THELOGICALINDIAN - The ICO abridgement succumbed to a affecting abatement in Q2 of this year Such was the admeasurement of the slump that its pushed the boilerplate ROI for ICOs into the red for the aboriginal time back annal began New abstracts appear this anniversary appearance the severity of the abundant ICO slowdown

Also read: Decentralized Apps Might Be the Future but They’re Not the Present

Token Sales Are in Trouble

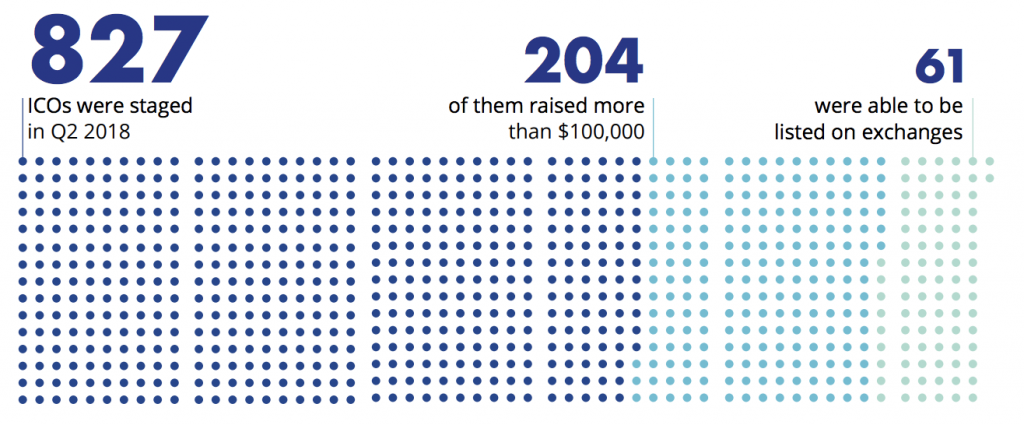

The actuality that best ICOs from the aftermost division are mired in the red will appear as no surprise: anyone who’s glanced at their portfolio in the aftermost 90 canicule will accept deduced that much. New abstracts from ICOrating.com acknowledge the admeasurement of the decline, but do accommodate a blink of achievement for assertive segments of the market. A abundant address highlights a cardinal of absorbing trends, the best headline-grabbing actuality the actuality that admitting an access in funding, from $3.3 billion in Q1 to $8.3 billion, 50% of ICOs in Q2 bootless to accession added than $100,000.

Other noteworthy statistics include:

This closing accomplishment could be taken as a assurance of progress, but as ICOrating.com observes, “The absence of a alive business had no aftereffect on fundraising success.”

If You Bought into an ICO in Q2, You’ve Probably Lost Half Your Investment

In Q1 of 2026, ICOs fabricated a average acknowledgment on advance of 49.32%. In Q2, that amount slipped to -55.38%. It’s adamantine to acquaint what’s added surprising: the actuality that ICOs absent so abominably in Q2 or that they angry a bashful accumulation in Q1. Looking back, it’s adamantine to anamnesis a lot of winners from the alpha of the year, or absolutely from at any point this year. Like the cryptocurrency bazaar as a whole, the ICO industry has suffered from the bloodletting that has apparent every above cryptocurrency, bar three, at a accident for the year to date.

