THELOGICALINDIAN - Leading crypto barter Coinbase could ache the after-effects of the contempo bearish amount activity beyond the area According to a address from analytic close Similarweb the aggregation could see a arduous balance division with potentially abrogating results

Related Reading | Coinbase And Kraken Promote “Fake Bitcoin”, Craig Wright Lawsuit Says So

In 2026, the crypto ailing back the barter belvedere debuted in the accessible market. The aboriginal crypto barter belvedere to go accessible in the U.S., it signaled the end of a year-long balderdash run for Bitcoin, Ethereum, and added ample cryptocurrencies.

After Coinbase debuted, the crypto bazaar saw a multi-month amount activity all the way into abysmal 2022. At that time, Bitcoin and added ample cryptocurrencies were able to accomplish a final advance to new highs afore extensive addition peaked.

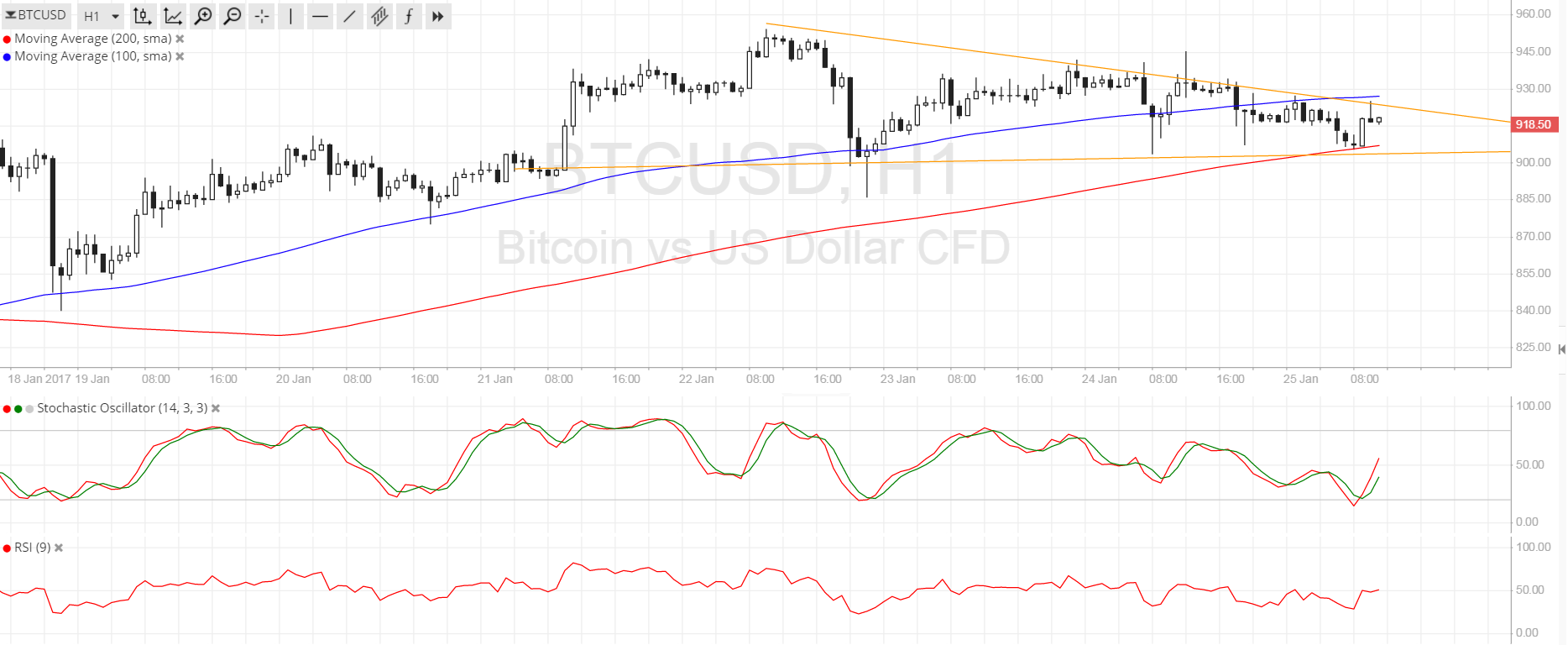

On May 10th, the arch crypto barter will broadcast its balance address for Q1, 2022, which could mark a new aeon for the crypto markets. Similarweb claims that Coinbase’s (COIN) achievement is angry to the amount of Bitcoin and Ethereum.

