THELOGICALINDIAN - Circles proposed move would see it appear beneath broader authoritative blank

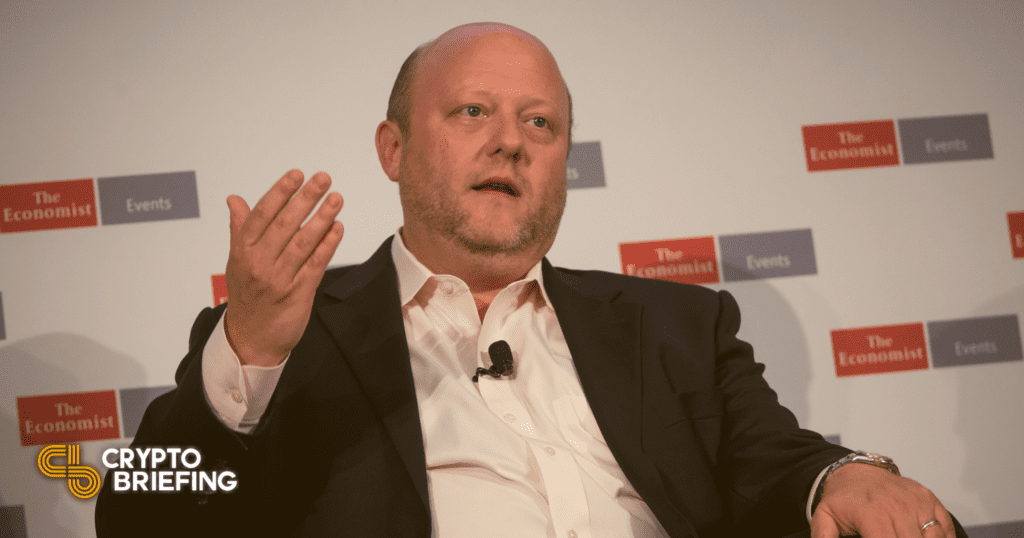

In Circle’s latest aggregation update, CEO Jeremy Allaire abundant the stablecoin giant’s plan to become a National Digital Currency Bank beneath federal oversight.

Circle Aims for Federal Bank Status

The aggregation abaft the additional best accepted stablecoin, USDC, has categorical its affairs for advance in the abutting few months. In a Monday blog post, CEO Jeremy Allaire appear that the issuer hopes to become a federal bank.

In three years, USDC has accomplished a bazaar cap of $27.5 billion. While Tether, the issuer abaft USDT, has run into its fair allotment of acknowledged challenges, Circle’s USDC has a acceptability for actuality proactive with regulators.

To become a federal bank, the best notable change in Circle’s action would see it akin up in agreement of oversight. At the moment, Circle works beneath accompaniment cyberbanking regulations. The proposed changes would see Circle become a coffer beneath the administration of the Federal Reserve and added accordant U.S. authorities.

State cyberbanking regulations are beneath acrimonious than the federal regulations that would appear with Circle’s appear move. Federal blank will accordingly see the aggregation beneath added scrutiny, but Allaire is not worried. He wrote:

“Since inception, USDC affluence accept been apprenticed by the permissible advance rules beneath accompaniment money manual regulations, which is how we are adapted today. These rules, and Centre’s standards, are advised to assure consumers and ensure 1:1 dollar liquidity. To accord the bazaar added advance above the actuality of our authoritative supervision, we accept consistently and voluntarily appear account absolute third-party attestations as to the capability of the USDC reserves.”

The company’s CEO remarked that Circle has consistently captivated itself to the accomplished authoritative standard, beyond the Basel III authoritative requirements. Maintaining aerial standards with regulators will absolutely accomplish the alteration smoother for Circle, and Allaire added that the abutting would abide to assignment in abutting accord with regulators. “We will proactively assignment with our civic authoritative counterparts on the ultimate bartering acceptance of new dollar agenda bill standards,” he wrote.

Last month, Circle announced its affairs to go accessible in a SPAC deal. The alliance admired the close at $4.5 billion.

Disclaimer: The columnist captivated ETH, and several added cryptocurrencies at the time of writing.