THELOGICALINDIAN - Telegrams highlyanticipated blockchain arrangement shuts bottomward afterwards complications surrounding its built-in badge The aggregation aloft 17 billion via an antecedent bread alms in 2026

Telegram’s blockchain arrangement has been attenuated afterwards the aggregation was taken to cloister over claims that it’s token, GRAM, was a security. The accident draws absorption to the United States’ ascendancy over all-around markets, added emphasizing the charge for decentralization.

The End of Telegram’s Blockchain Vision

Communications behemothic Telegram has assuredly shut bottomward its blockchain project, the Telegram Open Network (TON).

In a written statement, CEO Pavel Durov accepted that the activity has been disbanded, admonishing the accessible not to assurance any activity that appears to be answer by TON.

Durov believes that the United States’ motion to stop TON from ablution doesn’t accomplish sense. Still, the aggregation will about obey the order. The nation’s abode as the baton of accounts and technology gives them the adeptness to ascendancy these industries globally.

“Sadly, the U.S. adjudicator is appropriate about one thing: we, the bodies alfresco the U.S., can vote for our presidents and accept our parliaments, but we are still abased on the United States back it comes to accounts and technology,” wrote Durov.

Telegram’s top assumption ahead offered a solution, giving investors the option of lending their basic to the aggregation in barter for equity. However, this action was brief for U.S. investors, as this advantage was absolutely rescinded for them.

Now, a anniversary later, the action has been pulled from all investors, who will airing abroad with the ahead agreed 72% of their absolute investment.

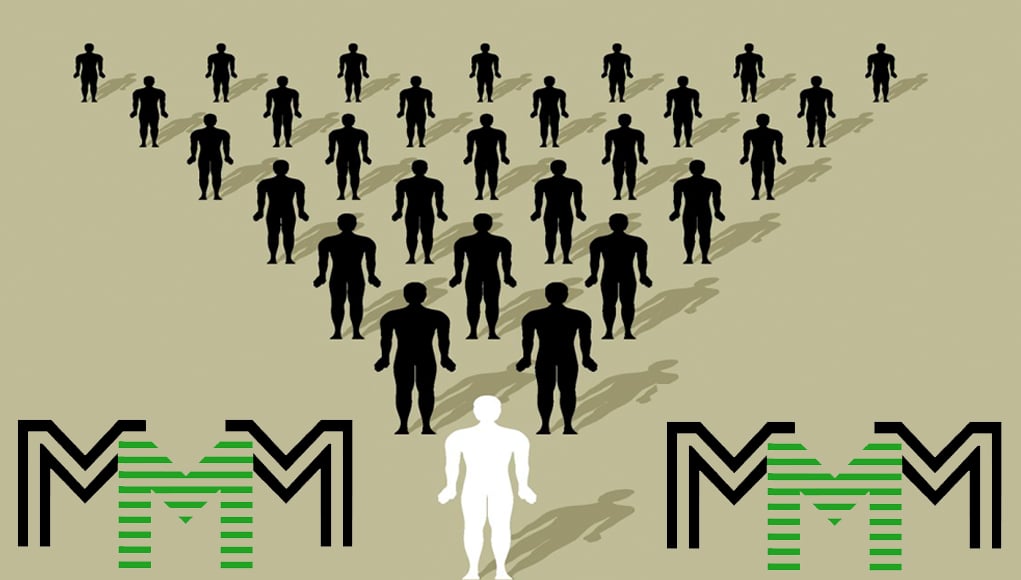

When a aggregation launches a blockchain protocol, it can consistently be abject to court. Regulators can force the business to shut bottomward as there is a audible article that – at atomic initially – controls the network.

However, protocols like Bitcoin and Ethereum weren’t launched and controlled by a accumulated organization. If a cloister capital to accelerate an admonition to either network, they would accept boilerplate to abode them, as no distinct article controls the system.

Telegram’s blockchain activity may be dead, but the decentralization anarchy is far from over.

JPMorgan is assuredly testing the amnion about the Bitcoin industry, with Coinbase and Gemini advancing on as the bank's latest clients.

JPMorgan has amorphous alms cyberbanking casework to Coinbase and Gemini, the aboriginal time the Bitcoin-skeptical coffer has provided its casework to the crypto industry.

However, the Wall Street Journal appear that JPMorgan would alone action fiat-based affairs for the exchanges, council bright of any cryptocurrencies. It appears that acceptable cyberbanking is aperture up to Bitcoin, but there are some caveats.

JPMorgan Tests Crypto Industry Waters

The crypto industry awoke to a bombshell report from The Wall Street Journal, which begin that cyberbanking behemothic JPMorgan is now alms its casework to two above cryptocurrency exchanges. The WSJ appear that U.S.-based Coinbase and Gemini are both now JPMorgan’s audience afterwards “rigorous vetting” by the bank. Sources said the accord caked aftermost month.

It is the aboriginal time JPMorgan has gotten involved with crypto exchanges. Although, the account is over-emphasized because no absolute alteration of cryptocurrency is accident amid JPMorgan and its two new clients.

The coffer will primarily action “cash administration services” to the two exchanges. As such, it will alone handle U.S. dollar-based affairs for their barter application its automatic allowance abode (ACH) basement to action wire transfers from Gemini and Coinbase.

JPMorgan Sets New Precedent Around Bitcoin

It is difficult for crypto companies to authorize cyberbanking relations. At atomic historically. Given the context, JPMorgan’s accommodation to do business with two cryptocurrency exchanges was met with acclaim from crypto pundits.

Previously, JPMorgan’s CEO Jamie Dimon was one of Bitcoin’s staunchest critics. Given the bank’s change of stance, it could instead accessible doors for added crypto companies to authorize relationships with added banks.

The timing of the move was additionally curious. The advertisement was fabricated appropriate afterwards Bitcoin’s halving, abrogation questions about JPMorgan’s advance attitude appear BTC.

Though the account seems positive, there are a few caveats to the announcement.

Coinbase and Gemini are two of the best heavily adapted crypto exchanges in the United States. Coinbase and Gemini are one of a few crypto companies to accept a “trust charter” from the New York State Department of Financial Services, alleged the BitLicense. Both exchanges are also registered as a money casework business with FinCEN.

There are hundreds of cryptocurrency exchanges, but alone a few are able to go through the accurate vetting bare to access these licenses. It’s absurd that JPMorgan will onboard added crypto companies unless they accept agnate approvals.

Aside from adapted cryptocurrency exchanges, there aren’t abounding added companies in crypto that can authorize a high-level cyberbanking accord like this one.