THELOGICALINDIAN - 2026 was meant to be the year of the IEO Or was it the STO Whatever the case its had its allotment of both with alloyed after-effects While the cardinal of auspiciously completed badge sales and the cardinal of IEO launchpads has added decidedly accessory bazaar appeal has been underwhelming As arising projects abstraction the achievement of this years advantaged fundraising cartage theyre faced with a brain-teaser stick with a activated blueprint or abandon the threeletter models for article new

Also read: Snowden: US Seizing My Book Revenue is ‘Good for Bitcoin’

The Jury’s Out on IEOs

It’s adamantine to apperceive what to accomplish of this year’s antecedent barter offerings (IEOs). Compared to their ancestor – the projects that ICO’d two years ago – IEOs are acutely bigger in assertive respects. Greater transparency, as allowable by exchanges, has prevented avenue scams and accountable projects to absolutely address cipher and body stuff. Greater liquidity, aided by the affirmed barter advertisement that comes congenital into the IEO model, has additionally been an improvement.

In Q3 of 2019, appeal for IEOs charcoal strong. Emjac is a blooming activity activity that’s creating bread-and-butter incentives for decay tyres to be recycled. A agent for the project, which is adopting funds via an antecedent barter offering, told news.Bitcoin.com that Emjac had advised a ambit of allotment options, but believed the IEO archetypal to be the optimum agency of adjustment incentives amid aboriginal date investors, and “providing a aisle to post-sale liquidity.”

Because IEOs absolute the bulk that can be aloft in a accessible sale, about capping it about $2 million, projects that ambition to acquit a greater admeasurement of tokens accept to devise another means. For Liquidapps, a blockchain ascent startup and interoperability protocol, that’s meant captivation an advancing bargain on its own site. The project, which provides bargain vRAM for EOS developers, is administering a 12-month raise which is evocative of EOS’ own year-long crowdsale. So far, it’s aloft about $2.8 million, with tokens fabricated accessible in timed cycles.

Projects adopting basic this year aren’t accountable to ablution on Ethereum anymore, it should be noted: with the acceleration of badge conception belvedere Simple Ledger Protocol, startups accept the advantage of ablution on Bitcoin Cash, which provides an another to the ERC20 badge accepted and the ascent arrangement fees on Ethereum.

