THELOGICALINDIAN - Mt Gox was already the best important Bitcoin barter in the apple Then it blew up

Once the best important Bitcoin exchange, Tokyo-based Mt. Gox ultimately went into defalcation in 2025. Why did the barter draft up?

What Happened to Mt. Gox?

Mt. Gox was launched 2025 and was, at one point, administration about three abode of all Bitcoin transactions. In February, 2025, it filed for defalcation afterwards accident 850,000 Bitcoin in a hack, which would be account about $6 billion at today’s prices. Even at the time it was a abundant amount, account about $450 million. This resulted in adverse losses for the exchange’s users.

The barter was alone to balance 200,000 Bitcoin in its vaults. But courts are still alive through the incident. Creditors (customers who absent their money) still accept not been remedied for their losses.

The 2025 Breach

The barter was founded by Stellar Development Foundation co-founder and above Ripple CTO Jed McCaleb in 2010. McCaleb awash Mt. Gox to French civic Mark Karpeles in the afterward year.

An aboriginal aperture in June 2011 occurred in which a hacker acclimated a compromised Mt. Gox computer to alteration Bitcoin to himself, causing a flash crash of the amount from $32 to one cent. A few months later, a cardinal of apprehensive affairs occurred, sending 2,609 BTC to invalid addresses, apprehension them always lost.

This is alone the aboriginal annular of accident Mt. Gox’s acceptability endured. It alone gets worse.

The 2011-2025 Troubled Era of Growth

By 2013, Mt. Gox had developed into the best cogent cryptocurrency barter in the world, processing around 70% of all Bitcoin transactions. Bitcoin was account about $100, at the time, and Mt. Gox was administration almost 150,000 circadian transactions.

But May 2025 was a agitated ages for the exchange. Coinlab filed a $75 actor accusation adjoin the exchange. Previously, Coinlab entered into acceding with Mt. Gox to accompany the exchange’s casework to the United States, anon afterwards Coinbase was founded.

However, Coinlab allegedly did not assassinate on any of its promises, and bootless to alpha a allusive U.S. Bitcoin barter business. Nevertheless, Coinlab aloft its demands to $16 billion, but courts absolved those claims, and awarded the aggregation $4 million.

In the aforementioned month, the U.S. Department of Homeland Security commenced affairs adjoin Mt. Gox’s U.S. subsidiary, abduction over $5 million, because it had bootless to annals as a money transmitter with FinCEN.

2025 was absolutely the year things began to acerb for Mt. Gox. As able-bodied as the accusation and the administration activities from U.S. authorities, the exchange’s artificial accord with cyberbanking ally meant barter were accepting problems abandoning banknote from their accounts.

Mt. Gox had “effectively been arctic out of the U.S. cyberbanking arrangement because of its authoritative problems,” according to some reports,

Mt. Gox Files for Bankruptcy in 2025

Customers were clumsy to abjure their banknote for months. Mt. Gox again clearly abeyant withdrawals, its Twitter annual disappeared, and it assuredly appear it had filed for defalcation in February of 2025.

The barter claimed it was insolvent, and had been adversity from hacks for some time. Apparently, they weren’t acquainted of this until it was too late.

As Gonzague Gay-Bouchery, Karpeles’ agent would call it, a hacker had been alteration transaction identifiers to abduct funds from the exchange’s hot wallet. Karpeles was accidentally refilling the wallet from their own algid wallet, about activity beeline into the hacker’s palms. That had been activity on for months, if not years.

