THELOGICALINDIAN - n-a

Jed McCaleb ability not attending like your boilerplate supervillain, but a new absolution puts him able-bodied on its way appear all-around domination. StellarX, the congenital decentralized barter for the Stellar protocol, afresh appear its abounding launch, putting the lumens badge several accomplish afterpiece to acquisition the world—of agenda currencies, that is.

The absolution was appear in a blog post, abundantly blue-blooded “How StellarX will booty over the world.”

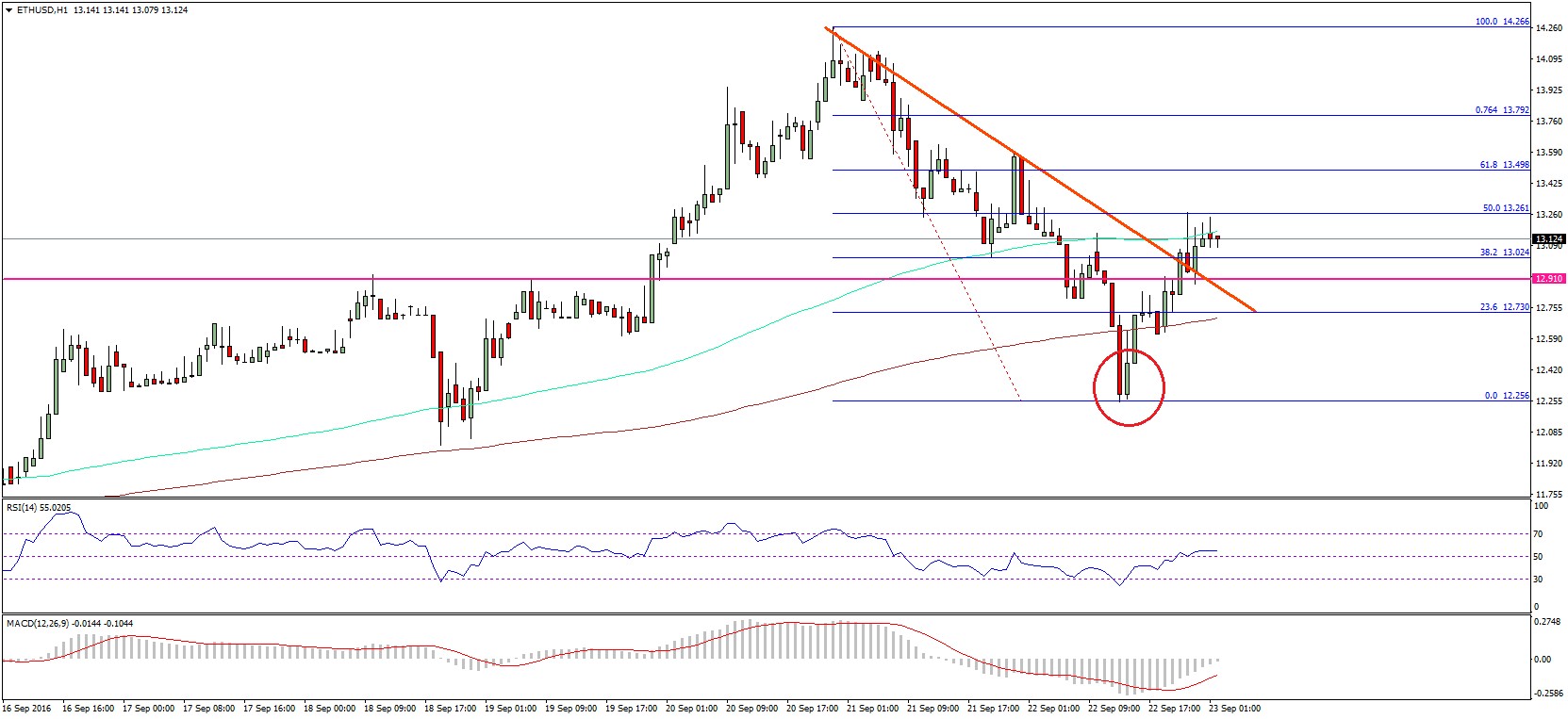

“We’re absolutely accession StellarX to be the best accepted abode to barter in the world,” Stellar wrote in the blog column afore advertisement the exchange’s advantages over Ethereum’s decentralized exchanges. These accommodate no-fee trading, alternative KYC, and best importantly—fiat trades.

In what the Foundation alleged “a aboriginal for a decentralized platform,” the StellarX barter allows users to anon armamentarium the app with dollar, through ACH transactions. The app additionally includes tokens for Euros, Yuan, Pounds, and several added authorization currencies.

Traders can additionally barter added agenda assets, through tokens apery Bitcoin, Ethereum, and tokens from added blockchains, which are accepted to “far exceed” the assets on added DEXes. Security tokens—like stocks, bonds, acreage titles and equities, will additionally acquisition homes on the barter as it develops its infrastructure.

“The “X” in StellarX ability assume like a nod to “exchange”, but we see it as the algebraic x. Anything. Anyone. Anywhere. That’s the belvedere we’ve got.”

Adios, KYC

Another affection is acceptable to affect Stellar traders, abnormally those who accept spent too abundant time assuming for selfies with their passports. Instead of acute anniversary new banker to abide a new KYC—a tedious process that adds an unnecessarily-high access barrier—StellarX makes identification optional. Traders can crave can crave their correspondents to analyze themselves, as may be accurately appropriate for banks or aegis tokens. Other traders may be able to escape that altercation altogether.

The alone affair you charge to alpha trading is an email address.

The Foundation explains:

“We get that KYC is a affair in the world. We additionally accept that acute affairs are the amiss abode to coffin axiological information. We acquiesce issuers—if they so require—to appoint KYC requirements before a being can barter their token. And we accord holders human-readable advice about what they own, so they can accomplish decisions for themselves.”

Bye Bye, Fees

That’s already a big advance over Ethereum-based DEXes like IDEX and TokenJar. Even no-fee exchanges, like TokenJar, crave users to pay gas fees to alteration tokens—and those fees can run absolutely high, depending on cardinal of crypto backing trades.

StellarX claims to be the aboriginal absolutely chargeless exchange, not alone by eliminating trading fees but additionally by refunding transaction fees. While added blockchains , “Trades and orders are built-in to Stellar,” the blog column explains. “And Stellar’s consensus mechanism requires neither “work” nor “stake” — that is, it doesn’t use your capital to function.”

A continued account of added appearance are additionally in the pipelines, from a adaptable app to automated tax adding and portfolio summaries. While it may not assume like the best absolute avenue to all-around domination, it may able-bodied be the best convenient one.

The columnist holds investments in Stellar, Bitcoin and Ethereum.