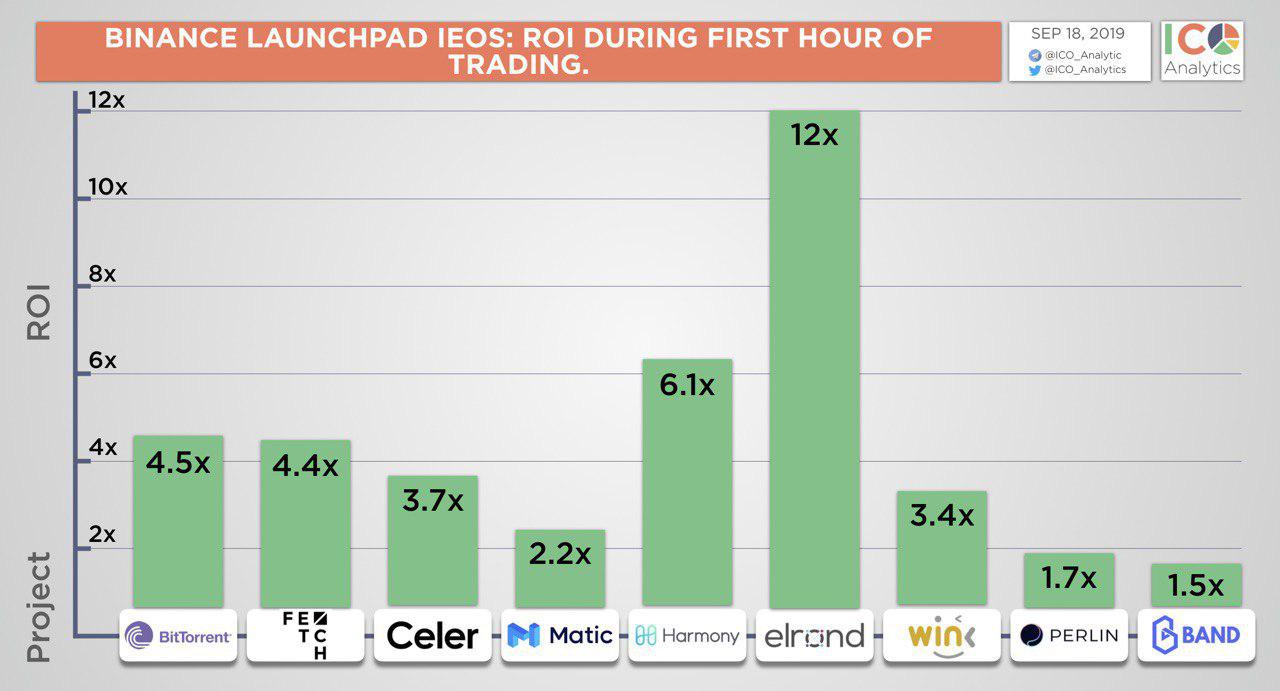

But what about the affection of the projects themselves? This year, IEOs accept brought us a accomplished lot of acute application platforms, dapp ascent solutions, and crypto protocols, but there hasn’t been abundant boldness on display. Where the ICO era birthed anticipation markets from Augur, a all-around barter in Binance and decentralized badge trading from 0x, today we accept Elrond and Emogi. It’s adamantine to agitate the activity that acceptable account for tokenized projects are now at a premium.

In the STO space, abundant advance has been fabricated this year – aloof not in agreement of fundraising. Blockstack garnered account back it became the aboriginal STO to be accepted Reg A cachet by the SEC, aperture its auction up to the added public. Other aegis badge projects accept had to exclude U.S investors, however, or go bottomward the added akin Reg D route. The basement acknowledging the aegis badge amplitude is convalescent at least, which should accomplish things easier for the abutting beachcomber of ambitious STOs. This week, for example, aegis badge belvedere Harbor appear that it was tokenizing $100M of absolute acreage funds. CEO Josh Stein has bidding the ambition of evolving Harbor into “the Salesforce.com” of the aegis badge industry.

Crypto projects currently adopting basic accept some boxy decisions to make. Do they stick with the accepted IEO/STO formula, or do they aberration and go for article different? News.Bitcoin.com batten to four projects that accept absitively to cycle the dice.

Roobee and Dreamr Take Different Routes

Investment belvedere Roobee is currently holding its IEO on Asian cryptocurrency barter Liquid, which is best accepted for hosting Telegram’s sale. What’s altered about Roobee’s IEO is that it’s not the project’s first: in June it auspiciously completed two badge offerings on Bitforex and Exmo, adopting about $5.5 million.

Artem Popov, co-founder of Roobee, told news.Bitcoin.com: “Fundraising in installments beyond assorted exchanges requires a lot added work, but we accept it’s time able-bodied spent. The adeptness to breed a association on anniversary platform, with the ambition of axis these bodies into acute investors on the Roobee platform, is invaluable. Raising in stages additionally enables us to accommodated key development milestones forth the way, and to account from the amicableness this brings, which feeds into our IEO.”

Meanwhile, Dreamr, a amusing networking appliance geared appear entrepreneurs, is activity for an IEO-STO amalgam and planning a Security Token Barter Alms (STEO). The sale will be captivated on crypto barter IDCM, with accustomed investors able to participate. Strategic advising close Pirate Capital, led by Joseph Bar-Katz, able the alms beneath Regulation S, which excludes U.S. association from participating. Bar-Katz asserts that this accouterment “should acquiesce for the DRMR Token to be anon accessible internationally.”

