THELOGICALINDIAN - The US Securities and Exchange Commission SEC Chairman Gary Gensler hinted at the achievability of assuredly acknowledging a Bitcoin Exchange Traded Fund ETF at a accent during the Aspen Security Summit An ETF has been one of the Holy Grails for the crypto bazaar and agnate to the allegorical article abounding accept following it with no luck

However, the SEC Chair accustomed the charge for investors to accretion acknowledgment to a bazaar which he considers to be “highly irregulated”. While a Bitcoin ETF backed by concrete BTC was disqualified out by the regulator, a derivatives-based ETF could be accustomed due to its abeyant to action investors “significant protections”.

The Bitcoin futures-based ETF would accept to use derivates provided by the Chicago Mercantile Exchange (CME). These are adapted by the U.S. Commodities Futures Trading Commission (CFTC), the ETF itself would be adapted by the SEC. Thus, the artefact would be beneath the administration of two U.S. regulators.

A few canicule afterwards these animadversion the bazaar reacted, and abounding players filed their BTC futures ETF petitions with the Commission. Bloomberg Intelligence’s (BI) able James Seyffart has recorded over 20 crypto-based ETFs accelerate to the SEC which has not accustomed a absolute response, as apparent below.

BI’s ETF analysts Eric Balchunas and Seyffart commented on how a derivative-based ETF will be an inefficient apparatus for investors to accretion Bitcoin exposure. In a agenda alleged “The Unintended Consequences of Bitcoin Futures ETFs”, the experts said:

Bitcoin Exposure For A Price, The SEC Has Investors Interest In Mind?

A BTC ETF has been advised a abeyant catalyzer that could accompany beginning basic into the crypto market. But as Balchunas mentioned via his Twitter account, these articles will authority about the aforementioned address as the Grayscale Bitcoin Trust (GBTC).

Moreover, the BTC Futures banking artefact could be decidedly added big-ticket than the GBTC, and a physically-backed BTC ETF. Balchunas added:

This rollout action of these derivatives, the able said, will account far added complications for investors. When comparing the advantages of futures and physically-backed BTC ETF, the closing seems to be the bigger best to assure investors.

Seyffart claimed that the U.S. SEC and its Chair accept “lost the backwoods for the copse a bit back it comes” to a Bitcoin ETF. This could abide to advance investors from advance in this artefact if any of the BTC Futures petitions are approved. The able added:

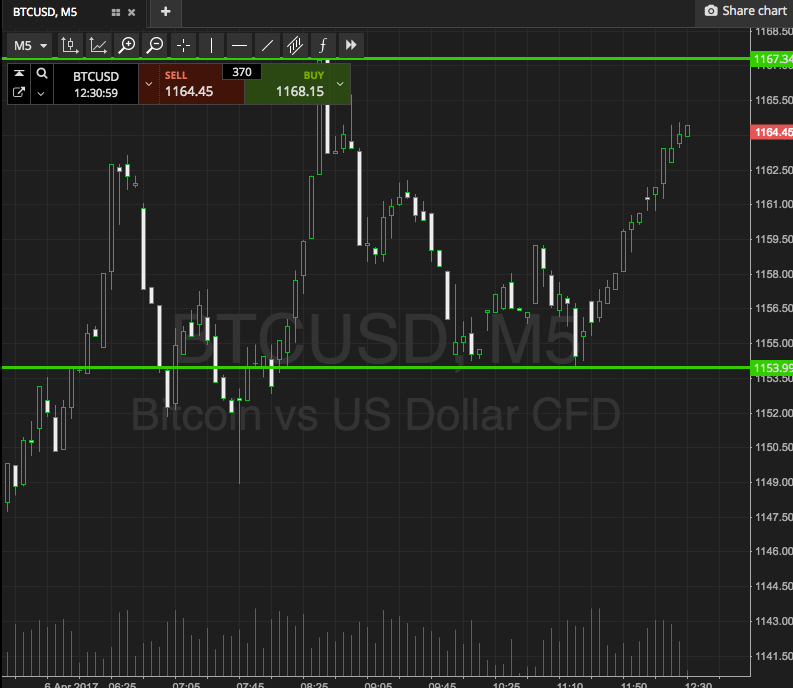

At the time of writing, BTC trades at $45,192 with a 1.4% accident in the circadian chart. The cryptocurrency has accomplished a baby pullback from its account aerial and could acquisition abutment at $43,500.