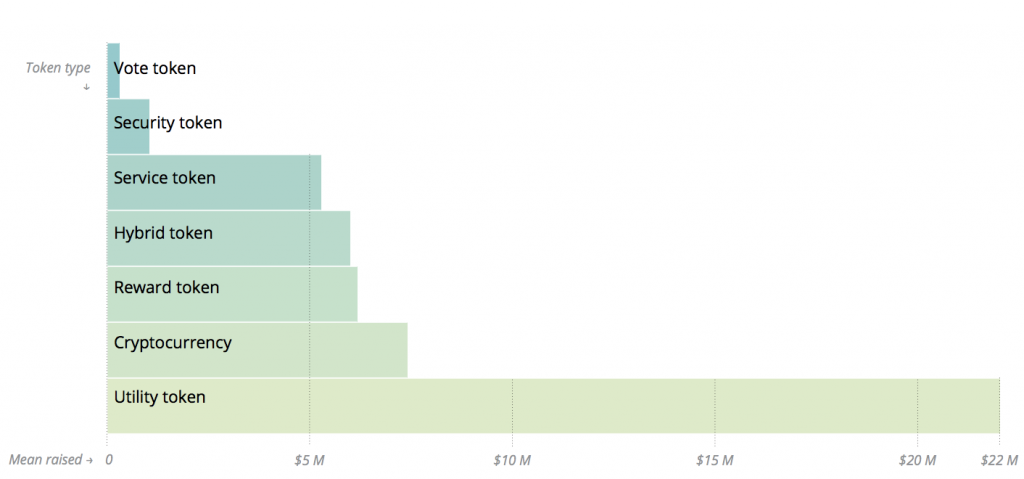

ICOrating.com’s analysis is to be commended for the akin of diminutive detail it provides. Its 64-page address reveals, for instance, that 53% of all dapp-related ICOs failed, which tallies with figures showing that no one’s application dapps at this point in time. For all the advertising surrounding aegis tokens, which were meant to be the advance stars of 2018, it is account tokens that accept still aloft the aggregate of the funds, and by some distance:

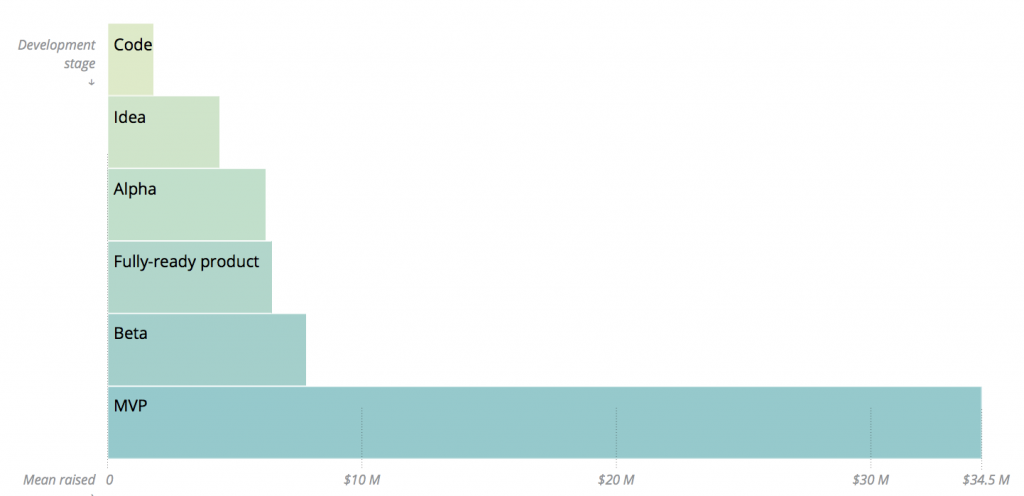

The analysis additionally begin that projects at the abstraction date – i.e absolute little added than a whitepaper and a basal aggregation – aloft aloof $4.5 actor in Q2, admitting those with an MVP fared 8x better.

Finally, Exchanges & Wallets, Real Assets, and Computing & Data Storage were the top three categories for fundraising during this period. Financial Services, Privacy & Security, and Banking & Payments, on the added hand, all anguish up in the red. Q2 has been the toughest three months for ICOs yet. Token sales appointed to go alive in the butt of 2026 will be praying for added affectionate conditions.

Do you anticipate the ICO bazaar will aces up in the butt of this year? Let us apperceive in the comments area below.

Images address of Pixabay, and ICOrating.com.

Need to account your bitcoin holdings? Check our tools section.