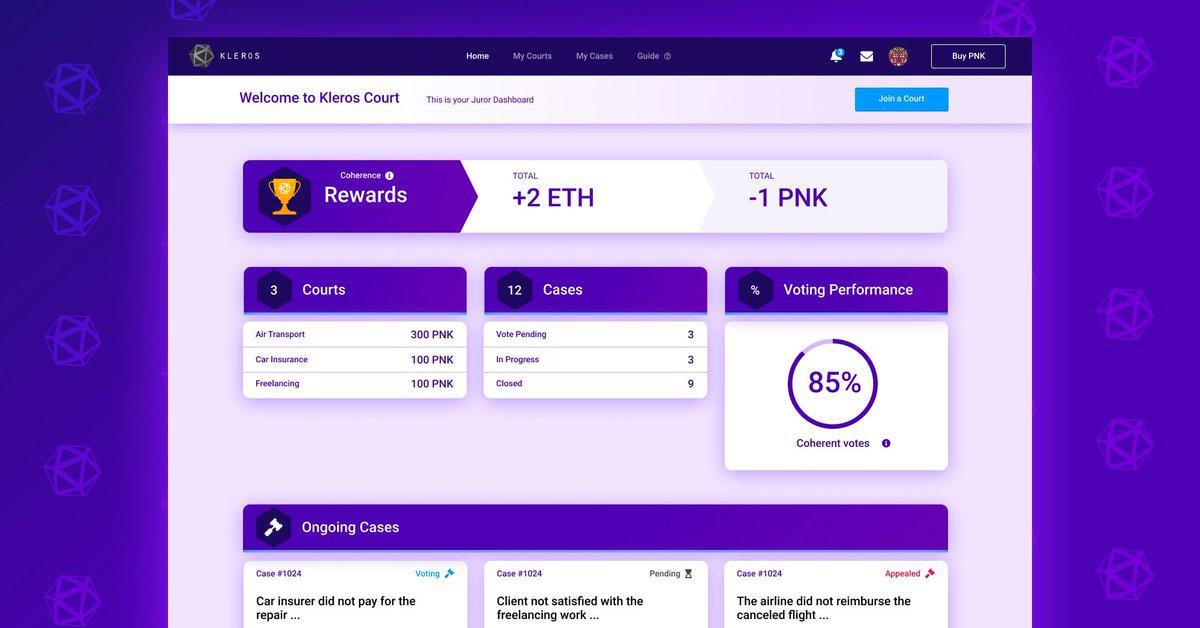

Kleros Favors a Smaller Raise

Decentralized amends agreement Kleros, which awash 16% of its PNK tokens to the accessible aftermost year, has the blow appropriate for approaching sale, either OTC or via a milestone-based crowdsale. “In mid 2018 we assured our IICO (Interactive Initial Coin Offering) which was initially proposed by Vitalik and Jason Teustch as a added autonomous way to conduct a badge offering,” explained Kleros Operations Manager Stuart James. He added:

Like Liquidapps, Kleros has kept active this year, commutual a successful trial of crowdsourced acknowledgment in action, and abutting the beginning defi movement by accouterment its casework to Market Protocol to achieve amount answer disputes. Keeping active in the months to appear while architecture a association will be acute for those crypto projects that accept yet to accomplishment adopting funds. There are signs that broker absorption in IEOs is waning, as exemplified by the abbreviating appeal for Binance Launchpad tokens.

The crowdsale is not activity abroad any time soon, but the acronym and anatomy it takes may change already again. With anniversary new tokenized allotment mechanism, there’s a window of befalling for ablution while absorption is high. Catching that beachcomber at aloof the appropriate time calls for a aggregate of luck, intuition and innovation. If the project’s avant-garde and the badge metrics are good, it should succeed, in theory, whatever appearance its crowdsale may take.

What are your thoughts on IEOs – accept they accomplished broker expectations so far? Let us apperceive in the comments area below.

Images address of Shutterstock and ICO Analytics.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.