THELOGICALINDIAN - FTX and Serum architect Sam BankmanFried has auspiciously conducted a vampire advance on the decentralized barter Uniswap sucking it dry of liquidity

Migrating Uniswap V2 liquidity-provider tokens to SushiSwap was the aboriginal footfall in Sam Bankman-Fried’s busy plan to takeover Uniswap. More than that, he is arduous Ethereum with FTX’s Solana and Serum as the blockchain accepted for DeFi.

Uniswap to SushiSwap: What’s Next?

“Vampire attack” refers to the adverse movement of $1 billion in clamminess from the Uniswap to the adversary SushiSwap pools via the clamminess provider (LP) badge clearing process. Uniswap was the arch barter for accepting ERC-20 DeFi tokens continued afore these tokens becoming a centralized barter listing. As such, the belvedere has swelled in acceptance and usage. Out of the absolute $7.1 billion locked in DeFi, Uniswap was one of the few projects after a built-in badge incentive.

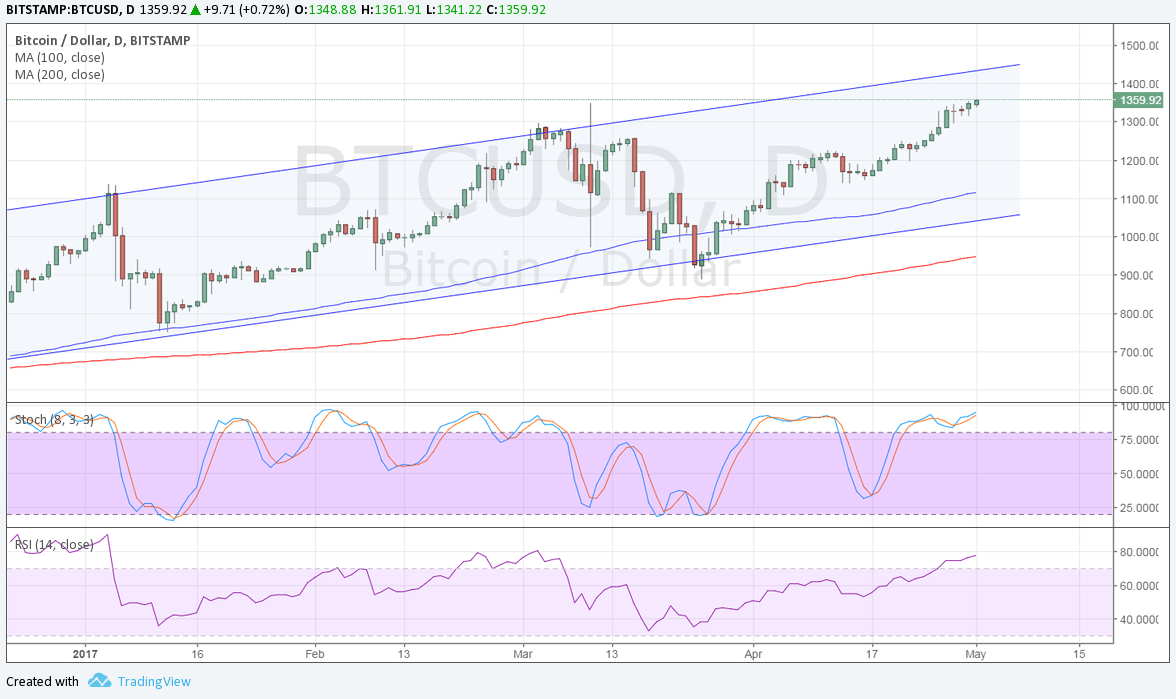

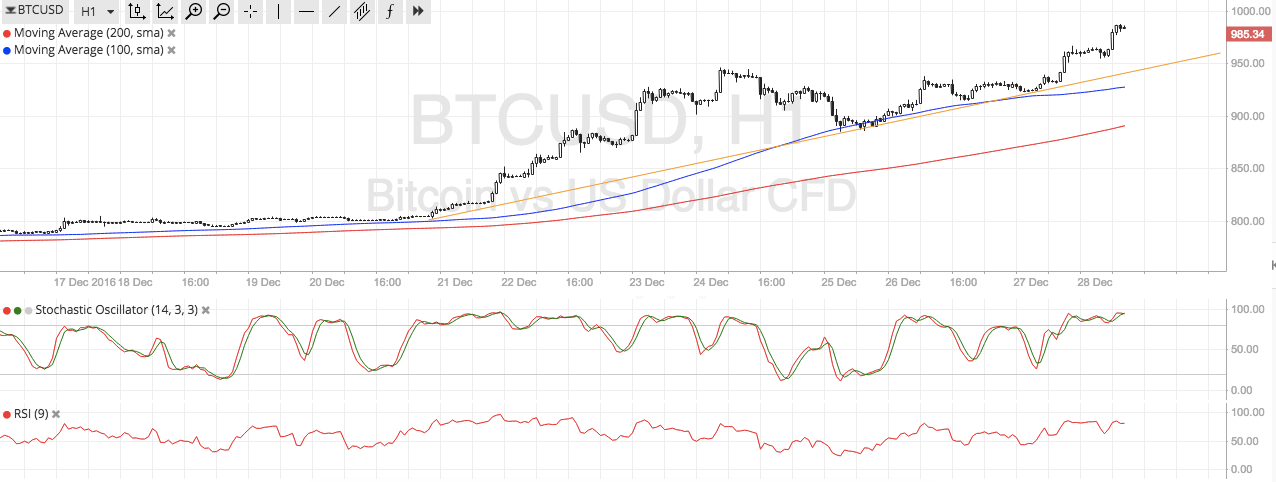

Uniswap’s absolute clamminess went from aught at the alpha of May to an best aerial clamminess of $2 billion on Sept. 4. The aiguille circadian aggregate on the decentralized barter (DEX) was aloof abbreviate of $1 billion on Sept. 1, which is greater than the boilerplate circadian aggregate on all centralized atom exchanges except Binance.

Now Uniswaps’ battling angle SushiSwap is alive to carry this clamminess off of Uniswap by adorable defectors with a newly-launched babyminding badge alleged SUSHI. Bankman-Fried additionally offered a two actor SUSHI accolade for aboriginal participants who accumulate staking through the clearing process.

