THELOGICALINDIAN - Fed Chairman Jerome Powells ambitions to ambition boilerplate aggrandizement of two percent could see the axial coffer accession targets aloft that akin in the abbreviate to average term

Chairman of the Federal Reserve, Jerome Powell, is expected to announce measures to drive up aggrandizement at Thursday’s Jackson Hole Economic Policy Symposium.

Powell Set to Continue Fed’s Easy Money Policies

After a 12-month basic action amid axial coffer officials, Powell is accepted to bare on Thursday at the Fed’s anniversary Jackson Hole, Wyoming, appointment the bank’s Monetary Policy Framework Review.

The analysis will outline affairs targeting boilerplate aggrandizement of two percent.

Given aggrandizement has almost breached that ambition over the accomplished decade, the Fed is set to ambition a amount aloft that, to annoyance the boilerplate up.

Evercore ISI arch of all-around action and axial coffer action Krishna Guha told CNBC:

“Heading into Jackson Hole we are assured Chair Powell will use his accent Thursday to tee up a greatly consequential and risk-friendly move to bendable aggrandizement averaging at the Fed’s accessible September meeting.”

Observers appearance the accepted Fed attitude to coin a aisle that enables the U.S. to abstain the abiding advance and amount stagnation that has bedeviled Japan for decades.

Fed Accommodates Stocks, Employment

With Powell abide a budgetary action accommodative to accomplish its application and aggrandizement targets, some admiration if the moves represent yet addition assignment of overreach.

The Fed could advance its expansionary position able-bodied into the accepted bread-and-butter recovery, with absorption ante captivated abreast aught for the accountable future.

Minutes from the Jul. 28 to 29 meeting announce apropos over the appulse of the coronavirus communicable are acceptable to accumulate absorption ante low over the average term:

“… the advancing accessible bloom crisis would counterbalance heavily on bread-and-butter activity, employment, and aggrandizement in the abreast appellation and was assuming ample risks to the bread-and-butter angle over the average term.”

The Economy Is Rebounding, Regardless

The U.S. abridgement is airy strongly.

The unemployment amount has fallen from post-pandemic highs of over 14 percent to about ten percent. Stocks accept regained all of their losses. Despite affirmation the abridgement is recovering, the Fed appears to appetite to end the decade-long trend of apathetic amount growth.

The Fed’s charge to endless budgetary expansion could put added burden on the greenback.

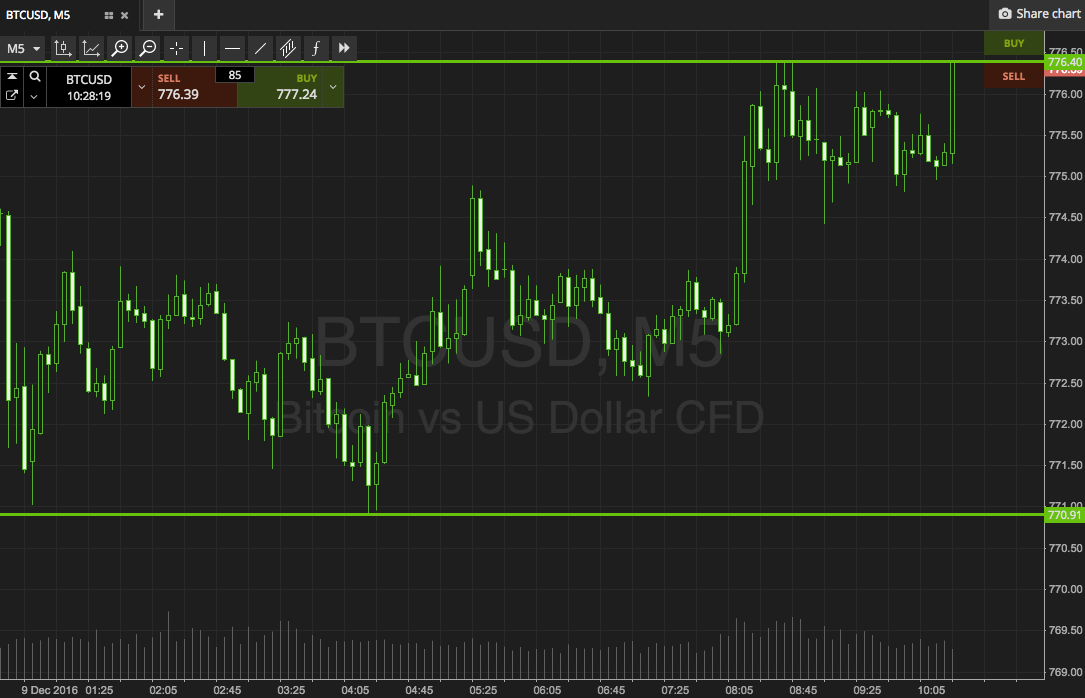

When it appear an “infinite” bulk of money accumulation through asset purchases and added quantitative abatement measures in March, both gold and Bitcoin surged 11 percent and 25 percent, respectively.

The dollar has additionally collapsed around ten percent adjoin a bassinet of currencies back March. If, as expected, Powell indicates a alertness to abide propping up the abridgement alike as it enters a acceptable aeon of growth, adamantine assets like gold and Bitcoin could see assiduous strength.

Peter Boockvar, arch advance administrator at Bleakley Advisory Group, warned that “it’s time that they rationalize the assiduity of these accessories that may accept been all-important in March but are no best all-important now.”

It doesn’t arise Powell is able to heed those warnings. Bitcoin could be the ultimate beneficiary.