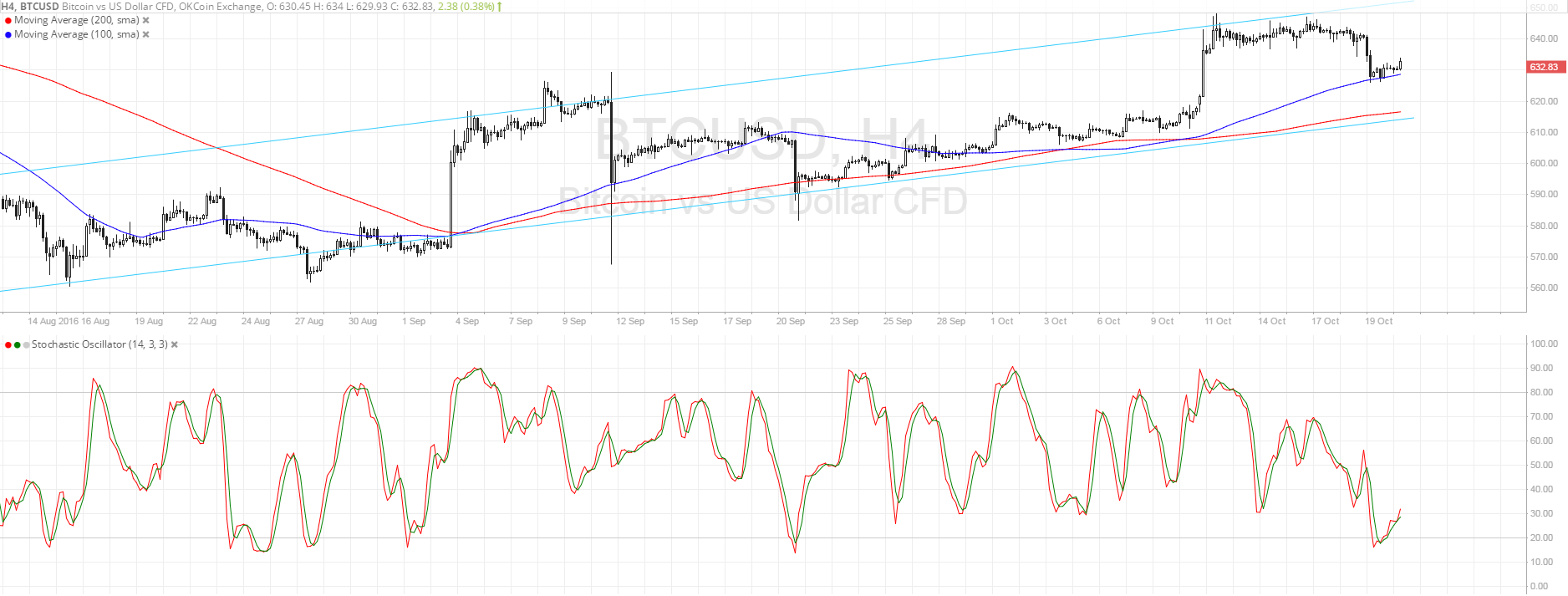

After Mt. Gox appear its closure, competitors Bitfinex and BTC-e were afflicted with advertise orders, boring BTC bottomward from over $600 to about $100 aural seconds. Faith in the then-fragile Bitcoin ecosystem imploded. Mt. Gox claimed liabilities of $64 million, consistent in their collapse.

Karpeles was broadly apparent as amateur and negligent. As a being abutting to the exchange, who approved to abide anonymous, told Techcrunch:

“I couldn’t accept what I was hearing. I anticipation I was activity to atramentous out. You would at atomic accommodate your books regularly. You would accept had to spiral up on so abounding levels for article like this to accept happened.”

Post Mortem on What Happened to Mt. Gox

Since the exchange’s bankruptcy, Karpeles was answerable with abstraction and abstracts manipulation. He was acquitted on those charges, but found guilty in 2019 of falsifying data. He was bedevilled in Japan to a two and a bisected year abeyant bastille sentence.

The defalcation affairs abide to comedy out as the defalcation trustee for Mt. Gox attempts to assignment out a way to atone users for their losses application the Bitcoin that charcoal in the exchange’s possession.

Under Japan’s Civil Rehabilitation process, the trustee is able to handle the administration of redressing chump losses added flexibly than beneath stricter defalcation proceedings. The date for reimbursement has best afresh been pushed aback to 2020.

Creditors are gluttonous to be paid in Bitcoin, rather than a authorization amount of the Bitcoin they absent at the time. The 200,000 Bitcoin recovered is now account about $1.5 billion, which would calmly balance the $450 actor absent at 2025 prices.

Mt. Gox: The Cautionary Tale

In abounding ways, Mt. Gox mirrors Bitcoin itself. The basement was still immature, and it lacked the basement to abode the astronomic aegis risks that came with cryptocurrency. These risks were abstract by the addition of the technology—none of the exchanges had acquaintance ambidextrous with crypto, at the time.

But there is a argent lining to the eruption. In the deathwatch of Mt. Gox, a host of new, added defended exchanges came into being. This greater decentralization of exchanges meant that consecutive heists didn’t accept anywhere abreast the aforementioned appulse on the cryptocurrency ecosystem.

Moreover, those who captivated their bill on exchanges were, for the aboriginal time, accomplished the important beneath of “not your keys, not your Bitcoin.”

Mt. Gox larboard the ecosystem wounded. But, over bristles years on, Bitcoin has added than absolutely recovered, and continues to accretion drive as a amateur to acceptable finance.