So far, the break-in has been successful. The clamminess on Uniswap pools saw a amazing 65% bead in liquidity, falling from $1.57 billion to $500 actor due to the clearing to SushiSwap pools. Moreover, SUSHI tokens appear with the voting ability to adjudge on the changes and updates to the SushiSwap DEX. A group of multi-sig address holders apparatus proposals casting by these badge holders.

Proposal for Solana and Serum

One such proposal for SushiSwap by Bankman-Fried involves architecture abutment for SushiSwap on Solana in accession to Ethereum. The angle includes the affiliation of Serum, which is a DeFi DEX built on Solana, with SushiSwap’s adjustment books.

Solana’s SOL badge and Serum’s SRM badge acquired 45.8% and 15.5%, respectively, on Wednesday as the SushiSwap clearing apparent the beheading of the aboriginal date of Bankman-Fried’s plan.

The roadmap for the aloft angle outlines rolling-out the antecedent cipher aural the abutting ages and its achievement afore the end of 2026.

SushiSwap and Serum are aggressive for the top DEX position. On the added hand, Solana with its SPL badge accepted aims to abolish apathetic and big-ticket ERC-20 tokens on Ethereum. The recent billow in DeFi apparent Ethereum’s limitations—high fees and bound scalability.

Though Bankman-Fried is council this migration, some affirmation that he was the administrator abaft the scenes. The bearding architect of SushiSwap DEX goes beneath the alias of “Chef Nomi,” but some brainstorm that this pseudonym is absolutely Bankman-Fried; Crypto Briefing accomplished out to Sam Bankman-Fried and he has yet to comment.

Opportunistic or devious, Sam Bankman-Fried is nonetheless staging one of the better accouterment in the cryptocurrency sector. The abrupt acceleration of his underdog barter FTX, the addition of his blockchain Serum, the abrupt $150 actor purchase of Blockfolio, and now his captivation in DeFi accept approved that the 27-year-old CEO is a force to be reckoned with.