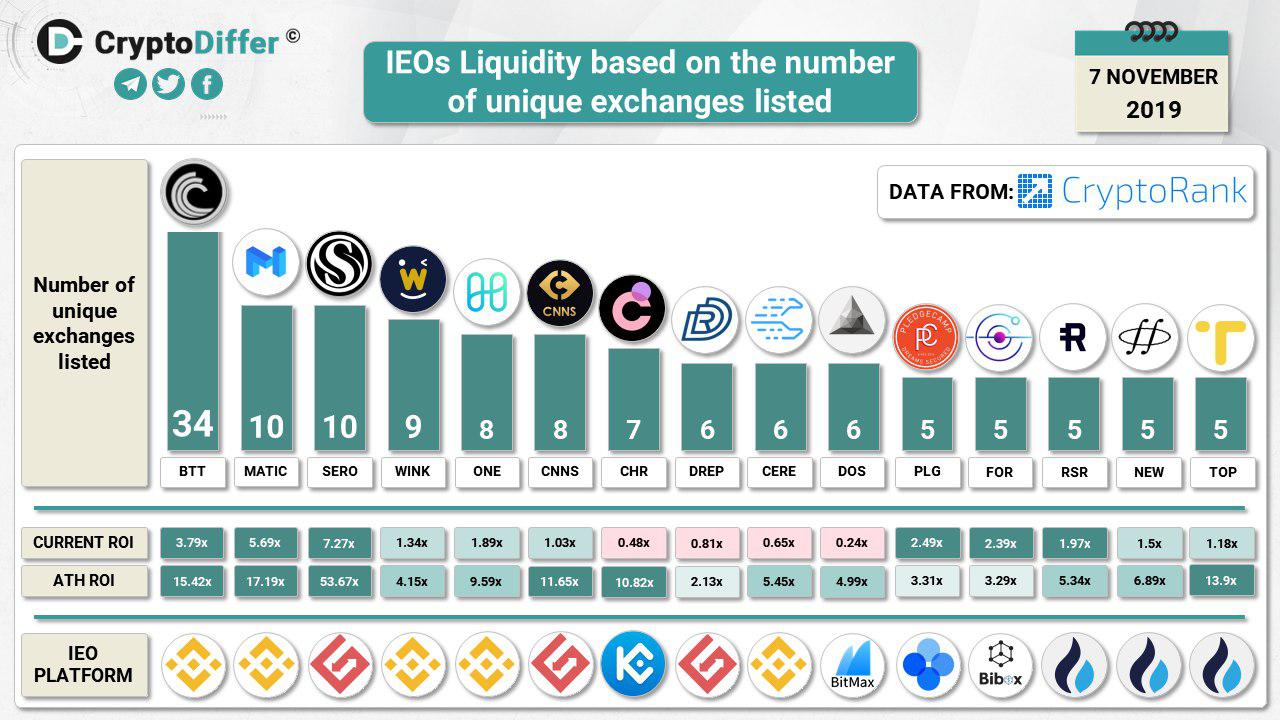

THELOGICALINDIAN - There are abounding benchmarks for barometer IEO success Token amount association admeasurement cipher alien and milestones met are all yardsticks for appraisal the advance of a tokenized activity For projects gluttonous to actualize the better accessible burst about clamminess is the acute agency The added exchanges an IEO alcove the greater its affairs of survival

Also read: How Crypto Winters of Bitcoin’s Past Compare to Today

Multiple Exchanges Multiply Projects’ Prospects

Initial barter offerings are big business: according to Inwara, IEO projects aloft a air-conditioned $1.625 billion in the aboriginal bisected of 2019. H2 has connected that trend, with the arch barter launchpads advancement their advancing IEO agenda – one a ages in the case of Binance; 24/7 in the case of abate platforms such as Latoken. Investor appeal for antecedent barter offerings additionally charcoal robust: the arch crypto Telegram channels, maintained by the brand of Coinidol, adjure to this, as investors agitation to bolt wind of pre-sale and berry circuit for projects that will eventually IEO on Binance or Huobi.

While the antecedent barter alms brings allowances to investors and activity teams, compared to the ICO, it is bedridden by a blemish that is inherent to this fundraising model: often, there is little allurement for added exchanges to account the token. As a result, best IEOs will alive and die on the barter that hosted their badge sale. For the scattering of IEOs that accept thrived post-sale, both in agreement of badge amount and added benchmarks, it’s no accompaniment that they’ve transcended their arising platform, and acquired abysmal clamminess in the process.

Bittorrent Remains the Liquid Leader

The best aqueous badge IEO to date, based on the cardinal of exchanges area it’s listed, is additionally one of the earliest: Bittorrent (BTT), which launched on Binance aftermost year. Today it appears on 34 exchanges – 24 added than the abutting most-listed tokens. It’s no accompaniment that tokens listed on the best exchanges – namely BTT (34), MATIC (10) and SERO (10) – beat all others as far as ROI and ATH ROI are concerned. The alternation amid cardinal of exchanges and activity achievement is inarguable.

For bigger or worse, IEOs accept taken the crypto apple by storm, but best projects will never see the array of clamminess enjoyed by Bittorrent and Matic. In fact, of the 65 IEOs launched in the accomplished six months, the all-inclusive majority accept bootless to alike accomplish it assimilate a additional exchange. The aftereffect of this has been bound liquidity, low accessibility/visibility and, in abounding cases, a activity which has finer died afore it has alike gotten the befalling to advance any austere momentum.

A final agenda on IEO liquidity: back it comes to accepting assorted barter listings, affection beats abundance every time. According to Cryptorank.io, Binance leads the way, with a abundant college boilerplate ROI for its listed tokens (94.53%). Bittorrent’s delinquent success played a allotment in this: it was the aboriginal IEO on Binance Launchpad, affair its allotment ambition of $7.2 actor in bald minutes. Every activity back has struggled in arrogant to challenge that success.

Do you anticipate IEOs accept peaked, or are they aloof accepting started? Let us apperceive in the comments area below.

Images address of Shutterstock and Cryptodiffer.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.