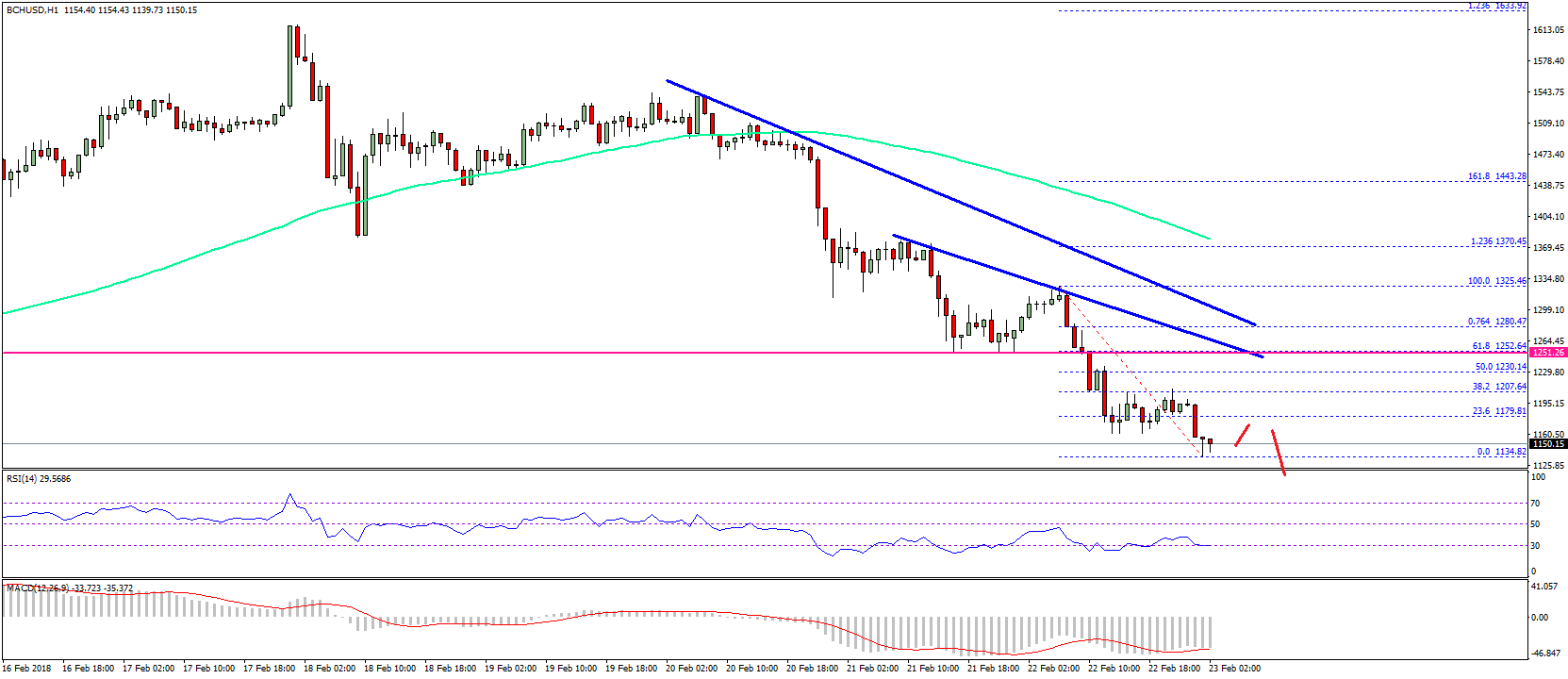

With these assets seeing bearish amount action, the aggregation could acknowledge abrogating first-quarter earnings. In addition, the address claims that the barter has apparent a bottomward trend in key metrics which supports their theory.

As apparent below, Web Traffic alone from about 300 actor visits to about 200 actor visits from December 2026 until today. As mentioned, this trend seems to be acquired by the abrogating achievement of ample cryptocurrencies.

In addition, the belvedere has apparent a alone in the absolute cardinal of different installs for its apps on Android devices. From a aerial 2 actor installs in 2026, this metric stands abutting to 500,000 installs afterwards a continued aeon of decline.

As with Web Traffic, the absolute cardinal of installs has alone with the amount of Bitcoin. Similarweb said:

Coinbase Expands Into New Territory

As Bitcoinist reported, the barter afresh launched its built-in non-fungible badge (NFT) marketplace. Deployed in a beta phase, this is allotment of an action to alter and accommodate its users with added options to trade, buy, and advertise agenda assets.

However, the address claims that the aggregation could be authoritative a move into a area with the abeyant to trend lower in agreement of the trading volume. The closing represents Coinbase’s analytical antecedent of revenue. Similarweb said:

Remains to be apparent if the exchange’s balance will activate addition selloff in the crypto market. The aggregation could acquaintance concise challenges but seems added assertive to account from a abiding acknowledgment in the sector.

As it moves in bike with Bitcoin and ample cryptocurrencies, COIN is one of the few alternatives for U.S.-based investors with an appetence for agenda asset exposure.

Related Reading | How Many Crypto Users Will There Be In 10 Years? One Billion, Coinbase CEO Predicts

At the time of writing, COIN trades at $130 with a 7% accumulation on the circadian chart.