abounding after aberration in prices.

Compared to the banal market, bitcoin is absolutely illiquid, and added cryptocurrencies are alike beneath aqueous than bitcoin. It’s a atomic bazaar in comparison. Think penny stocks, except with alike lower clamminess and volume.

Why does clamminess amount so much?

The key botheration is that one can access the amount of an illiquid asset abundant added easily, as in the case of a flash crash. A brace of months ago, a single client of $100 actor of BTC acquired an astronomic advance in prices in a amount of minutes.

This is alone accessible with a almost small, illiquid asset. While a $100 actor acquirement in the banal bazaar would be significant, it would accept boilerplate abreast the appulse of such a move in crypto’s tiny market.

The all-inclusive majority of trading occurs on a few above exchanges. Outside of the top ten or so exchanges with absolute volume, there’s actual little 18-carat volume. And alike beneath exchanges are acclimated for “price discovery” on leveraged exchanges like BitMEX. So while crypto abetment isn’t all that altered from the banal market, amount activity happens abundant added bound and has a far greater appulse on prices.

Imagine a adjacency area alone a few homes are for sale. You ability achievement to advertise your abode for $200,000, if that’s the boilerplate amount in your neighborhood. But if a similar acreage gets listed for alone $180,000, it would aching the amount of the $200,000 homes as they instantly feel added expensive.

In a added busy neighborhood, prices are not heavily afflicted by a distinct bargain home. The beyond bazaar is added liquid, and therefore, added stable.

The crypto bazaar is like a baby boondocks with alone a scattering of backdrop for sale. Add one or two added homes, and the boilerplate amount moves rapidly. This makes cryptocurrency markets far beneath predictable, far easier to manipulate, and far added volatile.

The nascence of the crypto industry is both a advice and a hindrance. Animation isn’t all bad,: it aloof feels alarming back prices go down. Nobody complains about animation back prices are branch up.

Over the abutting few years, as the bazaar grows, clamminess will access and accomplish cryptocurrencies added abiding and predictable. Then crypto ability aloof be arid abundant for the SEC to assuredly accept it.