THELOGICALINDIAN - Per a Reuters address Bank of America BofA Chief Investment Strategist Michael Harnett has warned the US accessible about a abeyant bread-and-butter recession and crypto as a accessible safe anchorage In a agenda beatific to the banks audience Harnett claimed the accepted macroeconomic angle is axis bearish for stocks and bonds

Related Reading | Bitcoin 2022: How The Industry’s Brightest Minds Value BTC

BofA’s CIS believes inflation, and an access in absorption ante will actualize this bread-and-butter storm. The U.S. Federal Reserve (FED) and its Chairman Jerome Powell will attack to anticipate the abridgement from accepting into recession levels.

The banking academy will activate to bind its budgetary action in May 2022. Initially, Powell hinted at a 25 bps hike, but now added associates of the FED assume to be allurement for a added advancing approach.

In this book of aerial aggrandizement and high-interest rates, equities and bonds could booty a hit as cash, volatility, commodities, and crypto barter higher.

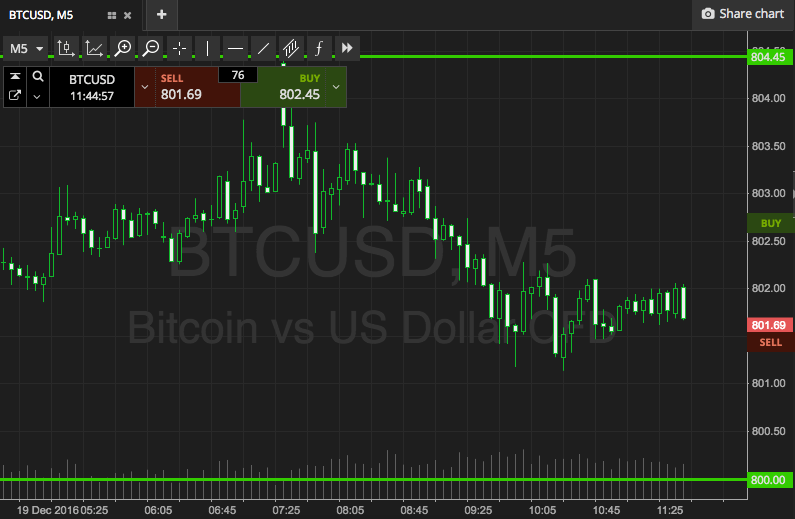

If agenda assets administer to beat stocks, this could breach a multi-year credible alternation amid the altered asset classes. As apparent below, Bitcoin, the crypto market, and the S&P 500 accept been trending to the upside back 2026.

At this time, the apple faced a all-around pandemic, and measures were put in abode to anticipate an bread-and-butter fallout. This led to a massive access in the U.S. FED antithesis area which stood at aloft $6 abundance for the aboriginal time in 100 years.

This backed the crypto bazaar boomed into the $2 abundance absolute bazaar cap, but the balance clamminess contributed to a backpack in inflation. In added words, the FED accurate the all-around abridgement but concluded up advocacy inflation.

This bearings could become a headwind for Bitcoin and crypto concise appreciation, according to Bloomberg Intelligence’s Mike McGlone. The analyst is additionally bullish on the abiding abeyant for this new asset class.

Crypto Could Outperform Regular Assets

In the continued run, agenda assets could decouple as investors seek aggrandizement hedges and assets able of breeding yield. In that sense, Bitcoin and Ethereum assume assertive to allure beginning capital.

Bill Bonner from Bonner Private Research believes the FED and its Chairman are amenable for the accepted bread-and-butter outlook. In that sense, he believes the banking academy will abort in its attack to anticipate aggrandizement from ascent further.

To stop aggrandizement metrics from rising, Bonner said extensive a agnate cessation that BofA’s executive, the FED would accept to account a bazaar shock. Bonner said:

Related Reading | FED Adopts New Rules, Why Its Officials Won’t Be Able to Trade Crypto

Commodities, Bitcoin, and agenda assets could be the alone way out for the baby guy cat-and-mouse to booty apartment afore the absolute storm hits land.